- ITR U - What is ITR-U & How to File Updated Return

- ITR Filing Last Date FY 2023-24 (AY 2024-25) | Income Tax Return Filing Due Date

- Documents Required for Income Tax Return (ITR) Filing in India FY 2022-23 (AY 2023-24)

- Section 154 Of Income Tax Act: Rectification of Mistakes under Section 154

- Section 139(5) of Income Tax Act - How to File Revised Return?

- Income From Other Sources: Meaning, Exemptions, Deductions & Examples

- How to Correct the Invalid Surname and First Name Error on e-Filing Portal

- Income Tax Return (ITR) : How to File ITR Online for FY 2022-23 (AY 2023-24)?

- How to Show F&O Loss in ITR? | Guide to Filing Income Tax Return with F&O Loss

- Who is Required to File ITR for FY 2023-24? Conditions & Exceptions for ITR Filing

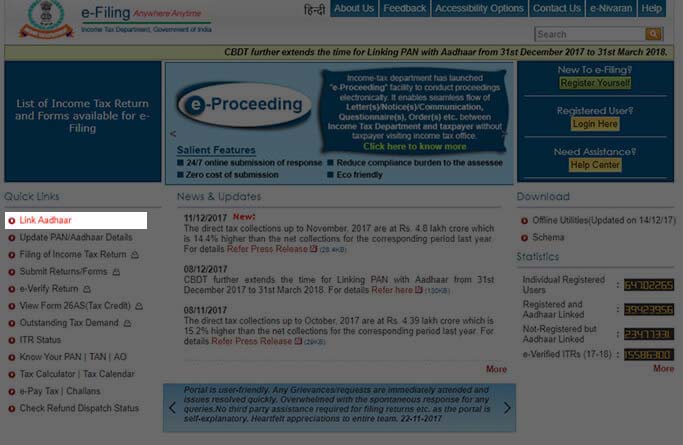

Here’s the link to the e-Filing website of the Income Tax Department : https://incometaxindiaefiling.gov.in

Who can register on the efiling website of the income tax department?

Every person having PAN can register himself on the website of income tax department.

What are the information required before starting registration on Income Tax website?

All you need is your PAN card, Address, Mobile Number and Email ID with you.

What is the process of registration on income tax efiling website?

The process of registration is very simple, similar to what we do when signing up in the ecommerce website. The only difference is the number of details required. Just follow these steps and register in less than 5 minutes -

Note: Click on the below steps to see how your screen will look like while following the process.

- 1 Go to the e-Filing website of the Income Tax Department.

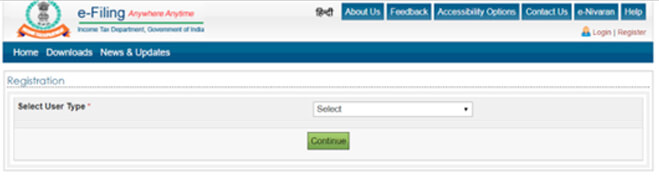

- 2 Click on the 'Register Yourself' tab and select 'Individual' from the drop down and click on ‘Continue’ button.

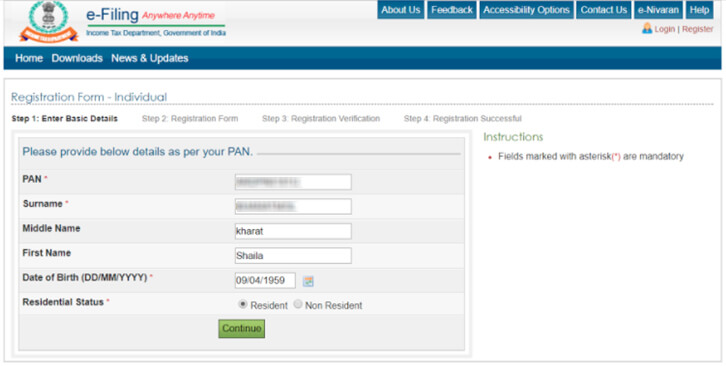

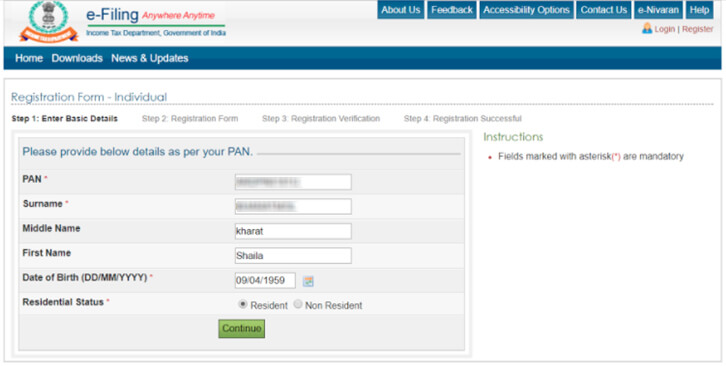

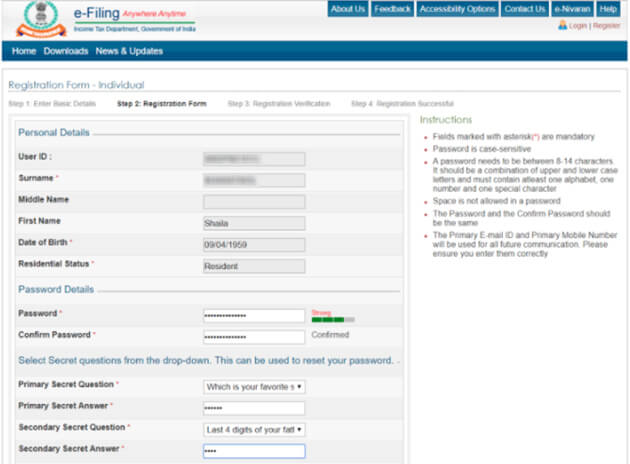

- 3 Now comes a four step registration form.

- 4 Click on “Continue” button. You will be redirected to Part 2 of the Registration Form where you will have to set a Password and Secret Questions for security purposes.

- 5 Now in Part 2, fill in the following details and click on submit.

- 6 After submitting abovementioned details , a six digit OTP 1 and OTP2 will be shared on your mobile number and email ID, specified at the time of registration.

Go to the e-Filing website of the Income Tax Department

Click on the 'Register Yourself' tab and select 'Individual' from the drop down and click on ‘Continue’ button.

Now comes a four step registration form.

Part 1: Enter Basic Details

| PAN | Mandatory : Should be valid at the time of registration |

| Surname | Mandatory : Should match with surname given in PAN Card |

| First Name | Not Mandatory : Should be as per PAN Card |

| Middle Name | Not Mandatory : Should be as per PAN Card |

| Date of Birth | Mandatory : Should match with Date of Birth given in PAN Card |

| Residential Status | Mandatory : Choose between these two status Resident and Non -Resident |

Not sure about your residential status? Check here now!

Click on “Continue” button. You will be redirected to Part 2 of the Registration Form where you will have to set a Password and Secret Questions for security purposes.

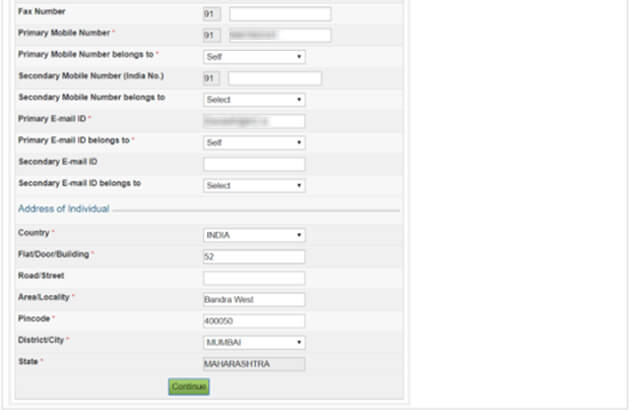

Now in Part 2, fill in the following details and click on submit.

Now in Part 2, fill in the following details and click on submit:

- Password Details

- Contact Details

- Current Address

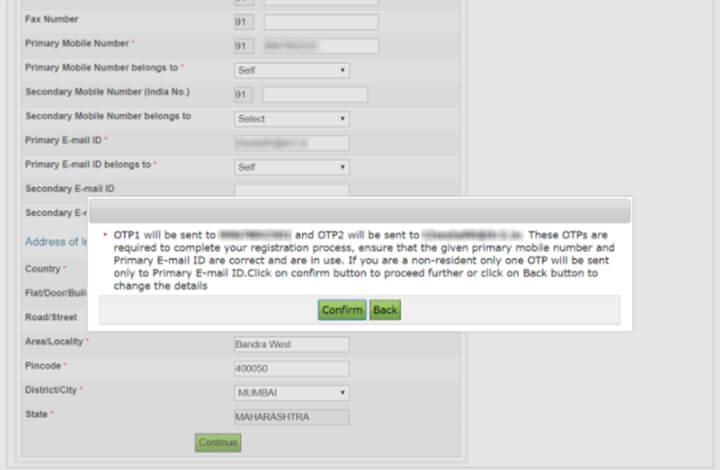

After submitting abovementioned details , a six digit OTP 1 and OTP2 will be shared on your mobile number and email ID, specified at the time of registration.

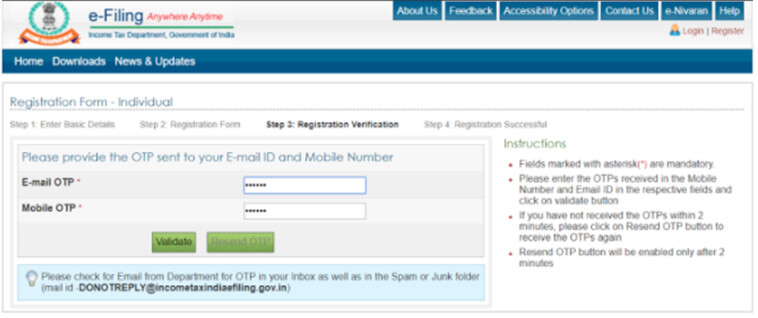

After submitting abovementioned details , a six digit OTP 1 and OTP2 will be shared on your mobile number and email ID, specified at the time of registration. Enter the OTP to complete the registration process.

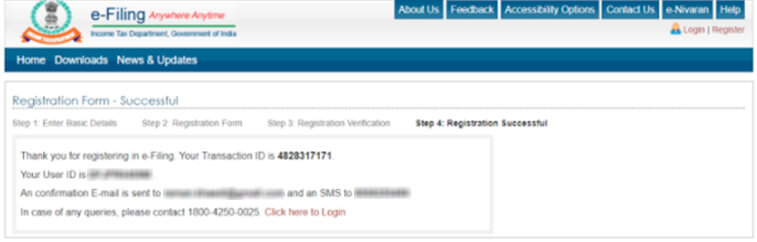

After successful validation of OTP entered , you will the message of successful registration as below :

Note : Your OTP will expire after 24 hours from the actual time of receipt then you need to register again from the beginning.

What will happen if I don’t register on income tax department website?

Although a return can be filed even without registration but If you don’t get registered then you will not be able to avail various other services provided by the website of income tax department.

Is registration compulsory for filing Income tax return?

No, registration is not compulsory for filing Income Tax return.You can e-file your IT returns without your income tax website password too. Just visit https://tax2win.in and file your ITR in just few minutes.

What you should do after registration on e-filing website?

You should keep your login credentials safe and secure similar to the way you keep your banking password and start using the facilities provided by the income tax department website. Know more about the facilities provided by the income tax department efiling website.

Is there a time-limit for registration?

You can register anytime, however it is advisable to register as soon as you get your PAN card

Can a minor register on income tax india website?

As discussed above, all a person needs is his/her PAN no for registration. So, a minor can also register on the income tax website.

Upload Form 16

File your ITR in just One Click

Easy & Quick

Easy & Quick Authorized by ITD

Authorized by ITD  Claim early refunds

Claim early refunds