Track PAN Card Status Online via NSDL & UTIITSL | Check PAN Application & Delivery

If you have applied for a PAN card through either the UTIITSL portal or the NSDL portal, you will receive periodic notifications via SMS and e-mail from the Income Tax Department regarding the status of your new PAN card. These updates will inform you whether your PAN card is in the printing process, has been printed, or has been dispatched to your address. If you have not received any notification from the department and a significant amount of time has passed, you may need to take further action to check the status of your application.

You can easily check PAN Card status online through various modes such as checking PAN card status by acknowledgment number or application number, checking PAN card status by mobile number, etc. In this article, we will guide you through the process of checking the status of your PAN Card application.

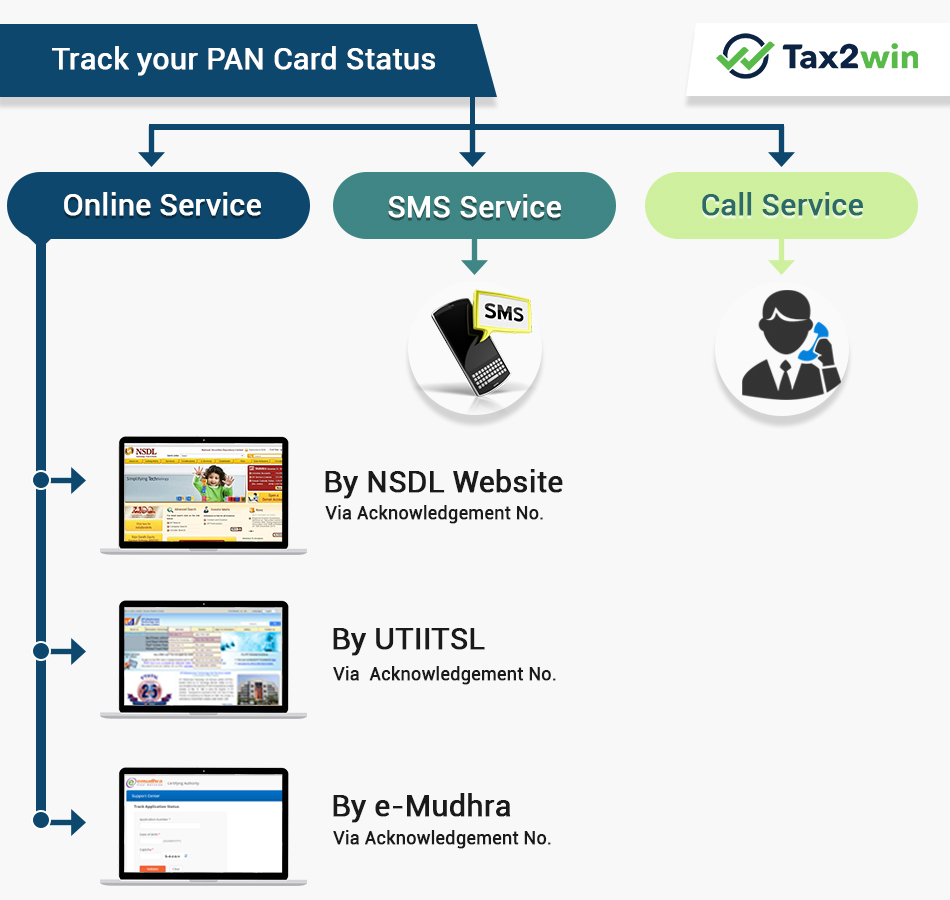

How to Track PAN Card Status Online

There are three modes through which you can easily track the status of your PAN Card application. The detailed description is under:

- Through Call Service: You can track your PAN application status by making a call at the TIN call center on the number – 020-27218080. You simply need to provide your 15-digit acknowledgment number for the PAN application.

- Through SMS Service: You can know the status of your PAN application by SMS. To get the status of your PAN application, type NSDLPAN

15-digit acknowledgment number and send this SMS to ‘57575,’ you will receive an SMS with your PAN application status. - Through Online Service Providers: The current status of your PAN application can be easily tracked online through the various service providers as below:

- By TIN NSDL

- By UTIITSL

- By E-Mudhra

Do remember to check the status only through the service provider’s website from which you have applied for PAN. Those who have applied physically at TIN – FC Center can check further status through the NSDL website at https://tin.tin.nsdl.com/pantan/StatusTrack.html.

Now, let’s briefly describe the procedure to check the PAN status through the above-mentioned modes.

How to check online PAN card application status through NSDL?

On the NSDL website, you will find the option to check your PAN card status using acknowledgment number. Let’s understand the process:

- Visit the TIN-NSDL portal

- Select the field ‘Application Type’ as ‘PAN – New / Change Request.’

- Enter your ‘Acknowledgement Number’ in the box provided.

- Enter the captcha code.

- Click on the ‘Submit’ button, and you are done with it.

How to check PAN card status without acknowledgement number

If you have applied for a PAN card online but have forgotten your acknowledgment number, you can still check the status of your application using your name and date of birth. Here's how:

Track PAN Card Status by Name and Date of Birth on the TIN-NSDL website:

- Visit the https://tin.tin.nsdl.com/pantan/StatusTrack.html_bkp24052013 page on the TIN-NSDL website

- Choose "PAN – New/Change Request" from the Application Type dropdown.

- Choose the name section to verify PAN card status without an acknowledgment number.

- Enter your full name as it appears on the PAN card application and your date of birth.

- After providing the required details, click on the 'Submit' or 'Search' button.

- The website will display the current status of your PAN card application if it's available in their database.

UTIITSL PAN card application status

Track PAN card status by coupon number on the UTI portal:

-

Visit the official web page of the UTIITSL portal: https://utiitsl.com/home

-

Take your cursor over the PAN card services as shown in the above picture, and then click on “Track your PAN card.”

- Enter the coupon number provided to you during the PAN card application process.

- Click on the 'Submit' or 'Search' button.

- The portal will display the current status of your PAN card application using the coupon number.

Check status using PAN number on UTIITSL portal

If you want to check the status of your PAN card using your PAN number on the UTI portal, follow the same steps as explained above and use your PAN card number instead of the coupon number. Now, you will be able to check your PAN application status.

Check the Status of Linking Aadhaar Card with PAN Card

Check PAN-Aadhaar Link Status Without Logging In

- Visit the Income Tax e-filing portal.

- Click on ‘Link Aadhaar Status’ under the ‘Quick Links’ section.

-

Enter your PAN number and Aadhaar number, then click ‘View Link Aadhaar Status.’

Status Messages:- Linked: "Your PAN is already linked to given Aadhaar.”

- Pending: "Your Aadhaar-PAN linking request has been sent to UIDAI for validation. Please check later."

- Not Linked: "PAN not linked with Aadhaar. Please click on ‘Link Aadhaar.’"

Check PAN-Aadhaar Link Status by Logging In

- Log in to the Income Tax e-filing portal.

- From the Dashboard, click ‘Link Aadhaar Status’ or access it via ‘My Profile.’

- Check the displayed Aadhaar number or linking status.

Check Status via SMS

- Compose an SMS: UIDPAN <12-digit Aadhaar number> <10-digit PAN number>.

- Send it to 567678 or 56161.

-

Possible Responses:

- Linked: "Aadhaar is already associated with PAN (number) in ITD database."

- Not Linked: "Aadhaar is not associated with PAN (number) in ITD database."

Track PAN card application status through SMS

The applicant must text 'NSDLPAN' to 57575, followed by the 15-digit acknowledgment number received once the application was submitted successfully. The application's current status is then delivered to the mobile number supplied in the application form.

Track PAN Card Delivery with Speed Post Tracking

- Visit the India Post Website on your computer or mobile browser.

- Locate the ‘Track & Trace’ option on the homepage and click to proceed.

- Use the tracking number provided by NSDL or UTIITSL at the time of PAN card dispatch. This number typically includes a mix of letters and numbers.

- Enter the tracking number in the designated field and click on ‘Track Now’ or ‘Search’ to view updates.

- Check details like dispatch time, current location, expected delivery date, and any delivery attempts.

- On the tracking page, subscribe to SMS alerts for updates directly on your phone.

For delays or issues, contact your nearest post office or India Post customer service for assistance.

UTIITSL PAN Card Helpline/Support

In case of any query or issues, you can contact UTIITSL’s PAN card helpline number at 033-40802999. This helpline is operational from 9 AM to 8 PM every day.

You can also email your queries to UTIITSL at [email protected]. You can also lodge a PAN-card-related complaint or a grievance with the Income Tax Department and also check the status of your grievance online.

Need help with taxes? Consult Online CAs Now!

Frequently Asked Questions

Q- What is a PAN Card?

PAN stands for Permanent Account Number. It is a code that is issued by the Department of Income Tax. It is a unique 10-digit alphanumeric allocated to every individual for performing various financial transactions. This card remains valid for the entire lifespan of the cardholder.

Q- What is the importance of a PAN Card?

A Permanent Account Number, commonly referred to as PAN, is one of the most important documents for an Indian national. It is mandatory to quote PAN at various places, like if you want to open a bank account, buy a property, sell assets above a specified limit, receive tax refunds, or file income tax returns, etc. It can be easily concluded that PAN aims to monitor finances in order to curb black money and prevent tax evasion.

Q- What are the various advantages of a PAN Card?

Benefits of having a PAN card:

- File income tax return and thereby claim the tax refund.

- Opening a bank account. To buy and sell movable and immovable assets, it is mandatory to have a PAN.

- For trade in securities other than shares, bonds, debentures, and other marketable securities, it is mandatory to have a PAN Card.

- A PAN card is mandatory to make a cash deposit, cheque, bank draft, and pay order exceeding Rs. 50,000

- Buy foreign currency exceeding 50,000; a PAN Card is mandatory.

Q- After how many days can I track my PAN card status?

Normally, the PAN application status is updated by the authority 5 days after application submission. However, the number of days may vary as well.

Q- Is it possible to check PAN Card status without an acknowledgment number?

If you’ve misplaced the acknowledgment number, then you can check your PAN status using your Name and Date of Birth through the NSDL website.

Q- Is it possible to open a savings bank account using a PAN status printout?

Yes, banks accept the printout of PAN status and acknowledgment slip to open a savings account in their brand.

Q- Is it possible to track the postal status of the PAN Card?

Use the tracking number provided to track the postal status. The tracking number can be found on the same screen as checking PAN Card status.

Q- Is it possible to check PAN card application status via telephone?

Yes, it is possible to check the status of the PAN card application by telephone. All you need to do is simply call 020-27218080 and key in your 15-digit acknowledgment number.

Q- What’s the meaning of Pan Card status ‘Application is inward’?

This means that your application for PAN has been received and is currently being processed.

Q- Your application is under process at the Income Tax Department. What does this message mean?

While checking the PAN Card status, if this message is visible on your screen, then it is not necessary that your application has been rejected. Due to the large number of applicants, the officials need time to scrutinize each and every application, which takes time. Sometimes, due to heavy website traffic, the status update may take more time to complete.

Q- PAN Card status shows ‘No matching record found’. What does it mean?

This message means there is a high chance that the PAN issuing authority has not received your application. In such a case, you should immediately call or send an email to the respective authority.

Q- PAN Card status shows that ‘application is being withheld from processing due to incomplete details/ documentary proof’. What is its meaning, and what steps that should be taken?

The above situation arises when the issuing authority either feels submitted information is incomplete or more information is needed. It is highly recommended that you get in touch with the authorities as soon as possible. Failure to take action will mandate you to make a fresh application again.

Q- PAN status shows ‘pan card is under printing’. In how many days I’ll get my card?

In common practice, a person receives his/her PAN Card within 21 days of applying. But there are chances that the number of days may vary.

Q- Why is the government invalidating more than one PAN card per user? And how to check the status?

The reason is very simple: having more than one PAN Card per individual is illegal. If you want to check your status, visit the Income Tax eFiling portal and select the option ‘ Verify Your PAN.’

Q- How to check UTI PAN application status?

It is very easy to check UTI PAN status. Simply visit the UTI PAN card page and enter your application coupon number along with the Captcha code. After this, click on the ‘Submit’ button, and your status will be shown.

Q- How to track Pan Card Application Status through acknowledgment number / Application Number?

PAN Card status can be tracked using the acknowledgment/application number with any of the options explained above. By Call, SMS, TIN NSDL, EMudhra, or UTI.

Q- How to check PAN Card status using Name and Date of Birth?

The PAN Card application status can be checked through the TIN NSDL website using the applicant's name and date of birth. Here’s how you check –

- Go to the link

- Under Application Type, select the option “PAN-New/Change Request” from the drop-down menu.

- Select the Name Option & enter the name details. For Applicants other than ‘Individuals’ like Partnership Firm, AOP, BOI, or Trust, write their name in the field for Last Name/Surname only.

- Enter the date of birth of the applicant as filled in on the application form at the time of the PAN Card Application. For the Applicants other than ‘Individuals’ like Partnership Firm, AOP, BOI, or Trust, write their Date of Formation / Agreement / Incorporation as applicable.

- Click on the “Submit” button.

For more details, read our guide on PAN.

Avoid Last-Minute Rush

Avoid Last-Minute Rush Faster Refund Processing

Faster Refund Processing Hassle-Free Filing with Experts

Hassle-Free Filing with Experts