The income tax department sends different types of ITR notices to taxpayers depending on the cause of the notice. These notices are as follows –

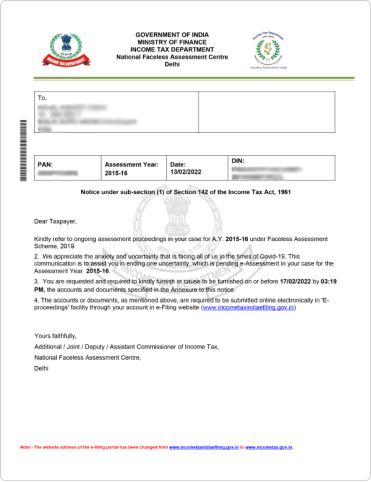

A ITR notice is served by the assessing officer u/s 142 (1) in two cases. Firstly, if the officer requires additional information and documents pertaining to your income tax returns...

Read more

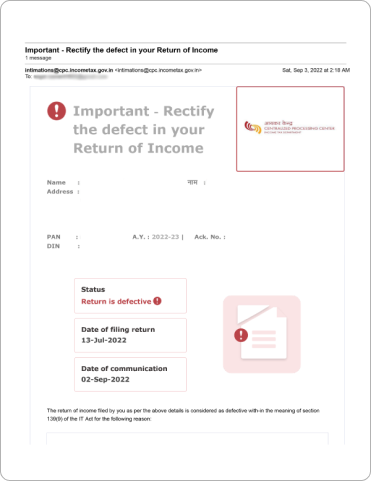

If the AO believes that a defective income tax return is filed, he will serve you an ITR notice under this section. The error can be missing information, selection of the wrong ITR form...

Read more

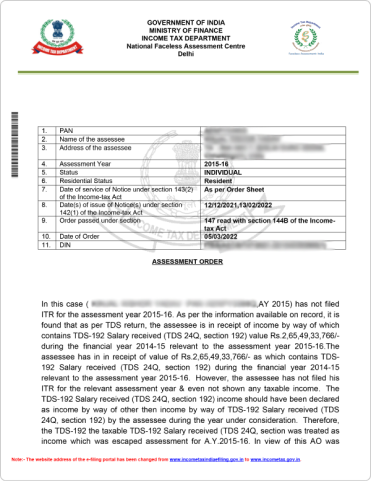

This ITR notice is sent in cases where the assessing officer(AO) has a reason to believe that a taxpayer has filed his ITR on a lower income or not filed when the law mandated him...

Read more

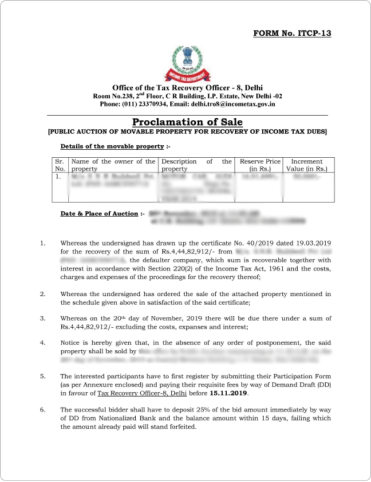

If there is any type of demand like penalty, fine, tax or any other amount which the taxpayer is supposed to pay to the income tax department, a income tax notice under Section 156 would be issued...

Read more

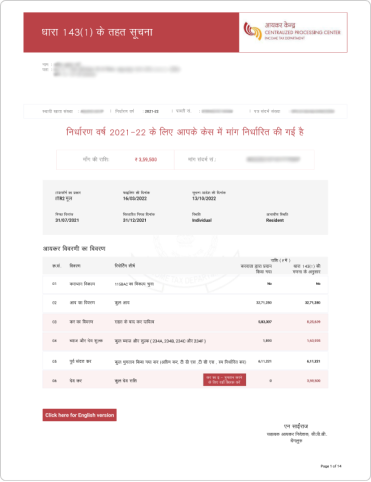

After you file and verify your ITR, they are processed online by the tax department. Intimation u/s 143(1) is computer generated initial assessment which is sent to all the taxpayers u/s 143(1)...

Read more

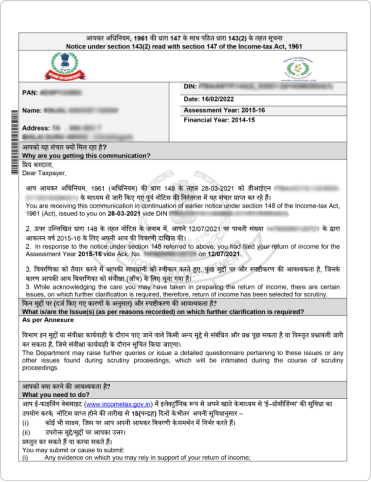

A notice u/s 143(2) is sent to the taxpayer if the Tax Department chooses to scrutinize the ITR of the taxpayer. The assessing officer sends this notice within 6 months from the end of the financial year...

Read more

If the assessing officer believes that the tax payer is concealing his income or a part thereof, he can serve a notice under this section...

Read more

This notice u/s 245 of the Income Tax Act is served by the assessing officer(AO) if it is believed that you have not paid taxes in the previous FY...

Read more

The most common causes for which you might receive an income tax notice include the following –

When you receive an ITR notice under any of the aforementioned sections, the following steps should be taken –

Ignoring a tax notice can lead to penalties, fines, and further legal action by the tax authorities. Your return may be treated as invalid and therefore consequences such as penalty, interest, non-carry forward of losses, loss of specific exemptions may occur, as the case may be in accordance with the Income Tax Act.It may also result in additional tax liabilities and damage to your financial reputation.

Return not filed within the due date of assessment period

Return processed successfully. Error in the amount of deduction, loss claimed, etc.

Notice to reconfirm that the tax return filed is accurate, and deduction has not been claimed in excess

Detailed assessment notice to ensure all claims, deductions, etc., are filled correctly without any errors.

A notice sent if the assessing officer feels that any income has not been assessed

In case of inaccuracy in returns such as missing information, incorrect filling of return, etc.

The type of documents required for replying to an income tax notice depends on the type of notice received. Here are some basic documents that are common to every notice -

Before responding to a tax notice received, it is important to authenticate it. Here are the steps to authenticate income tax notice online on the income tax portal -

PAN, assessment year, document type, mobile number, and issue date.

Authenticate using DIN and mobile number.

Received a tax notice from the Income Tax Department? Don’t worry—Tax2win’s got your back! Here's how we make it stress-free:

Don’t ignore that notice—get it resolved with ease! Connect Today

You must authenticate the notice/order issued by the income tax authorities to verify that the notice, order, or communication you received from the income tax authority is genuine.