Say goodbye to the hassle of gathering rent receipts for your HRA exemption claim. Tax2win makes it quick, easy, and hassle-free! Whether you're a landlord or a tenant, our user-friendly platform ensures accuracy and compliance.

Just enter your details, and within minutes, get a customized rent receipt that fits your needs—saving you time and maximizing your tax benefits effortlessly.

Start now and simplify your tax filing today!

For claiming HRA exemptions it is mandatory to submit Rent Receipts to the employer

This can be done by following 4 simple steps:-

Fill the required details like Monthly rent, Address of the rented house, email-Id, PAN number etc.

After selecting the time period of rent slip generator-monthly, quarterly, half yearly or yearly, the rent receipt will be shared to your email address.

Download the generated rent receipt slip in pdf form and get it stamped & signed by landlord.

Submit Rent Receipts to your employer and gain exemption on HRA.

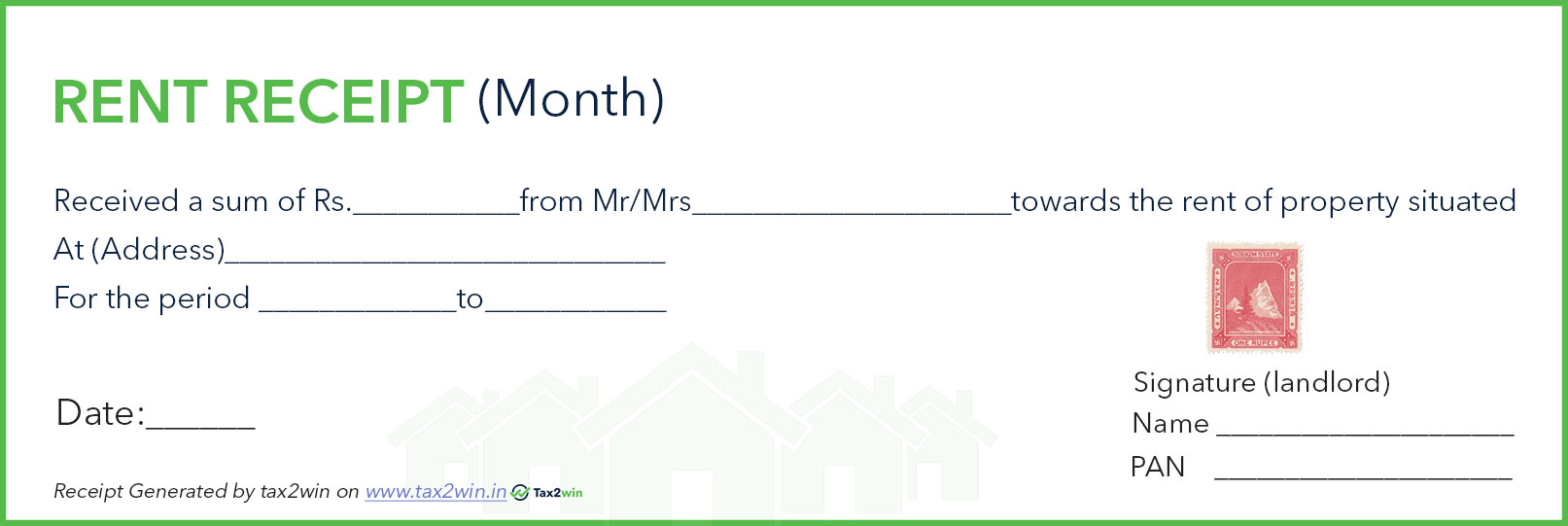

Sample Rent Receipt Template Format

Unlock Your Tax Benefits with Our Generated Rent Receipts!!

In India, a rent receipt is a crucial document that serves as proof of payment for the rent of a property. Its significance extends to various aspects, including income tax purposes, House Rent Allowance (HRA) exemptions, and maintaining accurate records of income and expenses. It is a key instrument for tax saving and so should be collected and kept safely. Salaried employees need rent receipts to claim their House Rent Allowance (HRA). The rent receipt(document) is provided by the landlord upon receiving the rent from the rentee, and his signatures are placed on it.

For claiming HRA exemptions it is mandatory to submit Rent Receipts to the employer

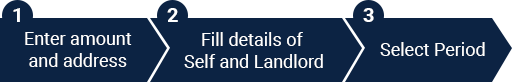

This can be done in just 3 simple steps

Enter amount of rent paid and address

Fill details of self and landlord

Select Period for which you want to generate rent receipt

(Monthly, Quarterly, Annually)

Calculate House Rent Allowance Online that too free here.

The following are the details which are required in the rent receipt:

Tenant Name (If you are the tenant, fill in your name)

Landlord Name.

Amount of Payment.

Date of Payment.

Rental Period.

House Address (Rented Property)

Signature of Landlord or Manager.

A revenue stamp is required to be affixed on rent receipts if cash payment is more than Rs. 5000 per receipt. If rent is paid through cheque or online transfer then revenue stamp is not required.

You can easily understand it from the given table

| Mode of Payment | Whether revenue stamp is required |

|---|---|

| Cash, upto 5000 per receipt | No |

| Cash, more than 5000 per receipt | Yes |

| Cheque or online transfer | No |

Revenue stamps can be obtained from nearby post offices or you can obtain the same by stationery shops, Amazon, local vendors.

It is mandatory to submit rent receipts or a copy of the rental agreement as proof for claiming a house rent allowance deduction. In India, individuals who are salaried and living in rented accommodation can claim House Rent Allowance (HRA) exemptions under Section 10(13A) of the Income Tax Act, 1961. The amount exempted is the least of the following:

By providing rent receipts, individuals can claim this exemption and reduce their taxable income, thereby saving on taxes. The exact amount saved will depend on the individual's salary, rent paid, and other applicable factors.

Ans. Yes, if an employee HRA is up to Rs. 3,000 per month, you can claim HRA without a rent receipt . However, if your HRA exceeds Rs. 3000/- per month, it is mandatory to provide Rent receipt to employer as an evidence for claiming HRA.

Ans. A rent receipt is essential as it provides clear proof of rent payment to your landlord. It offers several benefits:

Ans. Generally employers ask for rent receipts for 3-4 months.

Ans. While generating rent receipts online in the third step when you select the period you can make a choice of generating rent receipts yearly, monthly or quarterly for the specified time period.

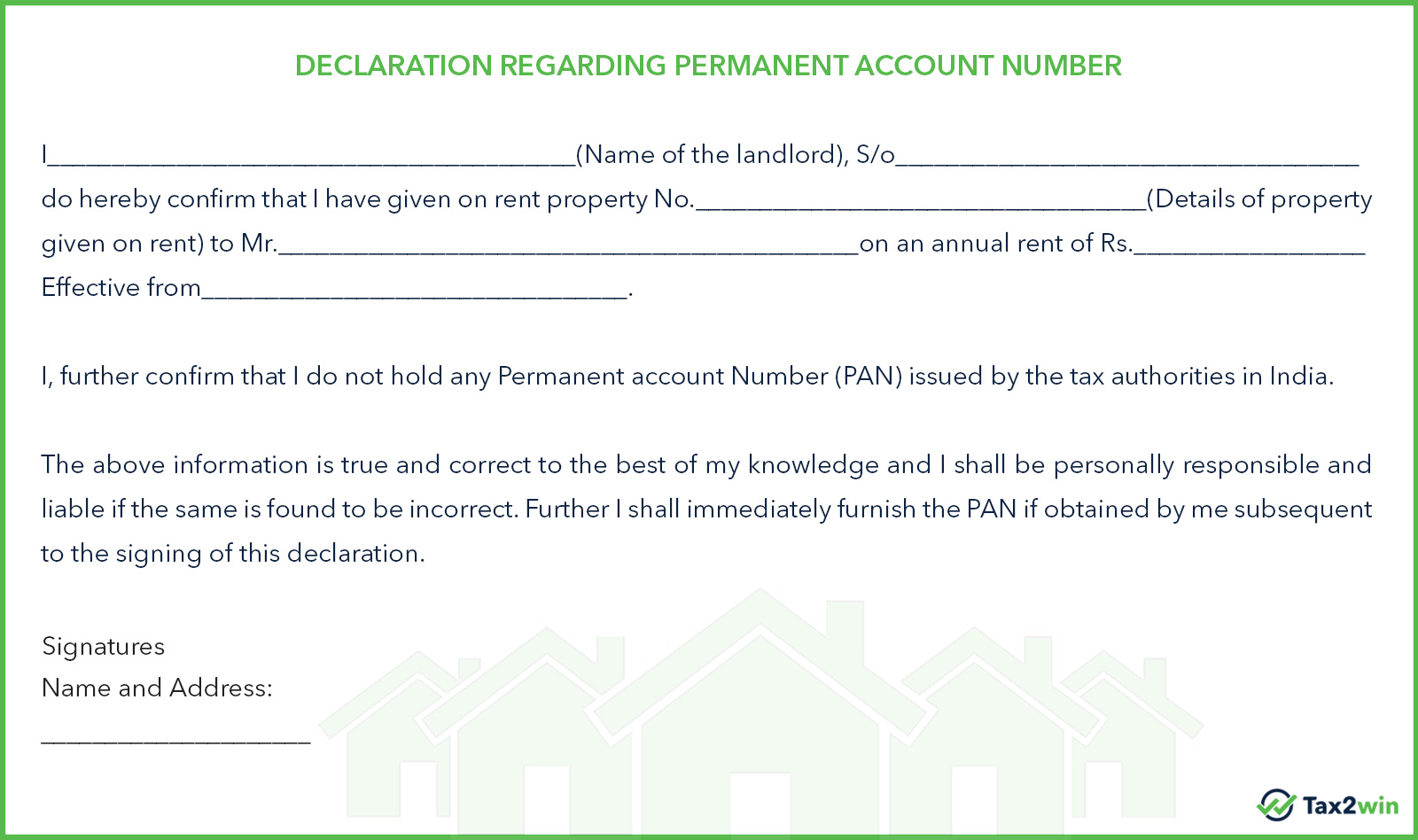

Ans. PAN of landlord is required only if rent exceeds Rs.8333/- per month (Rs.100000/- annually). In case the landlord does not have PAN, declaration of the same is required. Download Declaration Form

If the landlord does not provide his PAN, you can obtain the same from the below mentioned link. (PAN number verification)

Sample Declaration Form

Ans. The evidences required for claiming HRA are the Rent receipts, rental agreement and PAN card of the landlord in case annual rent exceeds Rs.100000/-

Ans. No, there is no need for the same. Only PAN No is required to mention on rent receipt.

Ans. The reason behind declaring a landlord's PAN is to track fake receipts being submitted by employees to claim HRA.

Ans. Even if you forgot to submit rent receipts, you are eligible to claim HRA while filing IT return. All you need is Rent receipts and PAN of landlord in case annual rent exceeds Rs.100000/-

Our experts are here to help you claim all the available tax exemptions and deductions & file your IT return in a hassle-free manner. Connect Now to know how!

Ans. Typically, employers ask for house rent receipts during the last quarter of the financial year to process HRA exemptions in Form 16. However, if you fail to submit these receipts, your employer will deduct TDS (Tax Deducted at Source) without taking into consideration the HRA component of your salary.

Even if this happens, you can still claim the HRA exemption while filing your Income Tax Return (ITR). Once you claim HRA in ITR, the extra TDS deducted will be refunded to you.

Ans. If you couldn’t submit your rent receipts to your employer, you can still claim the HRA exemption while filing your Income Tax Return (ITR). In this case, since the employer didn’t adjust the HRA exemption in your taxable salary, they would have deducted a higher TDS amount.

When you claim the HRA exemption in your ITR, the excess TDS deducted will be refunded to you. However, it’s essential to accurately calculate the HRA exemption and deduct the same from your salary before making the claim. Ensure you retain supporting documents like rent receipts and rental agreements for verification if required.

Ans. If your landlord refuses to provide a rent receipt, you can take the following steps:

If you are not able to furnish your rent receipts, you might not be able to claim HRA exemptions. However, you can also claim HRA while filing your ITR and receive a tax refund of the excess TDS deducted.