- Offline ITR Verification Methods: Step-by-Step Guide

- How to e verify ITR using Digital Signature Certificate (DSC)?

- How to E-Verify Your ITR Through Net Banking?

- E-Verify ITR with SBI Bank Net Banking: Step-by-Step Guide

- How to e-Verify an ITR V using HDFC Net Banking?

- E-Verify ITR through ICICI Bank Net Banking

- E-Verify ITR through Axis Bank Net Banking

- How to e-Verify ITR Using Kotak Net Banking?

- E-Verify ITR through Yes Bank Net Banking

- Quick Guide to E-Verify ITR Through Bank ATM

Step-by-Step Guide to ITR E-Verification-Axis Bank Net Banking

Filing an Income Tax Return (ITR) in India offers several advantages beyond just fulfilling your tax obligations. Filing an ITR can get you tax refunds, simplify loan applications, and serve as valid income proof. Read our comprehensive guide on the benefits of filing an ITR here.

Once you’ve completed the ITR filing process on Tax2win, a pop-up will appear on your screen, prompting you to e-verify your return within 30 days. You can conveniently e-verify using a One-Time Password (OTP) sent to a mobile number linked to your Aadhaar, banking, or D-mat account. If you choose to e-verify your ITR later, you can do so through the dashboard.

Here, we are providing our readers with a stepwise guide to verify ITR using Axis Bank Net Banking.

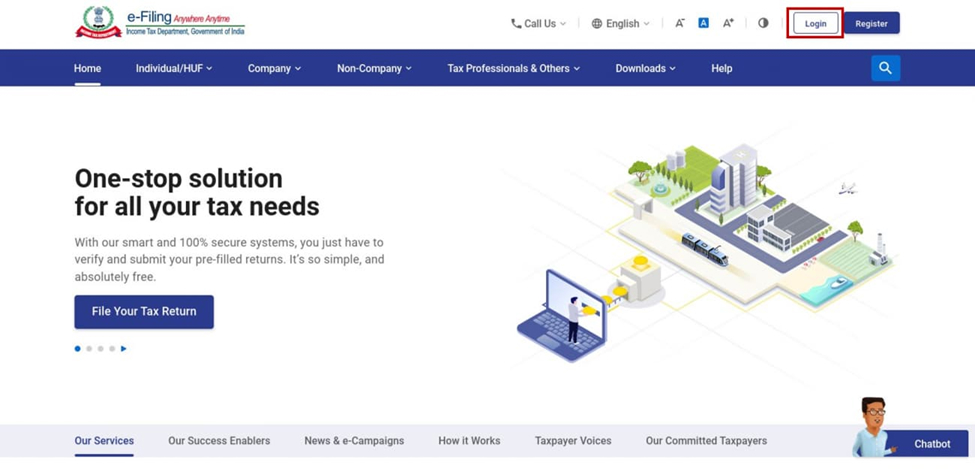

Step 1: Log on to the e-filing website

Go to the ‘e-file’ tab on the dashboard >> select ‘Income Tax Returns’ >> then select ‘e-verify return.’

Step 2: Select the option to e-verify via generating Electronic Verification Code (EVC)-Through Net Banking

Step 3: Once selecting the net banking option, you will be asked to select your preferred net banking; select Kotak Mahindra Bank. On the Kotak Mahindra Bank login page, you’ll have to enter “CRN/ Customer ID” or “Nickname” (if you have set any) and the password. After this, click on the “Secure Login” button.

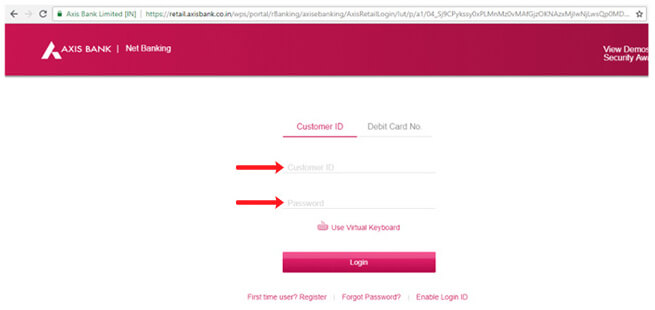

Step 4: At the Axis Bank login page, enter your Customer ID and Password or using a Debit Card and PIN. After this, click on the Login button.

Step 5: Once logged in, click on “Services” on the dashboard and then click on “Tax Services.” A further list will open; from here, click on the option “Income tax E-Filing”.

Step 6: On the next page, Confirm your account number and then accept the terms & conditions. After this, click on “Proceed.”

Step 7: Now, you are redirected and logged into your account at the Income Tax filing website. Here, under the tab “E file,” select option “Income Tax Returns and then select e-Verify Return.”.

Step 8: Once you click on the E verify return function, the following screen will appear. Please select the E-verify function for a particular Assessment year.

Step 9: Once you click on the E-verify option, a new pop-up will appear for confirmation. Once you click on the continue button, your ITR will be verified.

Alternatively, you can directly log in to Axis Bank as a first step to Process the E-verification process without having first login to the Income tax portal.

Now that you know the process of e-verifying your ITR using Axis Bank Net banking, make sure you e-verify your ITR within 30 days of filing it. If you have not filed your ITR yet, don’t worry! ITR filing is very easy with Tax2win’s revolutionary AI-integrated ITR filing solution. So file your ITR and get it e-verified with Tax2win.

Frequently Asked Questions

Q- How can I get EVC from Axis Bank?

Select the E verify options by login to your net banking. Then you will be redirected to the income tax website. Now login to the income tax website and click on e - file >e- Verify Return to generate EVC. A 10-digit alphanumeric code will be sent to your email and mobile number, valid for 72 hours.

Q- How do you e-verify ITR V?

You can e - verify ITR by 1. Aadhar OTP 2. E - verify through EVC 3. Sending signed ITR V acknowledging receipt

Q- What happens if ITR V is submitted after 30 days?

If you fail to submit ITR V within 30 days, your e-filing is considered null and void. It will be considered that you have not filed your return yet. In case of genuine delay, a condonation request can be filed.

Upload Form 16

File your ITR in just One Click

Easy & Quick

Easy & Quick Authorized by ITD

Authorized by ITD  Claim early refunds

Claim early refunds