- Rent Receipts : Definition, Format, Benefits, Process

- Taxability of Arrear Salary & Relief u/s 89

- How to Save Tax For Salary Above 20 Lakhs?

- How to Save Tax For Salary Above 10 Lakhs?

- Section 54F: Capital gains can be invested multiple times to buy a new residential house property

- Hindu Undivided Family (HUF) - How to Save Income Tax?

- Top Tax Saving Investment Strategies to Help You Keep More of Your Hard-Earned Money

- Startup India: Eligibility, Tax Exemptions and Incentives

- RBI Tax Saving Bonds: Features, Risk & Returns of RBI Tax Saving Bonds

- Gratuity, Its Meaning, Gratuity Calculation and Gratuity Act

How to Claim Tax Relief on Salary Arrears under Section 89?

After a good increment, an employee waits for the salary day or month for their oast arrears to get credited. An employee may receive a component of his salary in the form of arrear or advance salary during employment. But less of you know, these advances or arrears can affect your taxes as your income goes up and thus increase your tax outgo. In that case, relief under Section 89(1) of the Income Tax Act, 1961, can help you save from this additional tax burden. Let us know more about this relief under Section 89.

How does Section 89 relief help you from paying a higher tax due to arrears of salary?

Income tax is applicable and calculated on the taxpayer’s total income earned or received during the financial year. If the taxpayer has received a portion of their salary ‘in arrears or in advance’ or received a Family Pension in arrears, this may lead to put you in higher tax bracket.

To reduce this tax burden, the assessee can claim relief under section 89. The assessee might have to pay higher taxes because the arrear /advance salary is taxed in the year of receipt, not in the year it is due. The difference in the tax liability in the due year and the receipt year might be due to changes in the slab rates. For this reason, the provision of relief u/s 89 comes in.

When can you claim tax relief under Section 89?

An employee must meet certain conditions to claim relief under Section 89(1):-

- Salary is received in arrears or in advance;

- Salary received for more than 12 months in one financial year;

- Family Pension is received in arrears;

- Gratuity

- Compensation on termination of employment; and

- Commuted Pension

One important thing to note is that relief can only be claimed if the tax payable is higher due to the receipt of such arrears. If there is no extra tax liability, relief is not allowed.

Why is Section 89(1) important for tax-savings?

Section 89(1) of the Income Tax Act in India offers a tax relief benefit to taxpayers who receive income in arrears or advance. Here's how it benefits you:

- Reduces your tax liability: Since income tax is calculated on your total income for the year, receiving a bunch of income from a previous year (arrears) in the current year could push you into a higher tax bracket. Section 89(1) helps avoid this by recalculating your tax for both the year you receive the arrears and the year it relates to, ensuring you don't pay more tax due to a delay in receiving income.

- Fairness in taxation: This provision ensures that you are not unfairly burdened by a higher tax rate simply because you received income late.

Simply put, it prevents you from having to pay extra tax due to circumstances beyond your control, where income meant for one year is received in another.

How to calculate relief under Section 89 (1) on salary arrears

- Step 1: First, calculate the tax due in the current year, i.e., the year of receipt of salary, by including the arrears in your total income. The arrears provided will reflect in Part B of Form 16.

- Step 2: Now calculate the tax due in the current year, i.e., the year of receipt, by excluding the arrears from your total income.

- Step 3: Compute the difference between the two figures of Steps 1 & 2, and let’s call that difference ‘X.’

- Step 4: Now Calculate your tax due in the year, i.e., the year in which your arrear salary was due for which the arrears have been received by including the arrears in your total income.

- Step 5: Calculate your tax due in the year, i.e., the year in which your arrear salary was due for which the arrears have been received by excluding the arrears from your total income.

- Step 6: After that, compute the difference between the two figures of Steps 4 & 5, and let’s call the difference ‘Y.’

- Step 7: Lastly, subtract Y (Step 6) from X (Step 3) to get the relief amount.

This can be better understood with the help of the example below:

Total Income of Suraj was Rs. 15,00,000 p.a. in FY 2022-23 and also received an arrear of Rs. 3,00,000 p.a. For FY 2021-2022. His total income in FY 2021-22 was Rs. 6,00,000 p.a.

The table below explains the calculation of relief:

| Particulars | Tax Liability for FY 2022-23 | Tax Liability for FY 2021-22 | ||

|---|---|---|---|---|

| Salary inclusive of arrears | Salary without arrears | Salary inclusive of arrears | Salary without arrears | |

| Step 1 | Step 2 | Step 3 | Step 4 | |

| Total Income | 18,00,000 | 15,00,000 | 9,00,000 | 6,00,000 |

| Income Tax | 352500 | 262500 | 92500 | 32500 |

| Cess | 14100 | 10500 | 3700 | 1300 |

| Total Tax Liability | 366600 | 273000 | 96200 | 33800 |

| Step- 3 (X) Tax at Step (1) – Tax at Step (2) | 93600 | - | ||

| Step- 6 (Y) Tax at Step(4) – Tax at Step (5) | - | 62400 | ||

| Relief u/s 89: Step 3 – Step 6 | 31200 | |||

| Tax payable:- Tax at (1) – Relief | 335400 | |||

Relief under section 89 = (X) - (Y) = 93600 - 62400= 31200.

Similarly, tax liability for FY 2023-24:-

| 1 | Total income (excluding arrear) | 1500000 |

| 2 | Salary received as arrear (arrear received for FY 22-23) | 300000 |

| 3 | Total income including arrear | 1800000 |

| 4 | Tax on total income as per item 3 | 366600 |

| 5 | Tax on total income as per item 1 | 273000 |

| 6 | Tax on salary received in arrears (difference of 4 and 5) | 93600 |

| 7 | relief u/s 89 - step 8- step 6 | 31200 |

| Tax payable after relief | 335400 |

| Tax liability for FY 22-23 without arrear | Tax liability for FY 22-23 with arrear | |

|---|---|---|

| Total Income | 600000 | 900000 |

| Total Income | 33800 | 96200 |

| Difference | 62400 |

Need help calculating tax on salary arrears or advances? Minimize your tax liability and claim maximum relief under Section 89 with our expert Tax Advisory Service.

About Form 10E

To claim relief u/s 89, you must submit Form 10E online on the Income Tax portal before filing the Return of Income. Remember, your salary slips serve as proof of receipt of arrears therefore, should be kept safe.

Form 10E is the form for furnishing particulars of income under section 192(2A) for claiming relief. The features of Form 10E:

- Form 10E has details regarding the total income of employees and arrears or specified incomes received.

- Form 10E is to be filed before filing the income tax returns. If the form 10E is not filed by the employee and if they claim for the tax relief, then the Income Tax Department will notify them regarding the filing of form 10E to get the claim.

- Submitting Form 10E is quite easy as the form is available on the Income Tax Department’s e-portal. You just have to visit the portal and log in to the account. If visiting the portal for the first time, then you should register and create a valid ID and password. Form 10E is available in the income tax forms section. With some easy steps and filling in the required information, you can submit the form on the portal. Annexures are given while filling out the form.

- You have to select the relevant annexure and fill it in. Annexure I is for the arrear amount. Annexure II is for the gratuity, and Annexure III is for the compensation received upon termination of the job. For pension, annexure IV is required to be filled along with the form.

To claim relief under Section 89, you must submit Form 10E online on the Income Tax portal before filing ITR. Remember, your salary slips serve as proof of receipt of arrears and, therefore, should be kept safe. Connect tax experts

How to file Form 10E?

The steps to file Form 10E online is –

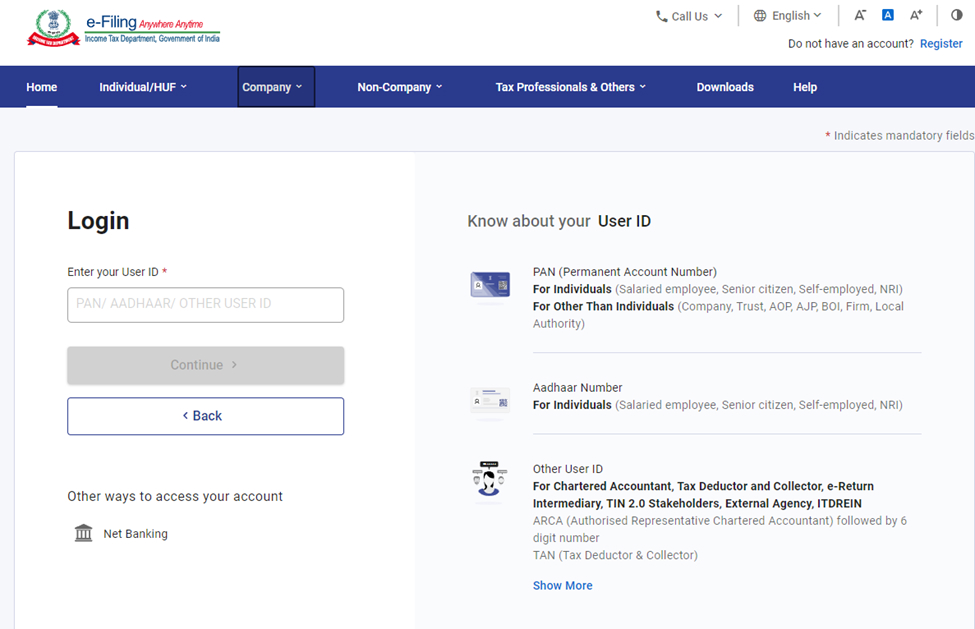

- Step 1: Log in to https://eportal.incometax.gov.in/iec/foservices/#/login with your User ID i.e. PAN, password

- Step 2: Now click on the tab named ‘e-File’, select ‘Income Tax Forms’, and click on File Income Tax Forms.

- Step 3 : The screen shall appear as below. From the 3 options, select persons without business and professional Income and then select FORM 10E.

- Step 4 : Now select the Assessment Year for which Form 10E will be filed.

- Step 5: When you click on continue after selecting the assessment year, the Form 10 E screen shall appear as below. You may select arrear salary and other options as applicable.

- Step 6: Now, when you click on continue after selecting the form of arrear, the Form 10 E screen shall appear as below.

Don’t forget to click on “Save Draft” while filling out the form, and lastly, click on “Preview & submit, “and you are done with it.

Income Tax Notice for Non-filing of Form 10E

An income tax notice for non-filing of Form 10E is a communication from the tax authorities to an individual or entity who has claimed relief under section 89(1) of the Income Tax Act but has failed to submit Form 10E.

Form 10E is used to claim relief for arrears or advance salary, particularly when there has been a delay or non-receipt of salary in a particular year or when salary is received in advance. This form aims to ensure that the taxpayer receives the appropriate tax relief for such income.

When the tax authorities identify that a taxpayer has not filled this form and still claimed relief under 89(1) while filing the return, they issue a notice to bring this non-compliance to the taxpayer's attention. The notice serves as a reminder and requests the taxpayer to file the form and provide the necessary information to claim the relief.

The notice will typically specify the reasons for the non-filing of Form 10E and provide a deadline for compliance. It may include instructions on submitting the form and any supporting documents. It is important to respond to such notices promptly and take the necessary steps to comply with the requirements outlined by the tax authorities. Failure to do so may result in an ITR being filed, but relief will be disallowed.

Avoid the hassle of scrutiny from the Income Tax Department due to inadequate assistance. Our team of tax experts is here to support you in filing Form 10E, optimizing your tax refund, and saving you valuable time during e filing income tax return. Don't wait until the last date to file ITR. Book eCA Today!

Frequently Asked Questions

Q- Is Relief u/s 89 available in the case of VRS Compensation?

Yes, relief under section 89 is available if the employee has not claimed the tax exemption under section 10 (10C).

Q- Due to last year's salary arrears, I have to pay additional income tax. Is there any solution to the distribution of arrears if the previous year's ITR is filed?

To save you from paying higher taxes on arrears, section 89 is introduced. If the total income of the previous year includes salary arrears, then you can claim relief under section 89(1).

Q- What are the methods to save tax on arrears?

Section 89(1) of the Income Tax Act, 1961 states that if an assessee's income has dues of salary from the previous year, then the assessee can claim relief as per section 89(1).

Q- Can I claim relief for an arrear of past years under section 89 if it is not mentioned in Form 16 and shown as gross income of the current year?

If the relief u/s 89 is not mentioned in Form 16, there is nothing to worry about; you can still claim the relief by providing all the details related to arrears at the time of filing the return.

Q- Is it necessary to file the previous year's income tax return to get the benefit of section 89 for the arrear salary received?

There is no such requirement by the IT department. The only thing required is the documents and details of the previous years' income in respect of which arrears are received to claim relief under section 89

Q- Is the filing of an individual income tax return mandatory to claim relief u/s 89 of the Income Tax Act?

To claim relief under section 89(1), filing Form 10E and an income tax return is mandatory.

Q- What is “Less: Rebate u/s 87A” reflected in the salary slip as per India income tax?

A rebate under section 87A means a tax rebate is available to resident individuals who do not exceed a certain limit. For the FY 2021-22 and FY 2022-23 [AY 2022-23) (AY 2023-24)], this limit is Rs. 5,00,000. This means, under both old and new tax regimes, a resident individual with taxable income up to 5 lakh is eligible to claim the tax rebate of 12,500, or the amount of tax payable (whichever is lower). Budget 2023 proposed several amendments, and the aim was to make the new tax regime more lucrative. For FY 2023-24(AY 2024-25), the rebate limit has been increased to Rs. 7,00,000 under the new tax regime. This means a resident individual with taxable income up to Rs 7,00,000 will receive Rs 25,000 or the amount of tax payable (whichever is lower) as tax relief. For this rebate, no additional investment is required.

Q- Can I claim relief under Section 89 of the Income Tax Act for HRA arrears?

HRA is part of the salary, and salary arrears come under the purview of Section 89. Hence, HRA arrears can be claimed under this section.

Q- How should I get the benefit of tax exemption for the arrears of the family pension received on 27 March relating to the previous three financial years?

To avail tax benefits for the arrears, individuals must file Form 10E. Form 10E is a requirement under section 89 to claim a deduction for the arrears, including family pension arrears.

Q- Is relief u/s 89 available for advance salary received?

Yes, Relief u/s 89 of the Income Tax Act can be claimed for receiving any portion of salary as an advance salary. To understand how to calculate the tax benefit under section 89, please refer to the detailed calculation explained above.

Upload Form 16

File your ITR in just One Click

Easy & Quick

Easy & Quick Authorized by ITD

Authorized by ITD  Claim early refunds

Claim early refunds

Avoid Last-Minute Rush

Avoid Last-Minute Rush Faster Refund Processing

Faster Refund Processing Hassle-Free Filing with Experts

Hassle-Free Filing with Experts