- How to Calculate Income Tax on Salary with Example FY 2023-24

- How to Calculate Taxable Interest on P.F. Contribution in New Budget: A Guide

- Leave Encashment - Tax Exemption, Calculation & Examples

- 7th Pay Commission Pay (CPC) Matrix Table : Overview, New Updates, Features

- Income Tax Exemption on Gratuity - Eligibility, Maximum Limit & Taxability

- Agricultural Income- Overview, Taxability, Types and Calculation

- Income Tax on Loan Taken from Friends or Relatives - All you need to Know

- Financial Year and Assessment Year - Difference Between Assessment Year and Financial Year - FY vs AY

- Income Tax on Savings Bank Interest - How is Interest on Savings Account Taxed

A Complete Comprehension of Income Tax Basics

Paying income tax for the first time is a milestone in any individual’s life thought it also comes with reducing your in-hand income if not filed properly. Filing ITR first time can seem daunting but with tax2win, we will help you understand the basics of income tax so that you won’t find it more complex. Let’s read more in the below excerpt.

Budget Update 2025

No Income Tax on Annual Income Up to ₹12.75 Lakh!

The government has raised the Section 87A rebate limit from ₹7 lakh to ₹12 lakh, providing major tax relief to the middle class. Salaried individuals can also claim a ₹75,000 standard deduction, making incomes up to ₹12.75 lakh tax-free.

New Slab Structure under new tax regime:

- ₹0 – ₹4 lakh → No Tax

- ₹4 lakh – ₹8 lakh → 5%

- ₹8 lakh – ₹12 lakh → 10%

- ₹12 lakh – ₹16 lakh → 15%

- ₹16 lakh – ₹20 lakh → 20%

- ₹20 lakh – ₹24 lakh → 25%

- ₹24 lakh & above → 30%

Extended time for filing updated returns (ITR-U):

Taxpayers now get 4 years (instead of 2) to update their Income Tax Returns.

These changes will be effective from 1 April 2025 i.e. for FY 2025-26

What is Income as per Income Tax Act?

The word Income has a very broad and inclusive meaning which is defined under section 2(24) of the income tax act; without getting too in-depth, we will understand it broadly.

- In the case of a salaried person, whatever amount received from an employer, either in cash or kind or as a facility, is considered as income.

- For a businessman, his profits and gains will constitute income

- For professionals, freelancers, etc., their earnings from various sources like professional fees, other incomes, etc., are considered as Income.

- You might receive Rental income from a house owned.

- Or capital gains from the sale of shares, buying or selling of property, etc.

- Income may also flow from investments in the form of Interest, Dividends, Commission, etc.

- The Income Tax Department has classified income into 5 broad categories. Those are;

-

Income from Salary : The amount you receive from your employer every month comes under the head Income from salary. This applies only if there is an employer-employee relationship. Otherwise, the amount will be considered under a different head, and you will not get the exemptions and allowances available to salaried individuals. Your salary includes:

- Basic pay

- Dearness allowance

- Medical allowance

- Transport allowance

- Annuity

- Gratuity

- Advance of salary

- Other allowances and commissions

- Perquisites in lieu of salary

- Retirement benefits

- Income from House property : Any Rental Income from residential or commercial property that you own will be taxed. If you have a home loan, then the interest part of it would also be considered as negative income from House property.

- Income from Business or Profession : Income earned through business or profession is taxable under the head's profits and gains of business or profession. The income on which tax is levied shall be net of expenses.

- Income from capital gains : Any profit or gain arising from the transfer of capital asset held as investments (such as house, Jewellery are chargeable to tax under the head capital gains). The gain can be on account of short-term and long-term gains. Our article Basics of Capital Gain talks about it in detail.

- Income from other sources : Any income that does not come under the above four heads of income is taxed under the head income from other sources. For example, savings bank interest, lottery you win, or Reality shows like “Kaun Banega Crorepati”, etc. All these Incomes are taxable, which means the person winning 1 Crore in the show will get the reward amount after tax deduction at source at the rate of 30%.

-

Income from Salary : The amount you receive from your employer every month comes under the head Income from salary. This applies only if there is an employer-employee relationship. Otherwise, the amount will be considered under a different head, and you will not get the exemptions and allowances available to salaried individuals. Your salary includes:

While your hard-earned income is generally taxable, there are certain categories of income that are exempted; these are called tax-free incomes and are provided in Section 10 of the Income Tax Act, 1961.

Tax Free Incomes – The Essential List Part-I

What are Exempt Incomes/Tax-Free Income and Taxable Incomes?

Exempt Incomes are not chargeable to tax as per the Income Tax act. I.e., they are not included in the total income for the purpose of tax calculation. For Example, Interest earned from PPF, etc. Whilst taxable Incomes are chargeable to tax. For example salary, house property, capital gains Income, etc.

Who is an assessee?

As per Income Tax Act, an assessee means “a person by whom any tax or any other sum of money is payable under this Act”.

In layman’s term if you are liable to pay taxes, have any taxable income, or are otherwise required to file ITR, you are an assessee. The Income Tax Act, 1961 has classified Assessee in different categories, such as

| Individual | Piyush Aakash |

| Partnership Firm | M/s ABC and Company M/s ABC and associates |

| A Hindu Undivided Family | Mr. A (HUF) or Mr. B (HUF) |

| Company | Winiin Taxscope Private Ltd. Winiin Taxscope Ltd. |

| An AOP (Association Of Persons) or BOI (Body Of Individuals) | ABC Sangh XYZ Dal |

| A Local Authority | Pune Municipal Corporation PCMC Municipal Corporation |

| Artificial Juridical Persons | Everyone not falling within any of the above categories. |

What is the difference between Financial Year and Assessment Year?

Financial Year is the year in which you have earned income. On the other hand, Assessment Year is always the succeeding year in which you file your Previous Year's Income Tax Return and offer the particulars of your income earned during the Previous Year to be assessed by the Income Tax Department.

Which body governs the filing of taxes in India?

The Central Board of Direct Taxes (CBDT) provides essential inputs for policy and planning of direct taxes in India and is also responsible for the administration of the direct tax laws through the Income Tax Department.

CPC Bengaluru or Income Tax Centralized Processing Centre undertakes the work of receiving and processing all income tax returns filed in India.

Do I have to file my Income Tax Return?

Yes, e-filing of Income Tax Returns (ITR) is mandatory if the gross total income of an individual taxpayer exceeds the basic exemption limit. Under the old tax regime, individuals under 60 years old needed to file an Income Tax Return (ITR) if their income exceeded Rs. 2.5 lakhs, while individuals over 60 years old needed to file if their income exceeded Rs. 3 lakhs.

In the new tax regime, the income threshold for individuals under 60 years old has been raised to Rs. 3 lakhs.

Documents Required For Income Tax Return (ITR) Filing In India

Go through this list to see the documents you’ll need to file your taxes. You won’t need all the documents listed here as they vary on a case-to-case basis:-

| SOURCES OF INCOME | REQUIREMENTS |

|---|---|

| **Mandatory | PAN Card (Must have linked to Aadhar Card) |

| Bank Account Details | |

Salary |

Form 16, 16A, 26AS |

| Pay slips | |

| Rent receipt for HRA | |

| Investment under section 80C, 80D, 80E, 80G | |

House Property |

Address of property |

| Home loan interest certificate | |

| Co-owner’s details including their PAN card details & share in capital | |

Capital Gains |

ELSS, SIPs, debt funds, mutual fund statement, purchase and sale of equity funds. |

| If there is capital gains through selling shares then stock trading statement is needed | |

| purchase price, selling price, capital gain details and details of registration, in case a house property is sold | |

Other Sources |

Income received from post office account |

| Bank details required if Interest is received from savings account | |

| Reporting of interest received from corporate bonds and tax saving bonds |

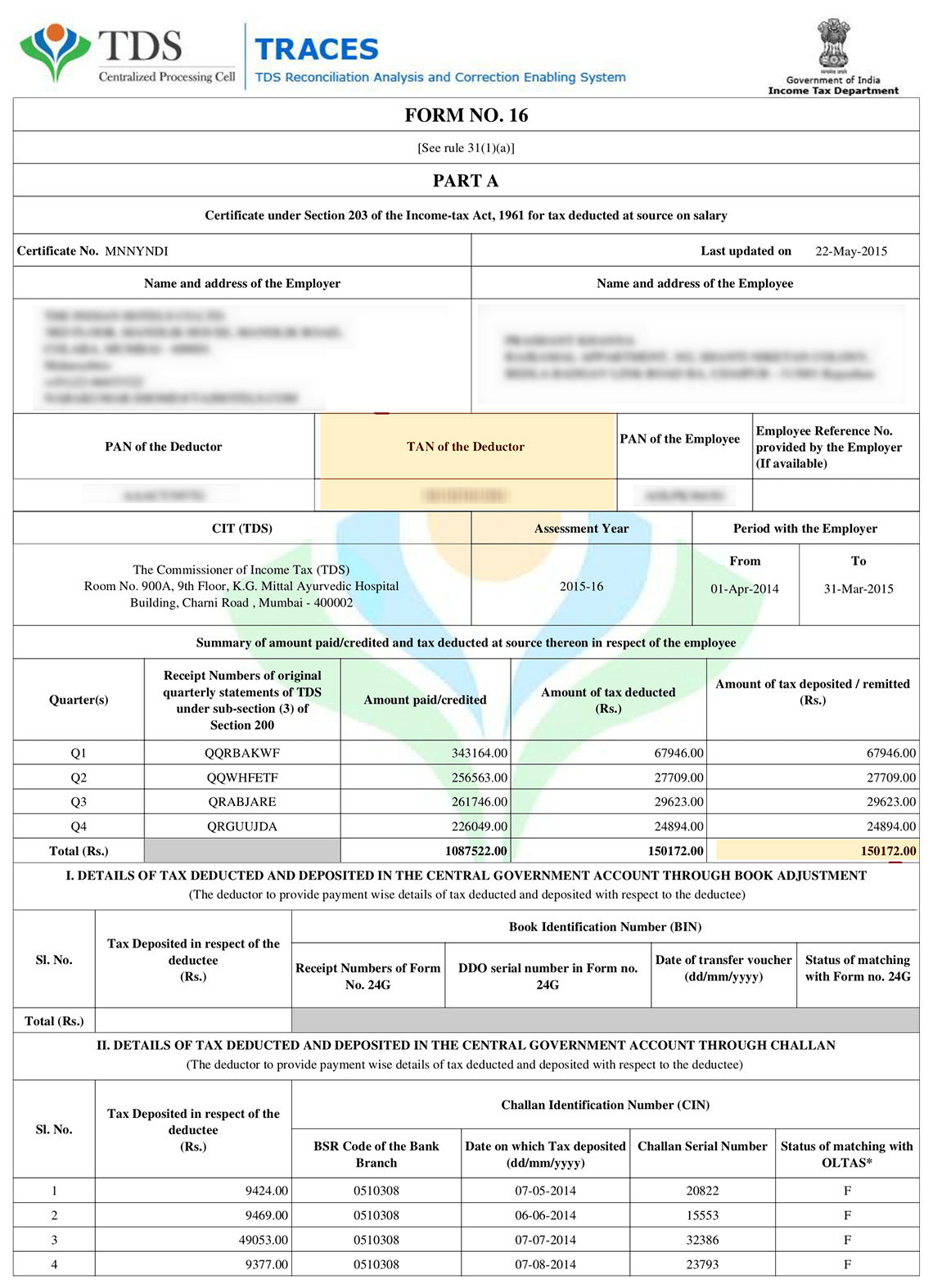

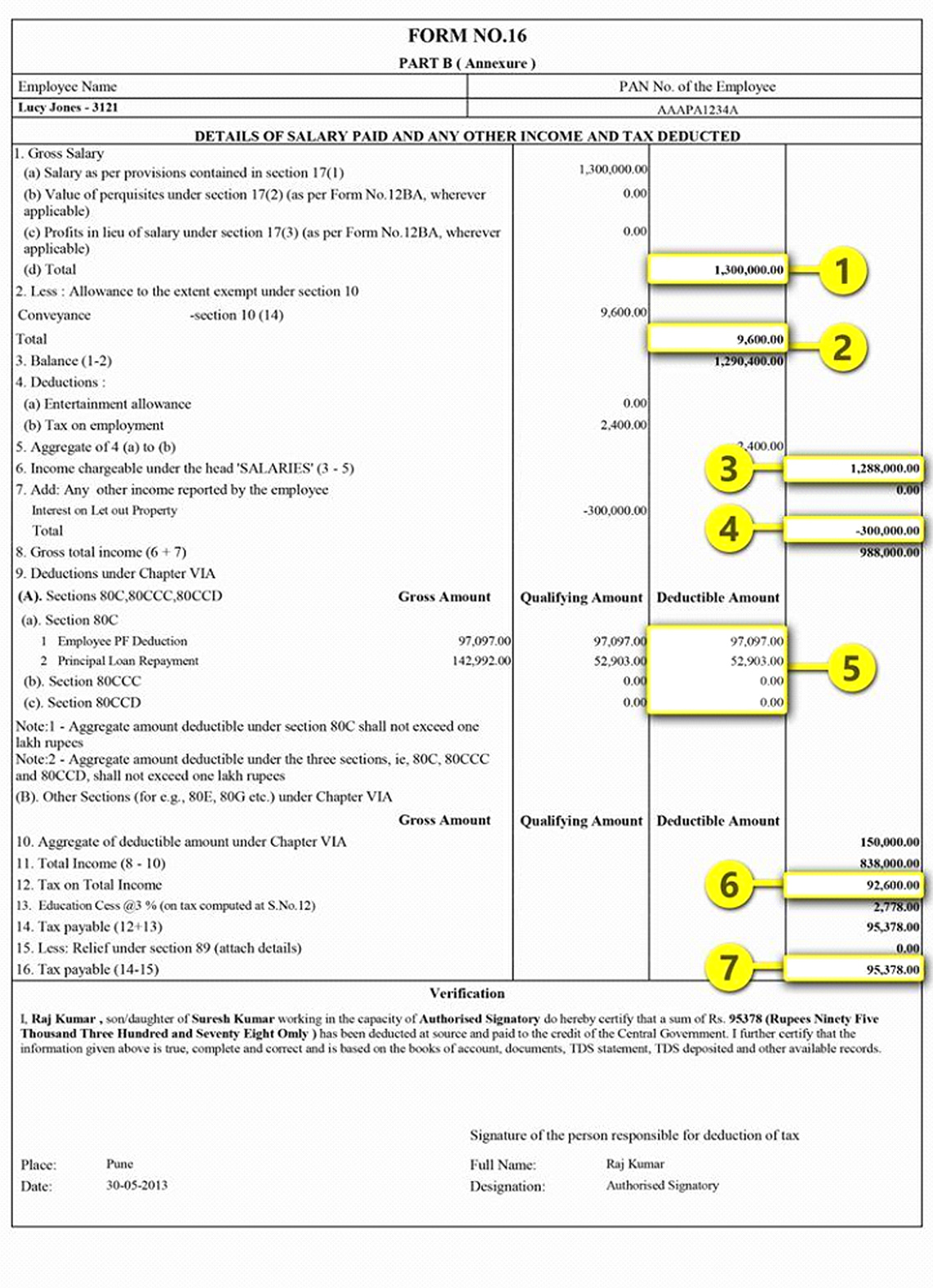

What is Form-16?

Form 16 is issued to salaried individuals by their employers. This form prescribes details regarding

- TDS deducted and

- The Salary Amount Received

- Allowances (like amount paid for HRA, medical reimbursements, etc)

- Other Income if detail is provided to the Employer.

- Deductions etc

Form is given at the end of the year and helps you file your income tax return as a breeze.

It is to be noted that deduction of TDS does not free you from the mandate of Filing of Income tax return.

Form 16 might differ in format depending upon employer to employer but a standard form 16 looks like this:-

- Part A of FORM 16 contains details of taxes that have already been paid by you or deducted from your income

- Part B gives a detailed breakup/composition of your income

What is TDS?

As per Income Tax Act, there are certain payments including salary, interest etc. in which the one who makes such payment is liable to deduct tax known as Tax Deducted at Source. At the time of making the final computation of income, TDS is adjusted with taxes payable. Any excess tax deducted at source is credited back to the taxpayer’s bank account by the Income Tax Department.

What is Form 26AS?

Form 26AS is a statement maintained and generated by the Income Tax Department for each individual assessee. Form 26AS is also known as an annual statement which contains all tax related information of a taxpayer. The details give a clearer picture of the tax commitments of a taxpayer. It is associated with PAN. Form 26AS contains:

- Details of tax deducted on your income by deductors

- Details of tax collected by collectors

- Advance tax paid by the taxpayer

- Self-assessment tax payments

- Regular assessment tax deposited by the taxpayers (PAN holders)

- Refund received during the financial year

- High value Transactions in respect of shares, mutual fund etc. performed during the year

Can I file my return even if I don’t have my Form-16?

Filing your ITR without Form-16 is possible but may require some extra effort and diligence on your part. You should always obtain your Form-16 from your employer as it simplifies the process and reduces the chances of errors or mismatches in your tax records. However, if you do not have your Form-16, you can still file your ITR using other documents and sources of information. Here are the steps to follow:

- Collect your payslips and bank statements for the financial year. These will help you calculate your gross income, deductions, exemptions, and TDS.

- Download your Form-26AS from the income tax e-filing portal. This is a consolidated statement of all the taxes deducted from your income by various sources, such as your employer, bank, etc. You can use this to verify the TDS amount and claim credit for it in your ITR.

- Compute your taxable income by adding all your income sources, such as salary, interest, capital gains, etc., and subtracting the deductions and exemptions available to you under various sections of the Income Tax Act, such as 80C, 80D, etc.

What is ITR Form? How is ITR submitted to Department?

ITR forms as already discussed are the prescribed forms in which information is needed to be furnished to the income tax department. There are different ITR forms for different categories of the assessee and the same have been explained below:-

Form and their Description

| ITR- 1(SAHAJ) | Resident Individuals having income from

|

| ITR-2 | Individuals and HUFs not having income from Profits and Gains of Business or Profession |

| ITR- 3 | Individuals and HUFs earning income from Business or Profession, including partnership firms |

| ITR-4 (SUGAM) | Anyone offering income for presumptive taxation |

| ITR-5 | Every person other than

|

| ITR-6 | For companies other than companies claiming exemption u/s 11 |

| ITR-7 | For persons including companies required to furnish return u/s 139(4A) or 139(4B) or 139(4C) or 139(4D) or 139(4E) or 139(4F). |

What is the due date for filing ITR?

| Category of Taxpayer | Due Date for Tax Filing - FY 2023-24 *(unless extended) |

|---|---|

| Individual / HUF/ AOP/ BOI (books of accounts not required to be audited) |

31st July 2024 |

| Businesses (Requiring Audit) | 15th November 2024 |

| Businesses requiring transfer pricing reports (in case of international/specified domestic transactions) |

30th November 2024 |

| Revised return | 31st December 2024 - Others 15th January 2025 - Resident Individuals |

| Belated/late return | 31st December 2024 - Others 15th January 2025 - Resident Individuals |

| Updated return | 31 March 2027 (2 years from the end of the relevant Assessment Year) |

Income Tax Slab Rates for F.Y. 2024-25

New Regime (FY 2024-25)

| Range of Income (Rs.) | Tax Rate |

|---|---|

| Up to 3,00,000 | NIL |

| 3,00,000-7,00,000 | 5% |

| 7,00,000-10,00,000 | 10% |

| 10,00,000-12,00,000 | 15% |

| 12,00,000-15,00,000 | 20% |

| Above 15,00,000 | 30% |

Old Regime (FY 2024-25)

| Range of Income (Rs.) | Tax Rate |

|---|---|

| Up to 2,50,000 | Nil |

| 2,50,000-5,00,000 | 5% |

| 5,00,000-10,00,000 | 20% |

| Above 10,00,000 | 30% |

Tax2win’s Old vs New Tax Regime Calculator provides you with all the computations and a detailed comparison of how much your taxability will be as per both regimes (old/new) so that you can decide which one is suitable for you. However, filing ITR yourself can be complicated and time-consuming. Moreover, it is common to miss out on some important deductions available to you due to a lack of knowledge. Therefore, the best way to file an ITR is to hire an online CA who can not only help you file your ITR smoothly but also reduce your tax liability. Hire an Online CA Now!

How to calculate income tax from income tax slabs?

This example explains how to apply tax slabs to calculate income tax for FY 2023-24 (AY 2024-25).

Rohit has a total taxable income of Rs 8,00,000 i.e. and not claiming any deduction deductions under chapter VI A. Rohit wants to know his tax dues for FY 2023-24.

| Income Slab | Tax Rate | Tax Calculation |

|---|---|---|

| Up to Rs 3,00,000 | No tax | - |

| Rs 3,00,001 – Rs 6,00,000 | 5% | 5% of (Rs 6,00,000 - Rs 3,00,000) = Rs 15,000 |

| Rs 6,00,001 – Rs 8,00,000 | 10% | 10% of (Rs 8,00,000 - Rs 6,00,000) = Rs 20,000 |

| Rs 8,00,001 – Rs 9,00,000 | 15% | Nil (since income falls between Rs 9,00,000 – Rs 12,00,000) |

| Rs 9,00,001 – Rs 12,00,000 | 15% | Nil (tax on this slab is 15%, but the income is not in this range) |

| Rs 12,00,001 – Rs 15,00,000 | 20% | Nil (since income falls between Rs 12,00,000 – Rs 15,00,000) |

| Above Rs 15,00,000 | 30% | Nil (tax on this slab is 30%, but the income is below this range) |

Tax = Rs 15,000 (from the first slab) + Rs 20,000 (from the second slab)

= Rs 35,000

Cess (at 3% on the total tax) = 3% of Rs 35,000

= Rs 1,050

Total tax in FY 2023-24 (AY 2024-25) = Rs 35,000 + Rs 1,050

= Rs 36,050 (rounded off)

Thus, Rohit's total tax dues for FY 2023-24 (AY 2024-25) amount to Rs 36,050.

What is Deduction under section 80C?

In simple terms, you can reduce up to Rs 1,50,000 from your total taxable income through section 80C, by making investment in prescribed routes like PPF, LIC etc. This deduction is allowed to an Individual or a HUF.

Example

| Income | 500000 |

| less- Deduction u/s 80C | 150000 |

| Taxable income | 350000 |

After providing deduction u/s 80C Taxable income will only be Rs 3.5 lakhs and not 5 lakhs.

What is Rebate u/s 87A?

Rebate under section 87A is accessible to resident individuals with a taxable income that falls below a specified threshold. This provision decreases the individual's payable income tax. The rebate's value and threshold under section 87A vary based on the chosen tax regime and the financial year selected by the individual.

For FY 2024-25 (AY 2025-26), the rebate u/s 87A is as follows:

- Under the new tax regime, the rebate is Rs 25,000 if the taxable income is up to Rs 7,00,000.

- Under the old tax regime, the rebate is Rs 12,500 if the taxable income is up to Rs 5,00,000.

For more details and calculations read our blog on Income Tax Rebate Under Section 87A

What is Advance Tax?

Advance tax means income tax paid in advance instead of a lump sum payment at the time of filing the ITR. It is also known as the “Pay As You Earn” tax. These payments have to be made in installments as per the due dates provided by the Income Tax Department.

Advance Tax Due Dates For FY 2024-25:

| Due Date | Advance Tax Payment % |

|---|---|

| On or before 15th June | 15% of advance tax |

| On or before 15th September | 45% of advance tax minus already paid advance tax |

| On or before 15th December | 75% of advance tax minus already paid advance tax |

| On or before 15th March | 100% of advance tax minus already paid advance tax |

Who should pay Advance Tax?

Advance tax is to be paid by an individual if his total tax liability is Rs 10,000 or more in a Financial Year. The provision of Advance tax applies to all taxpayers. Whereas, Senior citizens, who are 60 years or older, and do not run a business, are exempt from paying advance tax.

What is Self-assessment Tax?

Your income tax return cannot be submitted to the tax department unless you have paid tax dues in full. Sometimes, you may see tax payable at the time of filing your return. This income tax must be paid online so that the return is successfully e-filed afterward.Procedure for payment of taxes?

Taxes can be paid online by making an e-payment, or alternatively, the hard copy of the challan can be deposited in any nearest branch of a bank. For more details, please read click here.

What is interest under section 234A, 234B, and 234C?

You can attract the interests u/s 234A, B, C in the following circumstances

| 234A | Delay in filing the return of income |

| 234B | Non-payment or short payment of advance tax; and |

| 234C | Non or short payment of one or more than one instalments of advance tax |

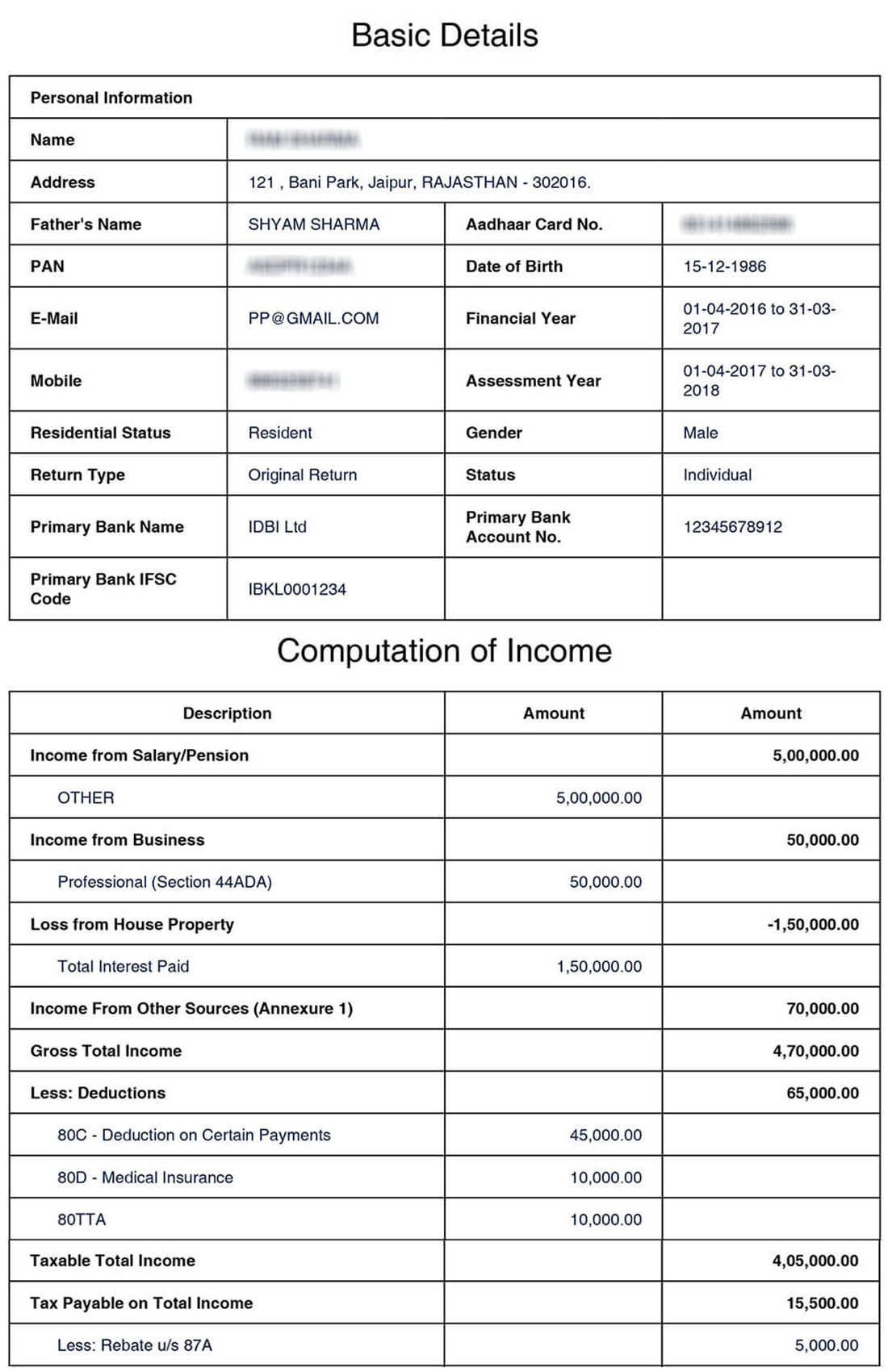

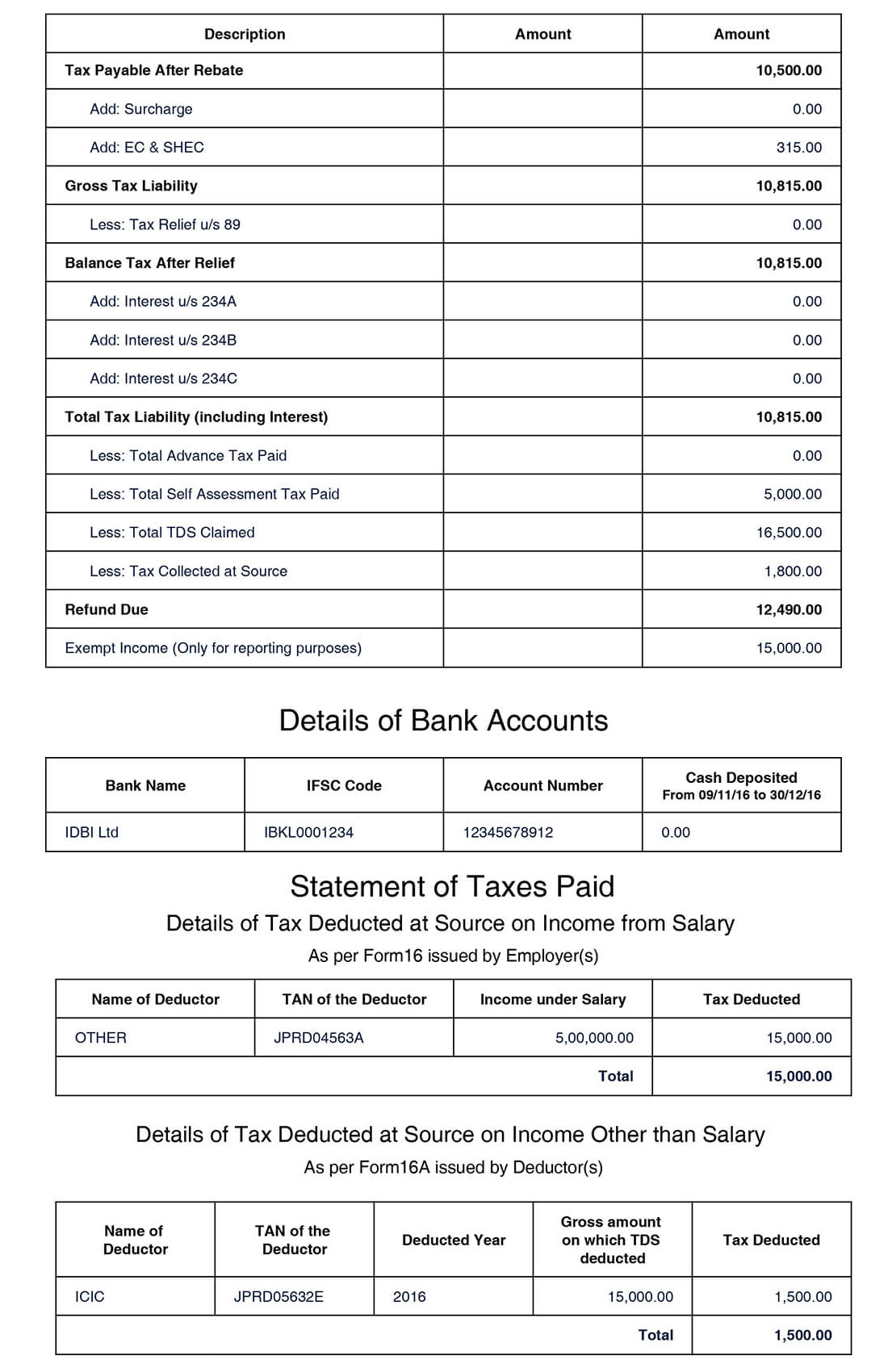

What is the computation of income?

A systematic presentation of inputs entered by an assessee, together with the calculation of taxes is known as computation of total income. There is no fixed format for the same. Generally, following elements are considered while making Computation Of Total Income

- Personal details of assessee

- Name

- Father's name

- Address

- Contact details etc - Bank account details

- Income details and

- Calculation of taxes

- Taxes paid details

A specimen of the computation has been given here under for your reference;

What if I don’t file my return?

In case you don’t file your return, following repercussions may follow:-

- A notice can be issued by the Income Tax Department.

- Any business losses during the year will not be allowed to carry forward to the next years.

- Penalty shall be imposed u/s 270A, and interest may be payable as per the section 234A,B,C

- Other consequences may also be there as per Income Tax act, 1961.

What if wrong particulars are furnished while filing Income Tax Return?

So, in case you have furnished incorrect information in your income tax return, you can submit a revised return before the end of the relevant assessment year in which the original income tax return was filed. I.e. for Financial Year 2023-24; AY 2024-25, you can file a revised return till 31st December 2024.

Your return can now be revised irrespective of the fact it was filed till the due date or afterward. To summarize, a belated return can also be revised.

In case of any misreporting detected in the income tax return, the income tax officer can levy a penalty of 200% of the tax, which is sought to be avoided. In other cases of underreporting of income, the penalty shall be restricted to 50% u/s 270A of the Income Tax Act 1961. Hence be very vigilant while disclosing your income and filing taxes.

What is an Income tax refund and How you can claim it?

An Income tax refund is the excess tax paid by you which is refunded back by the Income Tax Department. For eg : tax you need to pay was Rs. 10,000 but you paid 15,000, then after filing your income tax return which would be showing tax refund of Rs. 5,000 the amount will be given back to you by the Income Tax Department.

You can now track the status of your Income tax refund with our free Refund Status

Can a return be filed after the due date? Fee u/s 234F!!

Yes, if you fail to file the return of income on or before the prescribed due date, then you can file a belated return. A belated return can be filed till the end of the relevant assessment year.The timeline to file a belated return is on or before 31 December of the relevant A.Y.

Example :-

Return for F.Y 2023-24 was say required to be filed latest till 31st July 2024. But Mr. Chopra fails to do so. Now, he can furnish a belated return of income till 31st December 2024.

Penalty for Late Filing under section 234F:

The Income Tax Act has changed the rules for late filing of ITR under section 234F. If you miss the deadline, you may have to pay a penalty of up to Rs.5,000.

The penalty amount has been reduced from Rs.10,000 to Rs.5,000 for the financial year 2021 onwards. This means that for FY 2023-24, you can avoid the penalty if you file your ITR by 31st July 2024 (30th September 2024 for audit and 31st October 2024 for transfer pricing cases). If you file your ITR after 31st July 2024, the penalty limit will be Rs.5,000. But if your total income is not more than Rs 5 lakh, you will only have to pay Rs.1,000 as the maximum penalty for late filing.

Fee Details of late filing:

| e-Filing Date | Total Income less than 5 Lakh | Total Income more than 5 Lakh |

|---|---|---|

| 31st July 2024 | Nil | Nil |

| 1st August 2024 to 31st December 2024 | ₹ 1,000 | ₹ 5,000 |

Congratulations, you are no longer a tax novice but a tax-savvy! Well done!!

We recommend you consult an expert before filing your income tax return to avoid mistakes. If you have not filed your return yet, don’t delay any further. File it now! Book eCA now!

Frequently Asked Questions

Q- What is the administrative framework of Income-tax?

The Central board of direct taxes administers the direct tax law through the income tax department. Therefore the income tax department administers the income tax law under the supervision of CBDT.

Q- What is the period for which a person’s income is taken into account for the purpose of Income-tax?

income tax is charged on the annual income of assessee therefore period of 1st April to 31st March is taken as income period.

Q- In the Challan, there are terms like Income-tax on companies & Income-tax other than companies. What do they mean?

These terms are in reference of tax applicability. taxes paid by companies are corporate tax and for that challan contains the details of income tax on companies and for the others income tax other than companies.

Q- How is advance tax calculated and paid?

Advance tax is paid by the assessee having tax liability in excess of rupees 10000. it is calculated on the current income and paid in 4 installments.

Q- What is a tax on regular assessment and how is it paid?

Tax on regular assessment is the tax paid by the taxpayer on notice of demand. notice of demand means an additional tax is paid by assessee.

Q- What are the precautions that I should take while filling-up the tax payment challan?

PAN and correct name and address on challan is quote correctly and indicate FY and AY while filling the challan, separate challan shall be used for each payment and correct code is selected.

Q- How can I know that the Government has received the amount deposited by me as taxes in the bank?

Details of tax deposited by the assessee is shown in 26AS as self assessment tax. assessee can check this on 26 AS. NSDL also provides the service of challan status enquiry, assessee can take the information from NSDL website.

Q- What should I do if my tax payment particulars are not found against my name on the website?

There may be various possible reasons that amount is not shown in 26AS like PAN not correctley quoted, Incorrect PAN quoted etc. by rectifying the reasons details will be shown on website.

Q- Is my responsibility under the Income-tax Act over once taxes are paid?

No, you are now responsible for ensuring that taxes paid are shown in the tax credit statement. and if taxes are not credited in the statement possible rectification shall be made.

Q- Who is an Assessing Officer?

The assessing officer is an officer of the income tax department and AO is given jurisdiction over an area.

Q- Income-tax is levied on the income of every person. As per Income-tax Law, what constitutes income?

Income is defined under the 5 heads of income. that are salary, house property, business and profession, capital gains, and other sources. income constituted under these heads are covered under the income.

Q- What is exempt income and taxable income?

Incomes which are not chargeable to tax is exempt income and the income which are chargeable to tax are taxable income.

Q- What is revenue receipt and capital receipt?

Revenue receipts are in the nature of revenue like business income, salary income etc. and Capital receipts are those which are not in the nature of revenue like the sale of buildings, gold, etc.

Q- Are all receipts, i.e., capital and revenue receipts, charged to tax?

All the revenue receipts are taxable unless exemptions are provided in law, and capital receipts are exempt from taxes unless there is specific provisions for taxing them.

Q- Will it make any difference in Income tax if an assessee is a resident or non-resident?

Yes, it makes a big difference under Income tax provisions as there are different tax provisions for them. Hence, due care has to be taken in ascertaining your residential status so that you can correctly opt for eligibility to tax forms, rebates, etc.

Q- Do I need to attach any documents along with my Income Tax Return?

No, You don’t have to attach any document along with your income tax return. You are required to submit documents only when the Income Tax Department asks you to submit them.

Q- What is and How to E-verify Income Tax Return?

A signed hard copy of ITR V can be sent to CPC Bangalore or it can be e verified online.

Q- Is the Income Tax Act applicable only to residents?

No, Not only residents even the non-residents are covered under the scope of the Income Tax Act. In other words, it applies to all persons who earn income in India irrespective of their residential status.

Q- For whom is E-filing Mandatory?

All registered taxpayers who have taxable income must file their Income Tax Returns online. However, a taxpayer who has crossed the age of 80 years can file a paper return if he does not have income from regular business or profession.

Q- Can I claim a deduction for my personal and household expenditure in calculating my income or profit?

No, you cannot claim any of such deductions or expenditures.

Q- So far I have never paid any tax. If I file a return this year will the IT department ask me about my earlier years' income?

The IT department does not always asks for your earlier year returns, but the department may ask you to file a return of income for earlier years if it finds that you had taxable income in those years and you have not filed your income tax return despite being eligible for it.

Q- Am I required to keep proof of ITR filed? If yes, then for how long?

Yes. Since legal proceedings under the Income Tax Act can be initiated up to six years prior to the current financial year, you must maintain such documents at least for this period. Individuals who file their Income Tax Returns (ITR) should hold on to their previous ITR records and associated financial paperwork for a period of 10 years starting from the conclusion of the assessment year.

Q- What is the User ID to log in to Income Tax India efiling website?

The user ID is your PAN number.

Avoid Last-Minute Rush

Avoid Last-Minute Rush Faster Refund Processing

Faster Refund Processing Hassle-Free Filing with Experts

Hassle-Free Filing with Experts