- Section 80G Deduction - Donations Eligible Under Section 80G

- Income Tax Deductions List - Section 80C to 80U Deductions FY 2023-24 (AY 2024-25)

- Income Tax Rebate under Section 87A: Claiming the 87A Rebate

- Section 80DDB: What is Section 80DDB?, Diseases Covered, Claim Deduction & Certificate

- Standard Deduction on Salary for Salaried Individuals & Pensioners

- Section 80GGC - Deduction on Donations to Political Party

- Section 17(2) of the Income Tax Act - Perquisites in Income Tax

- Section 43B of Income Tax Act - All You Need to Know

- Section 80EEA of Income Tax Act - Deduction for Interest Paid on Home Loan

- Section 80U - Tax Deductions for Disabled Individuals

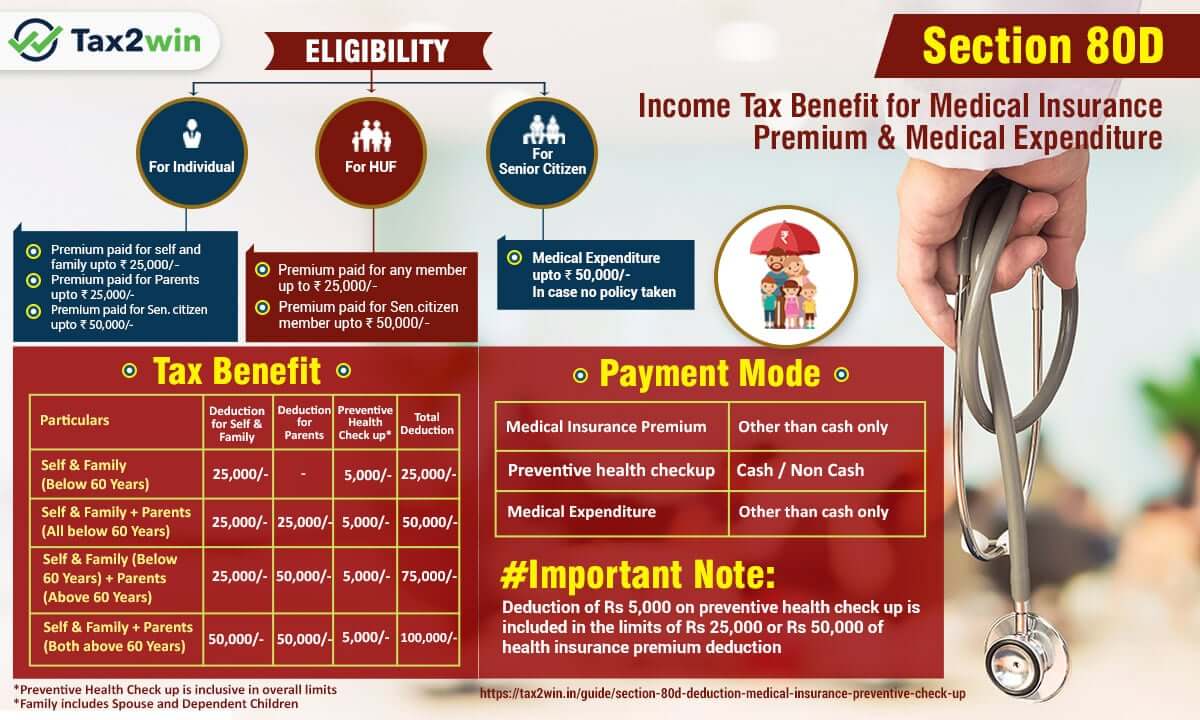

Section 80D of Income Tax Act: Deductions Under Medical Insurance, Eligibility and Tax Benefits

Medical emergencies can occur anytime and anywhere. Health insurance is one of the best options to mitigate the risk associated with a medical emergency. In a medical emergency, taxpayers can claim reimbursement from their medical insurance provider for the medical expenses incurred. The reimbursed amount can be claimed as a deduction under Section 80D of the Income Tax Act, subject to the maximum 80D deduction limit specified. The government encourages everyone to buy medical insurance and thus has allowed deductions under Section 80D. This article covers the section 80D deduction, the deduction limit under section 80D, etc.

Faked Tax Deductions? You Could Face A 200% Penalty Under Income Tax Rules Book Expert Consultation Now

What is Section 80D of the Income Tax Act?

Section 80D of the Income Tax Act allows individuals or HUF to claim a deduction for medical insurance premiums paid in a financial year. Section 80D provides a deduction for expenditure on the:

- Medical insurance premium

- Contribution to CGHS(Central Govt Health Scheme)/notified scheme

- Preventive health check-ups, and

- Medical expenditure (in case of senior citizens).

Section 80D offers tax deductions up to Rs. 25,000 for health insurance premiums paid by individuals and HUFs in a financial year. The deduction increases to Rs. 50,000 for senior citizens aged 60 and above.

| Insured | Amount of Deduction (in Rs) | |

|---|---|---|

| Age Below 60 years | Age Above 60 years | |

| Self, Children, Spouse | 25,000 | 50,000 |

| Parents | 25,000 | 50,000 |

| Max Deduction | 50,000 | 1,00,000 |

| Preventive Healthcare | 5,000 | 5,000 |

Note:- This deduction can be claimed over and above the Rs 1.5 lakh limit deductions claimed under Section 80C. This deduction is available only under old tax regime.

Who is Eligible to Claim Tax Deductions Under Section 80D?

Individuals or HUF can claim Section 80D deduction for:

- Self

- Spouse

- Parents

- Dependant Children

What is the Maximum Deduction that Can be Claimed Under Section 80D?

For claiming deduction u/s Section 80D, the premium should be paid in any mode other than cash. Although the expenditure on preventive health check-ups can be incurred in cash. The deduction for the following premiums is allowed under section 80D -

| Type of Expense | Premium Paid |

|---|---|

| Medical insurance premium paid for individuals and families. | Rs. 25,000, Rs. 50,000(in case of senior citizen) |

| Medical insurance premium paid for your parents. | Rs. 25,000 Rs. 50,000(in case of senior citizen) |

| Expenditure on preventive health check-ups. | Rs.5,000 |

| Medical expenditure of senior citizens or super senior citizens. | Rs.50,000 |

| Contribution to CGHS/notified scheme. | Rs.25,000 Rs.50,000(in case of senior citizen) |

| Maximum amount of deduction (A+ B+C+D+E) Non-senior citizens(Self & family and Parents) Senior Citizens (Self & family and Parents) Self & family (Non-senior citizens)Parents(Senior Citizens) |

Rs.25000+Rs.25000=Rs.50,000 Rs.50000+Rs.50000=Rs.1,00,000 Rs.25000+Rs.50000=Rs.75,000 |

A. Medical Insurance Premium: For Yourself & Your Family

- The maximum amount of deduction on the policy taken by you for self & for family is Rs. 25,000/-.

- In case of a senior citizen or any of your family members is a senior citizen(aged 60 years or more), the deduction amount will be Rs. 50,000/-.

Note: Under the 80D deduction, Family means your spouse & dependent children.

B. Medical Insurance Premium: For Parents

- In addition to the above, you can claim a deduction of the medical insurance premium paid u/s 80D for your parents as well.

- The maximum amount of deduction is Rs. 25,000/-. If your parents are senior citizens, the deduction will be Rs.50,000/-.

Notes :

- Parents for 80D include father and mother(whether dependent or not). Father-in-law and mother-in-law are not included.

C. Preventive Health Check-Up

Preventive Health check-ups identify the illness and work at the initial level through regular health check-ups. It is conducted once or twice yearly by your physician or general practitioner. The government introduced deduction under preventive health checkups to encourage people to be more proactive towards health. It was implemented in the year 2013-14.

The cumulative deduction for this check-up is a maximum of Rs. 5,000/- for yourself, your family, and your parents. Even cash payment for this expenditure is eligible for an 80D deduction.

D. Deduction of Medical Expenditure on Senior Citizens (aged 60 & above)

The expenditure is allowed for the deduction when no medical insurance premium is paid for the senior citizen. The term medical expenditure has not been defined under the income tax act, but generally, it will include medical expenses such as medical consultation fees, medicines, impairment aid, etc.

The maximum deduction amount is Rs. 50,000/-.

E. Contribution to CGHS/notified scheme

Contribution to Central Govt Health Scheme(CGHS) or any other notified scheme is allowed to individuals for themselves and their family for Rs.25,000.

Any contribution for parents is not allowed for deduction.

Section 80D: Amount of deduction comparative chart for current & previous years

*Preventive Health Check up is included in overall limits

*Family includes spouse and dependent children

To claim tax deductions under Section 80D , it is important to submit the medical bills to your employer or while filing your ITR. This deduction can be availed by the taxpayer for themselves, their spouse, dependent children, or parents. File your Income Tax Return here.

What is a Preventive Health Check-up Under Section 80D?

Under Section 80D of the Income Tax Act in India, taxpayers can claim a deduction for medical insurance premiums paid for themselves and their family. In addition to the deduction for health insurance premiums, the section allows a deduction for expenses incurred on preventive health check-ups. Preventive health check-ups involve medical tests and examinations aimed at early detection of illnesses and monitoring an individual's health status. Such check-ups help identify health risks early on, potentially preventing serious health issues.

- Tax Deduction: The Income Tax Act provides a tax deduction under Section 80D for expenses incurred on preventive health check-ups. Taxpayers can claim up to ₹5,000 per financial year for themselves, their spouses, children, and parents.

- Overall Limit: The deduction for preventive health check-ups is part of the overall limit for medical insurance premiums paid under Section 80D. For individuals below 60 years, the overall limit is ₹25,000, and for senior citizens (60 years or older), the limit is ₹50,000. This means that the deduction for preventive health check-ups is not separate from the limit for health insurance premiums—it is included within the total limit.

How to Claim Deduction Under Section 80D?

The process of claiming deduction under section 80D is simple. The assessees are required to provide proof of payment for the amount of medical insurance premium paid or the amount paid for preventive health checkups. It helps reduce the total taxable income for families, individuals and HUFs.

To claim your deduction under section 80D, you can send proof of the payment made towards insurance premiums and medical bills to your employer. Or you can also furnish the proofs of payment directly while filing your ITR and claim your deductions.

And if you still need help, don’t worry! Connect with our tax experts who will not only help you file your ITR but also maximize your income tax refund. Get online CA Now!

Example for the Calculation of 80D Deduction

Ram(57 years) is a taxpayer. Other members of his family are Sita(55 years old, Ram’s wife), Lav and Kush (dependent children), and his Parents. The following expenditures incurred by Ram for FY 2023-24:

| Ram, Sita, Lav & Kush | Parents | |

| Medical insurance premium paid by cheque | 22000 | - |

| Medical Expenditure paid by cheque | - | 47,000 |

| Medical Expenditure paid by cash | 7000 | 5000 |

| Preventive health-check-up | 8000 | 4000 |

80D Deduction Amount

| Ram, Sita, Lav & Kush | Parents | |

| Medical insurance premium paid by cheque | 22000 | - |

| Medical Expenditure paid by cheque | - | 47,000 |

| Medical Expenditure paid by cash | Not eligible since available for senior citizen, for whom medical policy not taken | Not allowed cash expenses. |

| Preventive health-check-up | 3000(maximum limit is 25000 since 22,000 is utilized, only 3000 can be claimed ) | 2000(maximum limit is 50000 since 47,000 utilized, remaining 3000. However, preventive health check-up has an overall limit of 5000, out of which 3000 are used for self and family, so only 2000 can be claimed now) |

| Total 80D deduction that Ram can claim is Rs. 74,000 | 25000 | 49000 |

Notes : *The amount of deduction u/s 80D will remain the same for the FY 2024-25 (old income tax slab).

Section 80D Tax Deductions for HUFs

- A medical claim can be taken under Section 80D for any of the members of HUF.

- The maximum amount of deduction is Rs. 25,000/-. If the member is a senior citizen, then the maximum deduction will be Rs. 50,000/-.

- HUF is not eligible to claim a deduction for a preventive health check-up.

Deduction on Single Premium Medical Insurance Policies

In such policies, a one-time lump sum payment is made against the regular installment for the complete policy tenure. Since the payment is a one-time payment, the deduction will be allowed on a proportionate basis.

- Amount Eligible under section 80D = Single Premium Paid / Number of years for which policy has been taken.

- The limit of 25,000 for individuals below 60 years of age and Rs 50,000 for others shall also apply in this case.

Mode of Payment under Section 80D

Here are the payment modes allowed to avail the tax deduction under section 80D:

| Expenses | Modes of Payment Allowed |

|---|---|

| Health insurance premiums | All payment modes are accepted except cash |

| Preventive health check-ups | Debit card, cheque, UPI, credit card |

Deduction of Medical Expenses for Senior Citizens (Section 80D)

Section 80D of the Income Tax Act is indeed a beneficial provision for senior citizens in India. It offers tax deductions on medical expenses, providing relief from high healthcare costs. Let's review and discuss the key points and eligibility criteria under Section 80D for senior citizens in more detail:

Eligibility Criteria:

- Age: The taxpayer must be a resident Indian and a senior citizen, meaning they should be 60 years of age or above.

- Medical Expenses: The medical expenses must be incurred for oneself, a dependent spouse, children, or parents.

- Insurance Premiums: In addition to medical expenses, senior citizens can claim deductions for health insurance premiums paid for themselves, their spouse, and their dependent children.

- Preventive Health Check-ups: Expenses incurred on preventive health check-ups for the senior citizen and their spouse can also be claimed as part of the total deduction available under Section 80D.

Deductions Allowed:

- For Medical Expenses and Health Insurance: Senior citizens can claim deductions of up to ₹50,000. This includes health insurance premiums and expenses for medical treatments.

- Specific Ailments: If a senior citizen incurs expenses on treatments for specific diseases such as neurological diseases, cancers, renal failure, etc., additional deductions might be available under Section 80DDB.

What is the Difference Between Sections 80D, 80DD, 80DDB, and 80U?

Sections 80D, 80DD, 80DDB, and 80U are different sections under the Indian Income Tax Act that provide deductions to taxpayers for various medical and disability-related expenses. Here's a brief overview of each section:

| Particulars | 80D | 80DD | 80DDB | 80U |

|---|---|---|---|---|

| Purpose | Medical Insurance & Medical expenditure | Medical treatment of a disabled dependent | Medical Treatment of Self/Dependant for specified diseases | Medical treatment of disabled assessee (self) |

| Maximum Limit | 1,00,000 | 75,000(non-severe disability) 1,25,000(severe disability) | 40,000(age < 60) 1,00,000 (age 60 or above) or amount spent whichever is less | 75,000(non-severe disability) 1,25,000(severe disability) |

| Type of assessee | Individual/HUF | Resident Individual/ HUF | Resident Individual/ HUF | Resident Individual |

Exclusions under Section 80D of the Income Tax Act

- Premiums Paid in Cash: Any premium paid in cash for health insurance policies is not eligible for deduction under Section 80D. The deduction is allowed only for premiums paid through digital modes or by cheque.

- Default in Premium Payments During a Financial Year: If there is a default in paying the health insurance premium during the financial year, no deduction will be allowed under Section 80D for that year.

- Premium Paid by the Employer for Group Health Insurance: If your employer pays the premium for a group health insurance policy covering you and your family members, you cannot claim a deduction for the amount paid by the employer. The tax benefit is available only for the premiums paid by you.

- Premium Paid on Account of Working or Employed Children or Other Relatives: The deduction under Section 80D is available only for health insurance premiums paid for self, spouse, dependent children, and parents. Premiums paid for working or employed children, uncles, aunts, grandparents, or siblings are not eligible for tax benefits under this section.

It's essential to be aware of these exclusions and ensure that you meet the eligibility criteria for claiming deductions under Section 80D while filing your income tax return.

Things to Remember When Availing Tax Deductions Under Section 80D

When availing tax deductions under Section 80D of the Indian Income Tax Act for premiums paid on health insurance policies, it's important to keep several key considerations in mind.

- The benefits under Section 80D of the Income Tax Act, 1961, are in addition to the tax benefits available under Section 80C. This allows you to claim further deductions on your taxable income.

- HUFs can also claim tax deductions under the Income Tax Act, 1961. This can help in reducing the overall tax liability for the family unit.

- It's important to carefully review the tax exemptions included in your health insurance policy to understand the benefits you are entitled to and ensure you are fully utilizing them.

- To qualify for the deduction under Section 80D, the premium must be paid through a non-cash method, such as a cheque, bank transfer, or credit card, except for preventive health check-ups, which can be paid in cash.

- Paying a health insurance premium in full can offer tax benefits for the entire duration of the insurance policy, providing long-term financial advantages.

- from the Income Tax Department can help ensure you are aware of any new deductions or changes in existing ones.

Claiming deductions under Section 80D is an important way to reduce your taxable income and save on healthcare costs. Know more on how to reduce your taxable income with the experts.

Section 80D at a Glance

ITR Filing for FY 2024-25 has started. If you are eligible for section 80D deduction, make sure you file your ITR on time and choose the old regime. And if you find taxes confusing, don’t worry! Get in touch with our experts who can not only help you file your ITR but also ensure you receive maximum tax refund and avoid penalties and notices. Book an eCA Now!

FAQs on Section 80D Deductions

Q- Can a term insurance premium be claimed as a tax exemption under Section 80D?

Normally term insurance premiums do not qualify for tax exemption under section 80D. Still it depends on the nature of the term insurance policy you have taken.

Q- What is the eligibility of mediclaim under section 80D?

Section 80D offers a tax deduction of up to ₹25,000 per financial year on medical insurance premiums for non-senior citizens and ₹50,000 for senior citizens. A ₹5,000 deduction limit is also allowed for any expenses paid towards preventive health check-ups.

Q- Can a son claim tax exemptions for his parents Medical Premium paid by him?

Yes, a son can claim for their parents medical premium as per section 80D.

Q- Does LIC premium payment for dependent parents come under section 80D?

No, Section 80D is for medical premiums and health insurance premium.

Q- Do I have to be the proposer of health insurance for myself to get a deduction from income tax u/s 80d?

Yes, taxpayers can claim a deduction under section 80D if they are making payments for medical and health insurance premiums.

Q- What is the limit of income tax deduction under section 80D?

The maximum limit u/s 80D is Rs. 25000 (in case senior citizen Rs. 50,000)and in case both assessee and parents are senior citizens, then the amount can be claimed up to INR 1,00,000.

Q- Does the GST paid along with health insurance premium eligible for tax deduction under 80D?

Yes, the whole amount paid will be available for deduction.

Q- Can I claim tax exemption under section 80D if I have cashless medical insurance provided by my company?

Yes, provided your company includes that premium paid into your CTC

Q- I have not taken any Mediclaim policy, but I incurred preventive health check-up expenses for myself and my spouse of Rs 10000. What is the amount of deduction I can claim under section 80D?

Section 80D allows you to claim a deduction for health checkups taken for spouses, parents, and dependent children up to Rs 5000.

Q- Can health insurance premiums be used for tax saving under 80D even if the employer reimburses the premium paid?

No, it will not be an expense for the employee if reimbursed by the employer.

Q- I got medical treatment from outside the country can I still claim a deduction under section 80D?

The expenditure on medical treatment outside the country can also be claimed u/s 80D as there is nothing specifically mentioned in the Act in respect of medical expenditure

Q- Can I avail tax benefits for more than one health insurance policy?

Yes, the benefit of more than one insurance policy are allowed but subject to the maximum limit.

Q- How to claim the tax benefit of section 80D?

For claiming tax benefits filing of ITR is mandatory. When filing ITR you need to disclose the 80D deduction under “Deduction under chapter VI-A”.

Q- What is a preventive health check-up?

Preventive health check-up has not been defined under the law, so we can interpret it in general terms to be an expenditure done for diagnosing, safeguarding, and minimizing the effect of the illness.

Q- What is the 80D and 80DD limit?

Individuals can claim a maximum deduction of Rs 25,000 under Section 80D. For senior citizens (aged 60 or above), this limit increases to Rs 50,000. Under Section 80DDB, the maximum deduction is Rs 1 lakh per dependent.

Upload Form 16

File your ITR in just One Click

Easy & Quick

Easy & Quick Authorized by ITD

Authorized by ITD  Claim early refunds

Claim early refunds

Avoid Last-Minute Rush

Avoid Last-Minute Rush Faster Refund Processing

Faster Refund Processing Hassle-Free Filing with Experts

Hassle-Free Filing with Experts