- Form 16 - Meaning & How to Download Form 16 Online?

- Form 26QB: TDS on Purchase of Immovable Property

- Form 26AS - How to View and Download Form 26AS from TRACES?

- Form 15G & Form 15H to Save TDS on Interest Income - How to Filll Form 15G for PF Withdrawal

- Form 10-IE: Understanding its Significance under IT Act

- Form 27Q - TDS Return for NRI Payments

- Form 16B – TDS Certificate for Sale of Property - Download From 16B from TRACES Website

- What is Form 16A? - How to Get and Fill Form 16A?

- Simplifying Form 13 of Income Tax for Non-Deduction/Lower Deduction of TDS

- Form 16 Password - What is the Password for TDS Form 16 and How to Open Form 16 Password?

- Form 24Q: TDS Return on Salary Payment

ITR 4 Form (SUGAM) - What is ITR 4, Eligibility & Who Can File ITR 4?

ITR-4, is filed by professionals & businessmen (online sellers, traders, wholesalers and manufacturers,freelancers such as online content writers, bloggers, vloggers, professionals like chartered accountants, doctors, lawyers and engineers, etc) who have opted for the presumptive scheme of taxation as per Section 44AD, Section 44ADA, and Section 44AE.

In this article, we will talk about the ITR 4 form, what is ITR 4, ITR 4 last date, and how to fill ITR 4 with examples.

Tax2win can help you select the right form while filing ITR for you. File ITR today.

Income Tax Return filing for FY 2024-25 has begun!

File your ITR on time with expert help – Accurate, timely, and refund-ready! File Today

Latest Update

Income Tax Dept. has rolled out Excel Utilities for ITR-1 & ITR-4 for AY 2025–26. Old Regime taxpayers, gear up for detailed disclosures this year!

Enhanced Disclosure Requirements across deductions:

- Place of Work

- Rent Paid & HRA Received

- Basic + DA

- Metro/Non-Metro Category

- Document/Receipt No.

- PPF A/c No.

- Insurance Policy No.

- Insurer Name

- Policy/Document No.

- Lender Name

- Loan A/c No.

- Loan Sanction Date

- Outstanding Loan (as on 31st March)

- Name of Specified Disease

Furthermore, if you’ve earned long-term capital gains from equity up to ₹1.25L, you can now use ITR-1 or ITR-4 instead of ITR-2/3! Connect today to file your ITR

What is ITR 4 (SUGAM) in the Income Tax Act?

The Income Tax Department has notified different ITR forms on the basis of the nature of income & class of people, like ITR-1, ITR-2, ITR-3, etc., to file income tax returns.

ITR-4 is an income tax return form that is used by taxpayers who are running a business or profession and have opted for the presumptive taxation scheme under Section 44AD, Section 44ADA, or Section 44AE of the Income Tax Act.

Opted for the Presumptive Income Scheme in FY 24-25? File your ITR accurately with Tax2win’s experts

However, if the turnover of the above-mentioned businesses exceeds Rs. 2 crores, the taxpayer will have to file ITR-3. The turnover limit will be increased to Rs. 3 Crore if 95% of the total receipts are in digital mode.

Under this scheme, the taxpayer is not required to maintain detailed books of accounts and can declare income at a prescribed rate based on gross receipts. The applicable rates for different businesses and professions are provided in the Income Tax Act.

What is the Eligibility Criteria for Filing ITR-4?

- The taxpayer should be an individual, HUF, or partnership firm.

- The taxpayer should be a resident of India.

- The taxpayer should have income from business or profession.

- The taxpayer should have opted for the presumptive taxation scheme under Section 44AD, Section 44ADA, or Section 44AE.

- The total income of the taxpayer should not exceed Rs. 50 lakh (75 lakhs if 95% of the receipts are through non-cash channels)

- The taxpayer should not have income from more than one house property.

- The taxpayer should not have income from capital gains except from the sale of assets mentioned in Section 44AD(1).

- If the agricultural income of the taxpayer is upto Rs.5000.

- As per the latest update for filing for FY 2024-25, if you have long-term capital gains up to Rs 1.25 lakh from the sale of listed equity shares and equity-oriented mutual funds, then from this year, you can use ITR-1 to file tax return. Till previous years, taxpayers having any capital gains were not allowed to file a tax return using the ITR-1 form. They were required to file their tax returns using ITR-2 form

- The ITR form now feature a drop-down menu in the utility for selecting deductions claimed under sections like 80C and 80GG. Additionally, assessees must furnish section-wise details regarding Tax Deducted at Source (TDS) deductions within the ITR.

Income from othere sources including -

- Interest from savings account

- Interest from deposits

- Interest from income tax refund

- Family pension

- Interest received on enhanced compensation

- Any other interest income

Who are Not Eligible to File ITR-4?

Here are some taxpayers who are not eligible to file ITR-4:

- RNOR or Non-resident

- Has agricultural income more than Rs.5000.

- Individuals having income from more than one house property

- Have income from winnings in lottery, activities of owning and maintaining race horses, income taxable at special rates under sections 115BBDA, and 115BBE.

- Companies

- LLPs (Limited Liability Partnerships)

- Individuals who have income from sources other than those eligible for the presumptive taxation scheme

- Individuals who have income exceeding Rs. 50 lakhs in a financial year

- Individuals who are either directors in a company or have invested in unlisted equity shares.

- Has deferred income tax on ESOPs received from the employer of an eligible start-up.

How to File ITR-4 Form Through Income Tax Portal?

You can file ITR 4 using the following 2 methods -

- Online - e-filing portal

- Offline - offline utility

Given below are the steps you must follow to submit the ITR 4 in online mode -

Step 1. Login to the e-filing portal using your ID and Password.

Step 2. On your dashboard click e-file > Income Tax Returns > File Income Tax Return.

Note: If your PAN isn't linked with Aadhaar, you'll receive a warning message about its inoperability. To link PAN with Aadhaar, click the "Link Now" button. Otherwise, click "Continue."

Step 3. Select the Assessment year for which you are filing ITR 4 and the mode of filing. Now, click on ‘Continue.”

Note: If you have already filled out your Income Tax Return and it is awaiting submission, click "Resume Filing." If you prefer to discard the saved return and begin preparing a new one, click "Start New Filing.

Step 4. Select the status that applies to you and click ‘continue’.

Step 5. If you're unsure about which ITR to file, you can choose the wizard-based return filing by clicking the "Proceed" button. The system will guide you in determining the correct ITR, and then you can proceed with filing.

However, if you already know which ITR to file, simply select the appropriate Income Tax Return from the dropdown menu and click "Proceed with ITR-4.

Step 6. Read the instructions and fill out the form. Now click on ‘Let’s get started’ and note down the documents required.

Step 7. review the pre-filled data and make any necessary edits. Enter any remaining or additional data as needed. Once you've completed each section, click "Confirm" to proceed.

Step 8. Choose "Yes" if you have ever opted for the new tax regime in earlier years; otherwise, select "No." If "Yes" is selected, specify the Assessment Year (AY), provide the date of filing of Form 10 IE, and enter the Acknowledgement number.

If you opted out of the new tax regime in later years after initially opting in, select "Yes" in "Have you ever opted out of new tax regime"; otherwise, select "No." If "Yes" is chosen, indicate the Assessment Year (AY), provide the date of filing of Form 10 IE, and enter the Acknowledgement number.

If you haven't chosen the New Tax regime in previous years, select "No." For the current year, choose the "Opting in now" option if you wish to opt in for the New Tax Regime; otherwise, select "Not Opting.

If you choose the new tax regime, a pop-up will appear indicating that you will not be eligible for certain deductions and allowances. Click "Proceed" to continue.

provide the Acknowledgement Number and the date of filing of Form 10IE, as they are prerequisites for opting for the new tax regime, especially for individuals with business income

Step 9. Input your income and deduction details in the respective sections. Once you have completed and confirmed all sections of the form, click "Proceed" to continue.

If you have a tax liability, you will be presented with a summary of your tax computation based on the information provided. If there is tax payable according to the computation, you will see the options "Pay Now" and "Pay Later" at the bottom of the page. It is advisable to utilize the "Pay Now" option.

By choosing "Pay Later," you can settle the payment after filing your Income Tax Return. However, there's a risk of being categorized as an assessee in default, which may lead to liability for interest on the tax payable.

Step 10. If there is no tax liability (No Demand / No Refund) or if you are eligible for a refund, you will be directed to the Preview Return page.

Step 11. Upon successful payment through the e-Filing portal, a confirmation message will be displayed. Click "Back to Return Filing" to finalize the filing of your Income Tax Return.

Step 12. Click Preview Return.

Step 13. On the "Preview and Submit Your Return" page, your place, name, and other details will be automatically populated. Select the declaration checkbox and then click "Proceed to Preview."

Note: If you have not engaged a tax return preparer or TRP in preparing your return, you can leave the textboxes related to TRP blank.

Step 14. Review your return and click "Proceed to Validation."

Step 15. After validation is completed, click "Proceed to Verification."

Note: You will be presented with a list of validation errors in your return, if any. You must return to the form to correct these errors. If there are no errors, you can proceed to e-Verify your return by clicking "Proceed to Verification."

Step 16. On the "Complete your Verification" page, choose your preferred verification option and then click "Continue."

Verifying your return is mandatory, and e-Verification (the recommended option - e-Verify Now) is the easiest method. It's quick, paperless, and safer than sending a signed physical ITR-V to the CPC by speed post.

How to File ITR-4 Form Through Tax2win?

Tax2win offers two types of ITR filings:-

DIY (Self-filing)

DIY (Self-filing)- If you have a little bit of knowledge about taxes, entering some basic details will let you file the ITR within 4 minutes. Tax2win’s DIY platform is AI-integrated, hence, it will auto-select the right ITR form for you itself and thus make filing super-easy for you. The user interface is friendly and easy.

If you are wondering how to file an ITR with Tax2win, here are some simple steps you need to follow -

Step 1. Either sign in to the tax2win website using your existing credentials or sign up to the portal and create an account. You can do self-filing only in the case of income from salary, business, and capital gains.

Step 2. After logging in, a table consisting of all the possible sources of income opens. You need to select the income sources that you have. Based on your sources of income, Tax2win’s DIY ITR filing system selects the applicable ITR form automatically.

Step 3. Step 3. Upload your Form 16. Uploading Form 16 will help fetch data automatically and reduce manual work. If you don’t have the Form 16, you can click on continue without Form 16.

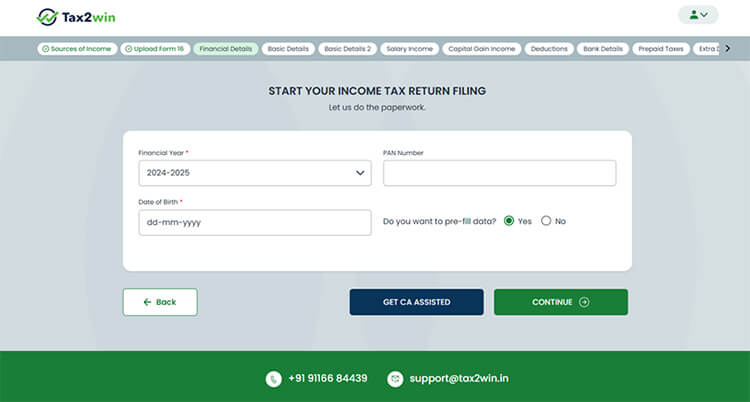

Step 4. Select the F.Y. and enter the PAN Details and DOB. (If you don’t have a registered account with the Income Tax Department, you will receive an OTP, and a new account will be created.). You can also choose if you want our DIY software to fetch your personal details and get data pre-filled.

Once you enter your details, you will receive an OTP on your registered mobile number for authentication. Please provide the OTP for a smooth ans secure filing process.

Step 5. Enter a few basic details in the next step. Some of it is pre-filled from the Income Tax Department’s database. Remember to cross-check the information available. As shown in the image given below, you have to enter your personal details like name, email ID, date of birth, father’s name, gender, etc.

Step 6. In the next step, you have to provide your address details and employer category. You can refer to the image below to understand this better.

Step 7. If you have opted for the presumptive income scheme, enter your income details and click on ‘Continue”.

Step 8: Enter the details of your capital gains or losses. Also, enter the details of unlisted shares and shares on which STT has been paid and investments in house property u/s 54F.

You can either upload the capital gains statement from the brokers given in the image below or import bulk data using the Tax2win template.

You can also enter details of debentures/bonds, land and building, other assets and virtual digital assets.

Step 9: Enter the details of the investment made during the year to calculate the applicable deductions. You have to enter details of investments in PPF, LIC, PF, housing loan, FDR, NSC, tuition fees, premiums paid to the annuity, and other 80C deductions. Also, you can claim deductions like 80D, 80CCD (1B), 80G, etc.

Step 10: Enter your bank account details and Aadhaar details. Make sure your bank account details are accurate to ensure you receive your refund on time. Now, click on continue.

Step 11: Enter the details of the taxes you have already paid, TDS and TCS deducted and collected. If you have your Form 26AS, you can simply upload it to avoid manual entry. Otherwise, you can enter your details manually to calculate tax liability.

Step 12: Select the return filing type. If it is your first time filing ITR for the relevant assessment year, then select original return and click on continue.

Note: Tax2win’s ITR filing Software selects the ITR-form applicable based on the information available. In this case, it will select ITR-4.

Step 13: Based on the information given by you in the previous sections, the software automatically computes your tax liability using both the old and the new regime. You can compare both regimes and select the one that is more beneficial for you.

Remember to cross-check all the information in return, click on the checkbox, and click on “File my return.” And here, you are done with filing. Don’t forget to e-verify the ITR at the same time. Remember to e-verify your return within 30 days.

Step 14: You can use any of the methods mentioned above to e-verify your ITR. If you have already e-verified your ITR, click on Already e-verified.

Step 16: A code will be sent to the mobile number linked to your Aadhaar. Enter the EVC and verify your return. You also have the option to change the e-verification method here.

Step 17: Once you enter the EVC, your ITR will be e-verified successfully.

The second way through which you can file ITR on Tax2win is:-

Expert-Assisted ITR Filing

Step 1. Click on Book eCA Now.

Step 2. Either sign in to Tax2win or register yourself on Tax2win by creating an account.

Step 3. Choose from where your income is and click on next.

Step 4. Select how many employers you have and click on next.

Step 5. Select if you have business or professional income and click on next.

Step 6. Select if you own a house or not and click on next.

Step 7. Select if you have any income from capital gain or not and click on next.

Step 8. Tax2win’s AI-integrated software automatically suggests the most suitable plan based on your needs. You can pay the fees and connect with an eCA to get a smooth ITR filing experience. If you have any other queries, you can also get in touch with our customer support executive at the number given on the website.

What is the Structure of ITR-4?

Part A: Personal Information & Filing Status

The first part of this form is related to the personal information of the assessee, such as

- Name,

- PAN,

- Address,

- Date of Birth,

- Aadhar no.

- Email and

- Mobile number, etc.

The next part shows the filing status of the return, i.e., whether it is a revised return or return in response to some notice issued by the income tax department or a return filed by the assessee himself or by any of his representatives and details of such representative.

Part B: Gross Total Income

Now comes the part for the calculation of Gross Total Income. It is the aggregate of income calculated under all different heads of Income.

Income from Business and Profession is calculated in the schedule on a presumptive basis based on the relevant section.

Income taxable under the head ‘Salary’: It is to be calculated the same as in the case of ITR-1. First, determine the monetary and non-monetary part of the salary and then deduct the allowance exempt under section 10. Then allow deduction under section 16, i.e., standard deduction, entertainment allowance, professional tax. To get the amount chargeable to tax under the head income from “Salaries.”

Income from House Property: Calculation of income from house property where maximum loss that can be set off in a period is limited to Rs. 2 Lakhs.

Other sources: Income from other sources can be calculated by specifying the source of such income from the drop-down list. After that, a standard deduction u/s 57 (iia) is available toward the family pension.

Part C: Deductions and Total Income

Now, allow for deduction under Chapter- VIA of the Income Tax Act 1961. The quantum of such deduction is based on the amount invested by the assessee.

Now, calculate the tax liability based on the income tax slab applicable to the income group of the assessee. And allow for Rebate u/s 87 A if income is less than Rs. 3.5 Lakh. And allow for Relief u/s 89 in respect of salary arrears received.

Schedule BP of ITR 4 – Sugam

The schedule for calculating Business Income is as follows:

- The first set of presumptive income is for Business income under section 44AD.

- Presumptive income of Profession is covered under section 44 ADA

- And for goods carriage, the presumptive income is calculated under section 44 AE.

- It also contains a column for information regarding Turnover/ Gross Receipt reported for GST.

- After that, it also contains financial particulars for Business.

Please enter details of Financial particulars in below screen

TDS Schedule under Indian Income Tax Return form ITR 4

Part 19 is related to the Tax Deducted at source from salary. This schedule is populated using the Form 16 issued by the Employer. It incorporates details such as:

- TAN of deductor,

- Name of the employer,

- Income under Salary, and

- Tax deducted thereon.

Part 20 TDS 2(i) is for TDS on Income other than Salary as per the Form 16A furnished by the deductor.

And Part 20 TDS 2(ii) is for TDS on Rent and as per Form 16C TDS certificate for Rent.

Schedule IT of Income Tax Return Form ITR 4

Part 21 is for providing details regarding the payment Advance Tax during the year and self-assessment tax paid at the end of the period. This Schedule requires the assessee to fill the information given on the payment challan such as BSR Code, Serial Number of Challan, date of payment, amount, etc.

Schedule TCS of Income Tax Return Form ITR 4

TCS Schedule 22 consists of details regarding the Tax Collected at the source and as mentioned in the Form 27D issued by the collector.

Part 21 is for providing details regarding the payment Advance Tax during the year and self-assessment tax paid at the end of the period. This Schedule requires the assessee to fill the information given on the payment challan such as BSR Code, Serial Number of Challan, date of payment, amount, etc.

Schedule – Taxes Paid and Verified of Income Tax Return Form ITR 4

In the next schedule, the total tax liability that the assessee is required to pay is automatically calculated. Such liability is calculated after considering the details furnished in the previous schedule. Net liability or refund is calculated by taking the difference of total tax paid from tax liability calculated based on income.

- Column / Part 28 is for providing the bank account details of assessee held in India at any time during the previous year but not including the dormant accounts.

- The above bank account details are followed by the Declaration regarding true and fairness of the information provided. And filing the return in the capacity of Self, Karta, Representative, and Partner.

- If the Tax return Preparer prepares the return, the details of such TRP is to be provided along the amount to be paid to TRP.

Schedule 80G of Indian Income Tax Return Form ITR 4

The Last schedule is to calculate the total amount of deduction to be claimed under section 80G for contributions/ donations made to the charitable institutions.

- The First two parts are for calculating deductions without any qualifying limit specified under the law. The listing is to be made as the donations eligible for 100% deductions and includes details of the donee and type of donation made.

-

After that donation eligible for a deduction of 50% of the donated amount.

-

The next two parts i.e, C & D are for donations having qualifying limit as specified under the Income Tax Act 1961.

- Part E reflects the cumulative deduction amount claimed under section 80D.

Verification of ITR-4

After successful filing, the income tax return needs to be verified. The verification is required to be done within 30 days of filing the ITR. It can be done online, i.e., e-verification through an OTP (One Time Password) or EVC (Electronic Verification Code). Alternatively, the offline process can be followed by sending the signed copy of ITR V to CPC Bangalore. For more details, refer to our guide on How to verify your Income Tax Return.

For further details on ITR forms Read More.

Need help filing your ITR, want to plan your taxes, or have a tax-related query? Don’t worry! Tax2win has got you covered. From tax planning to tax filing, our expert CAs are here to assist with everything related to taxes. Simply book an eCA and get solutions to your tax problems. Book an Online CA Now!

FAQs on ITR 4

Q- Can I file ITR-4 if audit u/s 44AB is applicable to me?

ITR-4 is a simplified form that cannot be filed by the individuals to whom the audit is applicable.

Q- Am I eligible to file ITR-4 if I am a joint owner of house property?

For FY 2020-21 ITR-1 & ITR-4 cannot be filed by an individual who is a joint owner of a house property. For FY 2021-22 you can file ITR 4 in this case.

Q- What is Presumptive Income?

As the name suggests, under the presumptive method of taxation no actual computations for determining the profits or losses of the businesses are made. The turnover is reported, and a certain percentage of it is taken as taxable income for the year. In the case of business u/s 44AD minimum 6% of the business turnover is required to be reported as taxable income in case the transaction is undertaken through electronic modes and 8% otherwise. To learn more about presumptive income and taxation Read More.

Q- Is it compulsory to file the ITR4 form for 5 consecutive years once filed in a particular year?

If a taxpayer is opting for Presumptive scheme as per section 44AD then he/she shall have to file ITR4 for 5 consecutive years.

Q- The new ITR-4 is requiring GST as mandatory to file an ITR. But I have not registered under the GST. How should I file my ITR?

ITR 4 can also be filed if taxpayers are not registered under GST Law.

Q- What is the procedure if I submitted the ITR-4 form instead of an ITR-1 form?

If the wrong ITR Form has been filed, then the return is a defective return, to make it validate, file the revised return. The last date for revised return is the end of the 31st December

Q- I am a salaried person. I also deal in share trading. Which ITR should I file?

ITR Form will depend whether the taxpayer intends to show share trading as capital gain or Business Income.

Q- Which ITR (1 or 4) form has to be filed if a doctor gets a salary from a private hospital and also receives the form 16A?

Doctor needs to file ITR 4 if he received form 16A, then he should be filed ITR 1

Q- How should I file an ITR-4 if the only income I have comes from tuition and house rent?

Taxpayers can consider his tuition income as business covered u/s 44ADA and can file his return accordingly.

Q- Can I file the ITR 4 under 44ADA if I filed the ITR 3 last year which was the first year of filing? The 5 years limit is for 44ADA as well.

Yes, Taxpayers can file ITR 4 if she/he filed ITR3 last year and the limit of 5 years is not applicable on Sec. 44ADA

Q- I am an individual having business income can I opt for old tax regime while filing ITR-4 ?

Yes you can opt for old tax regime if you have business income but for opting old Tax regime you have to file From 10 IEA before filing the ITR.

Q- I am an individual having business income can I switch between New tax regime and old tax regime every year ?

Individuals having business income are not eligible to choose between the new and old tax regimes every year. Once they have opted for the old tax regime, they only have a one-time option of switching back to the New tax regime in their lifetime. Once they switch back, they cannot opt for the old tax regime again.

Essentially, people with business income may have to fill out Form 10-IEA twice, once to use the Old tax regime and the second to switch back to the New regime.

Q- What is the due date of filing form 10 IEA for opting/withdrawing Old tax regime?

As per the income tax laws, an individual having business income shall submit form 10-IEA before the due date of filing ITR i.e. July 31 under non-audit cases and 31st October under audit applicable cases.

Q- Whether all deductions will be available to claim while filing ITR-1 return?

Yes, all deductions will be available to claim in the return once taxpayer will change the option of default new tax regime to old tax regime by selecting the below question as ‘Yes with the due date’ after filing Form 10-IEA within the due date and furnish Date of filing of Form 10IEA and Acknowledgement number in the return under Personal Information

Upload Form 16

File your ITR in just One Click

Easy & Quick

Easy & Quick Authorized by ITD

Authorized by ITD  Claim early refunds

Claim early refunds