Income Tax Notice Alert: The Income Tax Department has been issuing notices to taxpayers regarding House Rent Allowance (HRA) exemptions claimed under Section 10(13A) where TDS was not deducted on rent paid, as required under Section 194-IB. If you have received such a notice, it is crucial to take corrective action to avoid potential penalties. File Updated Return

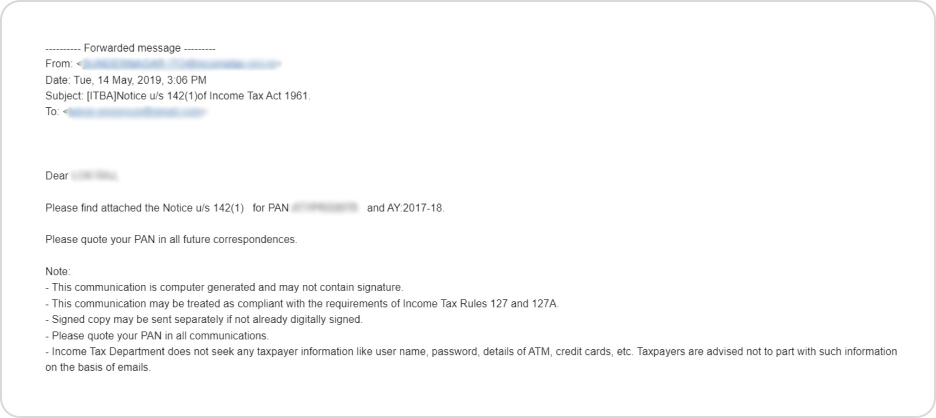

Section 142(1) of the Income Tax Act, 1961 grants authority to the Income Tax authorities to issue notices seeking additional clarifications or further details regarding a filed return.

This provision applies regardless of whether the taxpayer has filed their income tax return under Section 139(1) or has failed to file it altogether.

A notice under Section 142(1) can be issued whether or not you have filed your income tax return under Section 139(1).

If you haven't filed your return within the time limit specified in Section 139(1), the Assessing Officer can issue a notice requiring you to file the return within the time given in the notice.

This notice can also be issued after the end of the relevant Assessment Year.

Even if you are not required to file a return under any provision of the Income Tax Act, 1961, you must still respond to a notice under Section 142(1)(i) by filing a return.

Notice u/s 142(1) can be issued in both cases, where you file your income tax return u/s 139 (1) and also in the case you do not file your income tax return u/s 139 (1) and time specified to file a such return has been expired.

If the assessee has not filed the return within the prescribed time frame, the assessing officer can issue a notice asking the assessee to furnish the ITR within the time specified in the notice. This notice can also be issued after the end of the relevant Assessment Year.

If a notice under Section 142(1)(i) is issued to someone who is not required to file a return under any provision of the Income Tax Act, 1961, they are still obligated to file a return in response to the notice.

It can also be issued in cases where the Income Tax Department needs additional information in cases where tax return has been filed or in cases where it has not been filed.

If the taxpayer fails to file their income tax return within the specified period or before the end of the relevant assessment year, they may receive a notice under Section 142(1) prompting them to file their return. It serves as a reminder and legal requirement to fulfill their tax obligations. The last date to file ITR for non-audit cases without penalty is 31st July 2025. File Today.

Upon receipt of the filed income tax return, the Assessing Officer (AO) may request the taxpayer to furnish specific accounts and documents pertinent to the assessment. This could include providing evidence supporting claimed deductions, invoices for expenses declared under various income sources such as business income, etc.

The assessing officer may require you to furnish in writing and in the prescribed manner the information, notes, or workings on specific points as required by him, which may or may not form part of books of accounts. For example, A statement of your assets and liabilities.

The primary objective of issuing a notice under Section 142(1) of the Income Tax Act includes:

If you don’t comply with Notice u/s 142(1), then:

Have you received a tax notice under section 142(1)? Don’t panic. Tax2win tax experts can assist you in resolving these notices and responding to them timely and accurately. Connect with an expert now!

To respond to a notice under Section 142(1) of the Income Tax Act, you can use the online ‘e-Proceedings’ facility on the Income Tax portal. Here are the steps to follow:

If you have received an income tax notice, make sure you respond to it within the given time frame, or else you might attract heavy penalties and legal consequences. And if you are not sure or need assistance with resolving your notices, connect with our experts, who can not only help you respond to notices accurately but also help you gather the relevant documents and avoid further delays and penalties. Connect with tax experts now!