- ITR U - What is ITR-U & How to File Updated Return

- ITR Filing Last Date FY 2023-24 (AY 2024-25) | Income Tax Return Filing Due Date

- Documents Required for Income Tax Return (ITR) Filing in India FY 2022-23 (AY 2023-24)

- Section 154 Of Income Tax Act: Rectification of Mistakes under Section 154

- Section 139(5) of Income Tax Act - How to File Revised Return?

- Income From Other Sources: Meaning, Exemptions, Deductions & Examples

- How to Correct the Invalid Surname and First Name Error on e-Filing Portal

- Income Tax Return (ITR) : How to File ITR Online for FY 2022-23 (AY 2023-24)?

- How to Show F&O Loss in ITR? | Guide to Filing Income Tax Return with F&O Loss

- Who is Required to File ITR for FY 2023-24? Conditions & Exceptions for ITR Filing

Income Tax Return Processing

The ITR is processed by the CPC unit of the Income Tax Department, which verifies the details submitted in the ITR with the information on hand and sends a notice of intimation to the registered email address under Section 143 (1).

The ITR is taken up for processing by the CPC unit of the Income Tax Department, which verifies the details submitted in the ITR with the information on hand and sends a notice of intimation to the registered email address under Section 143 (1). The CPC in Bangalore carries out all primary assessments. The Income Tax Department only processes tax returns after they have been verified by the taxpayer. Therefore, taxpayers are encouraged to submit their returns on time to ensure that they are processed quickly.

Income Tax Return filing for FY 2024-25 has begun!

File your ITR on time with expert help – Accurate, timely, and refund-ready! File Today

Budget Update 2025

No Income Tax on Annual Income Up to ₹12.75 Lakh!

The government has raised the Section 87A rebate limit from ₹7 lakh to ₹12 lakh, providing major tax relief to the middle class. Salaried individuals can also claim a ₹75,000 standard deduction, making incomes up to ₹12.75 lakh tax-free.

New Slab Structure under new tax regime:

- ₹0 – ₹4 lakh → No Tax

- ₹4 lakh – ₹8 lakh → 5%

- ₹8 lakh – ₹12 lakh → 10%

- ₹12 lakh – ₹16 lakh → 15%

- ₹16 lakh – ₹20 lakh → 20%

- ₹20 lakh – ₹24 lakh → 25%

- ₹24 lakh & above → 30%

Extended time for filing updated returns (ITR-U):

Taxpayers now get 4 years (instead of 2) to update their Income Tax Returns.

These changes will be effective from 1 April 2025 i.e. for FY 2025-26

Income Tax Return filing and ITR Verification

Once an individual or entity completes the filing process and verifies it, the Income Tax Department (ITD) begins processing and takes further action depending on various scenarios, like issuing a refund if TDS deducted more than your tax liability or initiating scrutiny, depending on the circumstances. You can file your ITR with Tax2win here.

The taxpayer should verify their return within 30 days of filing it, and if not verified within the specified time period, then ITR is considered invalid. Here are different ways of verifying ITR-

- Sending signed ITR-V physically to the CPC, Bangalore

- Through Aadhaar OTP

- Through EVC generated from a pre-validated bank account

- Through EVC generated from a pre-validated Demat account

- Through EVC through ATM (offline method)

- Through Net Banking

- Through Digital Signature Certificate (DSC)

ITR processing under section 143(1)

Once the ITR has been verified, the department processes the income tax return and sends the intimation under Section 143(1) of the Income Tax Act, 1961. This intimation will be sent to the registered email address and mobile number. A text message is sent to the mobile number which is:

(example) ITR for AY 2023-24 and PAN abcxxxxx1r have been processed at CPC. Intimation u/s 143(1) has been sent to your registered email ID. If not received, check the SPAM folder.

CPC processes each e-filed return, and an intimation u/s 143 (1) is generated. The department compares the information submitted in the taxpayer's return to the records held by the CPC and issues an intimation under section 143 (1). The intimation also includes a tax computation, as calculated by both the taxpayers and the income tax department.

Possible Outcomes of Section 143(1) Processing:

- No Assessment: If the AO finds the ITR to be complete, accurate, and consistent, they send the simple intimation without making any changes.

- Assessment with Adjustments: The AO may make adjustments to the income or deductions claimed by the taxpayer, resulting in a higher or lower tax liability.

- Notice Under Section 143(2): In certain cases, the AO may find it necessary to conduct a detailed scrutiny of the taxpayer's affairs. They may issue a notice under Section 143(2) to initiate a more comprehensive assessment process.

How to know the status of ITR processing?

Here are the steps to follow to know the status of ITR processing -

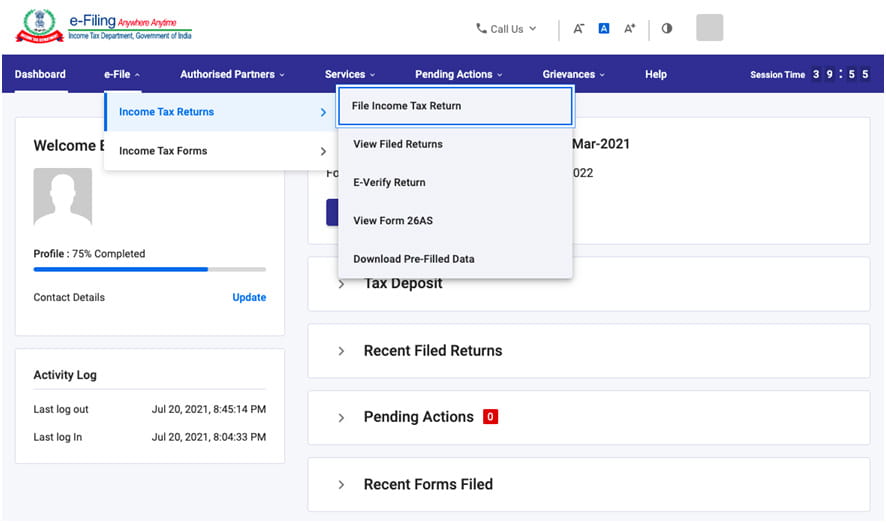

- Log in to the income tax portal using PAN and password to check the status of their ITR processing

Hover your cursor over the ‘e-file’ tab and click on ‘View filed returns’ under ‘Income Tax Returns’

- Post that, the following screen will appear where taxpayers can see the status of their ITR processing along with the date of processing.

What are the possible status post the ITR processing?

There are 3 possible scenarios under ITR processing that the taxpayers should know to decode their intimation under section 143(1).

- No demand, no refund

In this case, the department accepts the taxpayer's information filed in the ITR, and the ITR processing status changes to "No demand, no refund." It signifies that the assessee does not owe or receive any amount to/from the departments. - Demand determined

The department issues a demand intimation if there is a mismatch in the taxes paid or the credit claimed. Under section 143 (1), the demand must be paid within the time period specified in the intimation. - Refund determined

The refund is issued to the taxpayers if the return filed by the taxpayer is found to be accurate and includes a refund claim. The credit of refund process typically takes 20-45 days from the date of e-verification of the income tax return. However, if the acknowledgment (ITR V) is physically sent to the CPC, it may take longer.

What is the password for the intimation notice U/S 143(1)?

The intimation notice received from the Income Tax Department comes with password protection, and you need to decode the password before opening it. The default password set by the Income Tax Department comprises your PAN and date of birth. If your PAN is CMDPP5555E and your date of birth is March 16, 1994, your Intimation notice password will be cmdpp5555e16031994.

Don’t let the intimation notice under section 143(1) stress you out. Need help in responding to Income Tax Notice, connect with the experts here.

FAQs on ITR processing under section 143(1)

Q- When I check the status of my ITR, it shows 'your return has been processed there is no payment due meaning.'?

When your Income Tax Return (ITR) status shows 'your return has been processed, there is no payment due,' it means that the Income Tax Department has reviewed and processed your return, and there are no discrepancies or additional taxes to be paid. Essentially, it indicates that your tax calculations match the department's records, and you neither owe any additional tax nor are you due for a refund.

Q- My ITR processed at CPC when will I get refund?

Once your Income Tax Return (ITR) is processed at the Central Processing Centre (CPC), the refund is typically issued within 20-45 days from the date of e-verification. However, this timeline can vary based on factors such as the accuracy of the details provided, any discrepancies found, and the efficiency of the processing by the tax authorities.

Q- What is CPC in income tax?

CPC stands for Central Processing Center. It's a centralized unit of the Income Tax Department responsible for processing income tax returns.

Q- How many days does it take to process income tax return?

Typically, it takes 20-45 days for the Income Tax Department to process your ITR after you've e-verified it.

Q- What to do if ITR still not processed?

If your ITR is still not processed, first verify if you haven’t e-verified. If it's verified, check the refund status on the e-filing portal. If the refund is delayed, contact the Income Tax Department through their helpline or grievance portal.

Q- How long does it take for the ITR to be processed?

The processing time for ITR can vary depending on several factors, such as the jurisdiction, complexity of the return, ITR FORM, and the workload of the tax authorities. In general, the processing time can range from a few weeks to several months.

Q- How can I check the status of my ITR after filing?

You can check the status of your ITR by logging into the tax department's online portal or through their designated mobile application.

Q- What does 'ITR processed at CPC' mean?

'ITR processed at CPC' means that the tax authorities have completed the assessment of your tax return and have calculated the tax liability or refund, if applicable. It indicates that the initial processing of your return is complete.

Q- What happens if there is a discrepancy or error in my ITR?

If there is a discrepancy or error in your ITR, the tax authorities may issue an intimation or notice seeking clarification or additional information. It is important to respond to such notices promptly and within the time limit issued and provide the necessary documents or rectify the errors as requested.

Q- Will I be informed if my ITR is rejected?

Yes, if your ITR is rejected, the tax authorities will inform you through an intimation or notice. The intimation will specify the reasons for the rejection, and you will need to rectify the issues and file a revised return if required.

Q- What happens if I have a refund due after ITR processing?

If you are eligible for a refund after ITR processing, the tax authorities will issue the refund to you. The refund amount will be credited to the validated bank account that you provided during the filing process.

Q- Can I track the status of my refund after ITR processing?

Yes, you can track the status of your refund by using the tax department's online portal or mobile application. You will need to provide your PAN (Permanent Account Number) and other required details to track the refund status.

Q- What should I do if there is a delay in the ITR processing or refund?

If you experience a significant delay in ITR processing or refund, it is advisable to contact the tax department's customer service helpline or visit their local office to inquire about the status and seek assistance. They will be able to provide guidance and address your concerns.

Q- As per the data received on ITR filing for FY 2023-24, 71,039,095 ITRs were filed and verified. 51,577,573 ITRs were processed. This shows that about 28% ITRs are still remaining to be processed (about 2 crore). What might be the reason of 28% ITRs still not processed?

Once an Income Tax Return (ITR) is filed and successfully verified, the Central Processing Centre (CPC) handles its processing. Submitting ITRs promptly ensures faster processing, typically taking 20-45 days from the e-verification date. If offline verification (ITR-V form) is used, expect extended processing times. ITR not processed timely may depend on several factors, such as the selected form, the complexity of the return, the number of deductions and exemptions claimed, and whether these claims are reflected in Form 16. One significant factor that can delay processing is the type of ITR form used. Simpler forms like ITR-1, meant for individuals with straightforward income sources, typically undergo faster processing compared to more complex forms that require additional scrutiny.

Q- What are the timelines for ITR processing for ITR forms, ITR-1, ITR-2 and ITR-3?

Different ITR forms have varying processing times. Simpler forms like ITR-1, which cater to individuals with straightforward income sources like salary or pension, are processed more quickly. In contrast, complex forms like ITR-3, used by individuals and HUFs with business or professional income, take longer to process. This is because forms with detailed financial information, such as business income, capital gains, or foreign assets, require more extensive verification by income tax authorities, resulting in extended processing times.

Avoid Last-Minute Rush

Avoid Last-Minute Rush Faster Refund Processing

Faster Refund Processing Hassle-Free Filing with Experts

Hassle-Free Filing with Experts