Intimation u/s 143(1) is issued by the income tax department once your return is processed. However, you need to respond to the notice ASAP. In this guide, we will understand the meaning of notice u/s 143(1) and how to respond to it.

Have you received a notice u/s 143(1) of the income tax act causing you sleepless nights? Well, that’s what an income tax notice does to individuals. But let us tell you an interesting fact that you might not be aware of the fact that not all Income Tax Notices are as dreaded as they’re perceived. Some income tax notices have good news too. So you should keep calm and read the notice carefully. This guide would also be helpful for you to understand how to respond to the notice you have received.

What is Intimation u/s 143(1)?

The taxpayer has to file a return either voluntarily under section 139 or on demand under section 142(1). Now, after you file an ITR, the income tax department examines it. This process is known as assessment. The preliminary assessment made by the income tax department and informs the taxpayers about its result. The assessment might include arithmetical errors, tax calculation and verification of tax payment, and internal inconsistencies. This process is automated. Therefore, an intimation generated by the system indicates an error in the ITR.

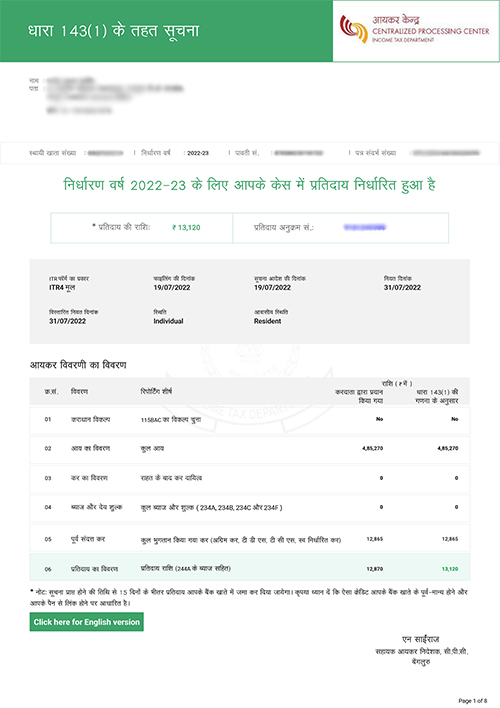

Intimation u/s 143(1) of the Income Tax Act is a summary of the details you have submitted to the tax department and the details the department has considered while processing your return. Basically, the intimation u/s 143(1) contains the following information:

- Permanent Details of the assessee like name, address, etc.

- Income Tax Return filing details like acknowledgment number, filing date, etc.

- Refund sequence number

- Tax Calculation as provided by you in the Return of Income

- Tax as Computed under section 143(1) of the income tax act {i.e. As per Department}

Sample of an Intimation under 143(1)

Why is the Intimation u/s 143(1) Issued?

Basically, when a return is submitted to the Income Tax Department, the department applies the following computerized checks as a part of its review procedure:

- An incorrect claim, which is apparent from any information in return. For example, if the deduction u/s 80C is claimed more than the maximum permissible deduction u/s section 80C i.e., Rs 1,50,000, the excess shall be disallowed and reflected in your intimation u/s 143(1). Another example may be that rent income is deducted from business income, which is not shown under Income from House Property.

- Disallowance of expenditure indicated in the audit report but not taken into account in computing the total income in the return

- Comparison of Advance Tax, Self-assessment tax and TDS, etc., from 26AS.

- Addition of income appearing in Form 26AS or Form 16A or Form 16 which is not included in ITR

- Claiming the losses for carry forward to next year when the return is submitted after the due date / set off of losses of the previous year where the return was filed after the due date.

- Whether deduction under section 10AA, 80-IA, 80-IAB, 80-IB, 80-IC, 80-ID, 80-IE has been taken after the due date of the Income Tax Return

- Calculation of Tax, Late filing fees, Interest, etc.

When Does One Receive an Intimation Under Section 143(1)

Every assessee receives an intimation u/s 143(1) when the return is processed successfully. The following are the primary instances for receiving an intimation under section 143(1):

Tax Refund:

If the taxpayer has paid an excess amount of tax, the notification will mention the refund amount. Refunds exceeding Rs. 100 will be disbursed to the taxpayer, while amounts below this threshold will not be paid out.

Tax Shortfall:

If the taxpayer has underpaid taxes, as determined through computation, the notice will specify the deficient amount. Additionally, a challan for making the required payment will be enclosed with the notice.

Conformance Notice:

A straightforward notice will be issued in cases where the tax returns filed by the taxpayer align with the assessment conducted by the assessing officer. In such instances, no separate 143 1 intimation is sent, and the taxpayer should consider the ITR V acknowledgment of filing the return of income as the intimation notice.

Adjustments under 143(1)

Under Section 143(1), the total income or loss declared in the return is computed after making the following adjustments:

- Arithmetical Errors: Any calculation mistakes in the return.

-

Incorrect Claims: Any claims that are clearly incorrect based on the information provided in the return. These may include:

- Claims that are inconsistent with other entries in the return, such as deducting income from other sources from business income without declaring it under the "Income from Other Sources" section.

- Disallowance of Loss Carry-Forward: If you attempt to carry forward losses from previous financial years, but the return for that year was filed after the due date, the set-off of those losses will be disallowed.

- Disallowed Expenses: Any expenses mentioned in the audit report but not reflected in the return will be disallowed.

Time Limit for Issue of 143(1)

Intimation u/s 143(1) can be issued only up to 9 months from the end of the financial year in which the return is filed and not after that.

For example,

- If you filed your return for the year 2023-24 on 21.07. 2024, then in that case, the financial year-end will be on 31st March 2025, and intimation can be issued upto 9 months from 31st March 2025. i.e., intimation u/s 143(1) can be issued for the FY 2023-24 only up to 31st December 2025.

- Lastly, do not ignore this notice, as you must submit your response within the time specified in such notice in case any action is required.

What Should be Done on Receiving Intimation u/s 143(1)?

After receiving an intimation u/s 143(1), the taxpayer needs to -

- As a first step, review the Section 143(1) intimation to ensure it matches your return and the data pertains to the same financial year. Check the name, PAN, address, assessment year, and e-filing acknowledgment number.

- If you identify mistakes in your return based on the 143(1) intimation, you can correct them by filing a revised return on the income tax e-filing website.

- If no mistakes are found, but you disagree with the adjustments made by the CPC/computerized system, you can file an online rectification application under Section 154(1) to correct the errors in the Section 143(1) intimation. Refer to our article on filing rectification applications.

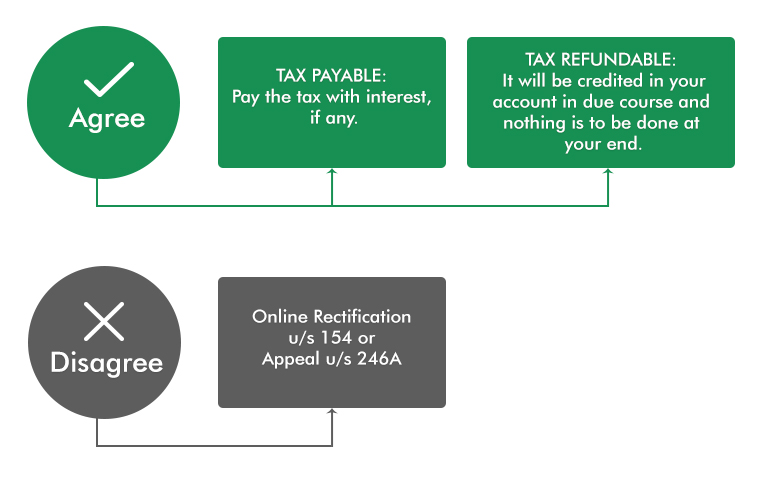

- Submit your response on the e-filing portal regarding any tax demand, indicating whether you agree or disagree.

- If you are unsatisfied with the processing of your rectification return by CPC, you can file online grievances or contact your assessing officer. If there is no satisfactory action from CPC or the assessing officer, you can file a complaint with the income tax ombudsman.

- In case you agree with the tax amount payable or the amount of refund due, You would be required to pay the amount of outstanding taxes, or you will simply receive the amount of refund shown in the intimation u/s 143(1).

- In case you do not agree with the calculations done by the income tax department, You can opt to file an online request to rectify your income tax return under section 154 or file an appeal under section 246A.

- And, if the net amount refundable or payable is zero, then you can treat the intimation received u/s 143(1) as the completion of the return filing process from the Income Tax Department for the financial year in relation to which the return was filed.

Have you received an intimation under Section 143 1? Don’t panic!! Tax2win tax experts can help with responding and resolving the tax notice. Consult with our tax experts today.

What if no Intimation is Received Till the Expiry of One Year?

If you do not receive any intimation till the expiry of one year from the end of the financial year in which you have filed your return, then your ITR–V acknowledgment will be deemed your intimation in that case. However, it is still suggested that you check online whether the Income Tax Department has processed ITR.

How is the Intimation u/s 143(1) Received?

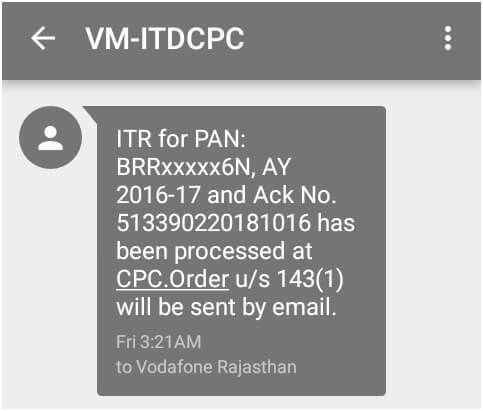

These intimations are auto-generated and are sent to the Email address provided by you at the time of filing income tax returns online / mail id given at the time of registration on the income tax website after thorough ITR processing. The sender of these emails is Central Processing Centre (CPC), with the sender ID being [email protected], as the returns are processed at CPC only.

As technology is growing, so is the Income Tax Department. Now with Intimation u/s 143(1), a text message is also sent to the registered mobile number.

How Many Days Will it Take to Get the Refund After 143 1?

The credit of refund process typically takes 20-45 days from the date of e-verification of the income tax return. However, if the acknowledgement (ITR V) is physically sent to the CPC, it may take longer.

What is the Password to Open Intimation u/s 143(1)?

The attachment received is a password-protected file. The ITR intimation password for opening the attachment/file received is your PAN number in lowercase followed by your date of birth in DDMMYYYY format.

For example,

Suppose your PAN is AAGRK5803P and your birth date is 2nd November 1982, then the intimation order password to open your online intimation u/s 143 1 shall be “aagrk5803p02111982”.

How to Get the Intimation u/s 143(1) Again?

If you have not received your intimation on the registered mail Id or in case you are unable to find that mail, you can get your intimation u/s 143(1) again by following these steps :-

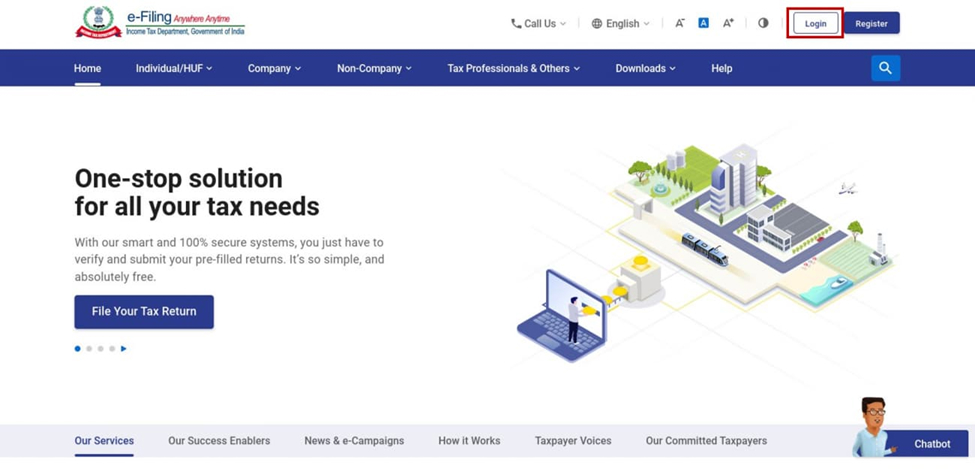

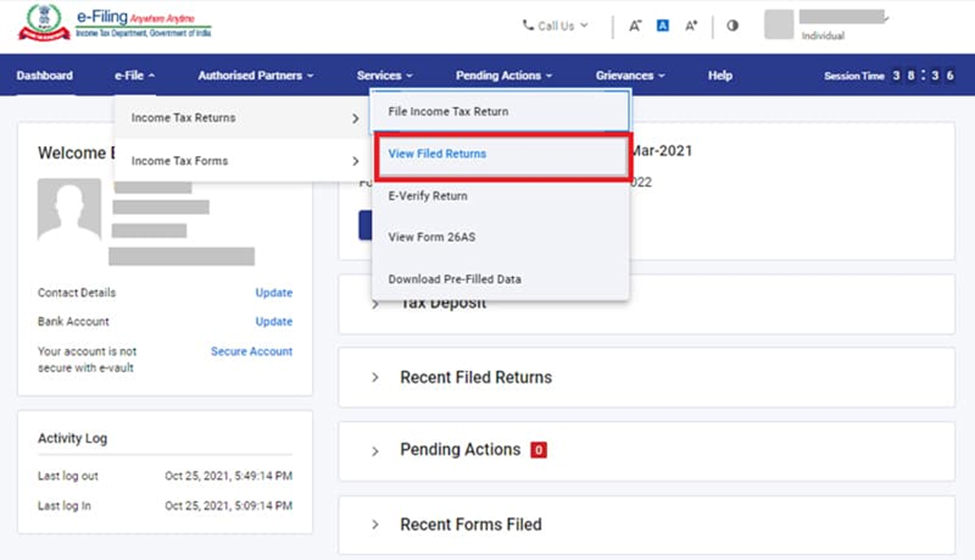

Step 1: Log in to the e-filing portal and enter your login credential.

Step 2: On your dashboard, click on the e-file and hover over the Income tax return. Click on ‘View Filed Returns.

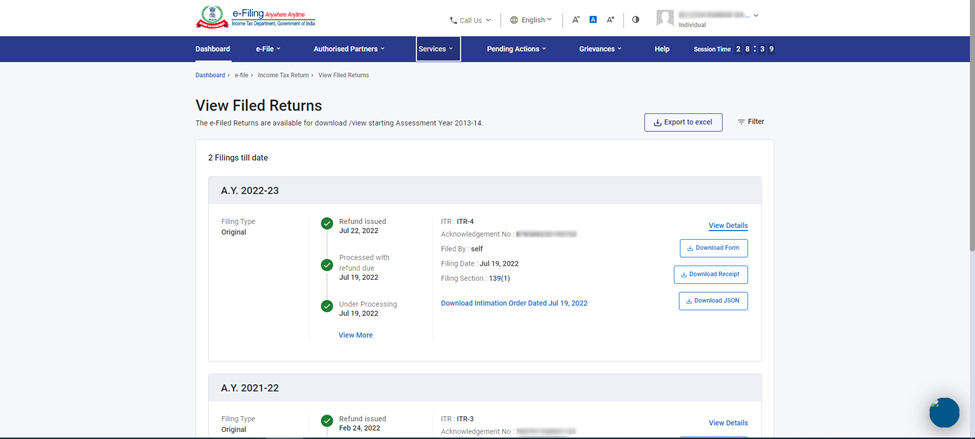

Step 3: You will see a page with your filed returns. Click on the Download Intimation Order.

Check the Following Points When you Receive an Intimation u/s 143(1)

- The intimation has your name on it.

- The Intimation has a document identification number

- All Incomes are considered properly under the appropriate head, and the Income of one head is not considered under another head or repeated elsewhere.

- The deductions you have claimed under 80C and other sections of chapter VI A are considered.

- TDS/TCS claimed Advance Tax paid, and Self-Assessment Tax paid in the computation by CPC.

- Any relief u/s 89, 90/90A/91 or any rebate claimed/ allowable is considered in the Intimation.

How to Respond to Intimation u/s 143(1) of the Income Tax Act?

Step 1: Log in to the income tax e-filing portal.

Step 2: Click on the “pending actions” tab and then select the e-proceedings option and select e-assessment.

Step 3: Select adjustment u/s 143(1)(a)

Step 4: Intimation notice details will be displayed; click on the submit button to start the process of responding intimation notice.

Step 5: You will be able to see the mismatch found, select the drop-down next to the response, and submit a response to that particular mismatch.

Step 6: Justify your response and submit the supporting documentation.

Step 7: Your response will be acknowledged after clicking on submit button.

Do I Need to Respond to the Notice/Intimation under Section 143(1)?

Yes, you need to respond to a notice/intimation under Section 143(1) of the Income Tax Act. Here’s what to do:

Understand the Notice:

- No Adjustment: No action needed if no discrepancies.

- Refund: Intimation shows refund amount.

- Demand: Indicates additional tax due.

Verify Details:

- Cross-check the notice with your filed return for errors or discrepancies.

Respond:

- Agree: Pay the additional tax if you agree with the demand.

- Disagree: File a rectification request under Section 154 if you find errors.

Seek Help:

Consult a tax professional who can help you with responding to the notices correctly.

Responding promptly helps avoid penalties and interest on unpaid taxes.

How Can Tax2win Help You Respond to an Income Tax Notice?

Received a tax notice from the Income Tax Department? Don’t worry—Tax2win’s got your back! Here's how we make it stress-free:

- Expert Guidance: Get personalised assistance from our team of experienced CAs and tax professionals.

- Detailed Notice Analysis: We decode the notice to help you understand exactly what the IT Department wants.

- Right Documentation: We help identify and compile all necessary documents needed for your reply.

- Drafting Accurate Responses: Our experts prepare clear, compliant, and timely replies to avoid penalties.

- Complete Compliance: We ensure your response aligns with tax laws to reduce the chances of further queries.

Don’t ignore that notice—get it resolved with ease! Connect Today

Easy & Quick

Easy & Quick Authorized by ITD

Authorized by ITD  Claim early refunds

Claim early refunds