- ITR U - What is ITR-U & How to File Updated Return

- ITR Filing Last Date FY 2023-24 (AY 2024-25) | Income Tax Return Filing Due Date

- Documents Required for Income Tax Return (ITR) Filing in India FY 2022-23 (AY 2023-24)

- Section 154 Of Income Tax Act: Rectification of Mistakes under Section 154

- Section 139(5) of Income Tax Act - How to File Revised Return?

- Income From Other Sources: Meaning, Exemptions, Deductions & Examples

- How to Correct the Invalid Surname and First Name Error on e-Filing Portal

- Income Tax Return (ITR) : How to File ITR Online for FY 2022-23 (AY 2023-24)?

- How to Show F&O Loss in ITR? | Guide to Filing Income Tax Return with F&O Loss

- Who is Required to File ITR for FY 2023-24? Conditions & Exceptions for ITR Filing

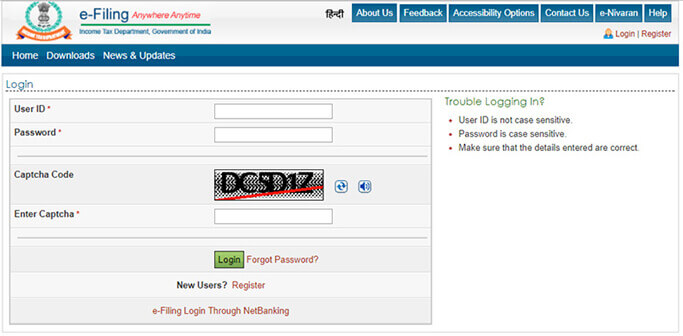

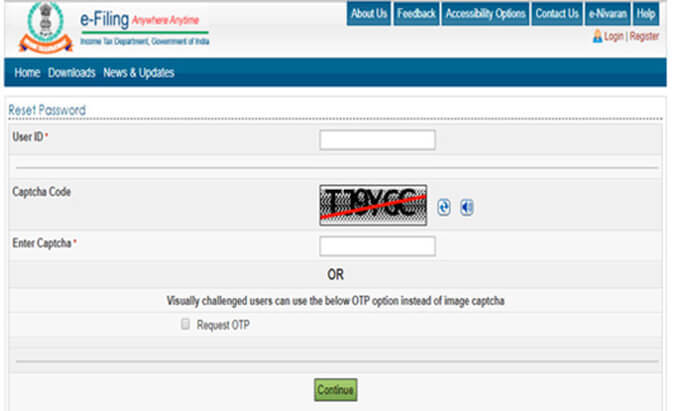

- 1 Click on forgot password option on the login page, a new window will open asking the User ID and Captcha code.

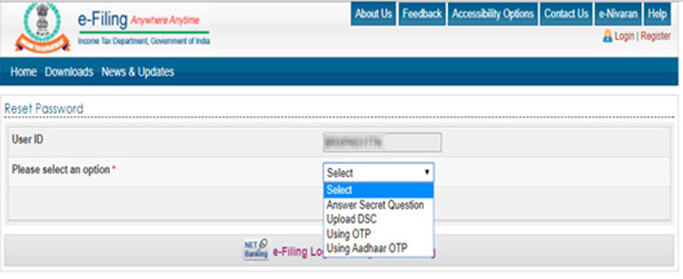

- 2 As soon as you will click on the continue button from the above screen , all the options through which password could be reset would be displayed.

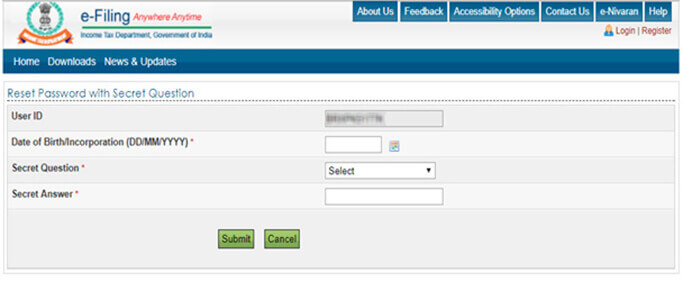

- A In case of Secret Question option , Mention date of birth and select your Secret Question and answer to that secret Question from the dropdown. Click on validate button.

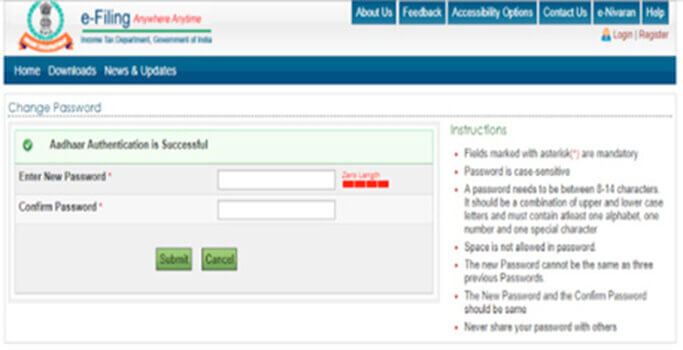

- B In case of Aadhaar OTP option, the OTP would be send to your registered mobile number . Enter it and then set the new password as you desire.

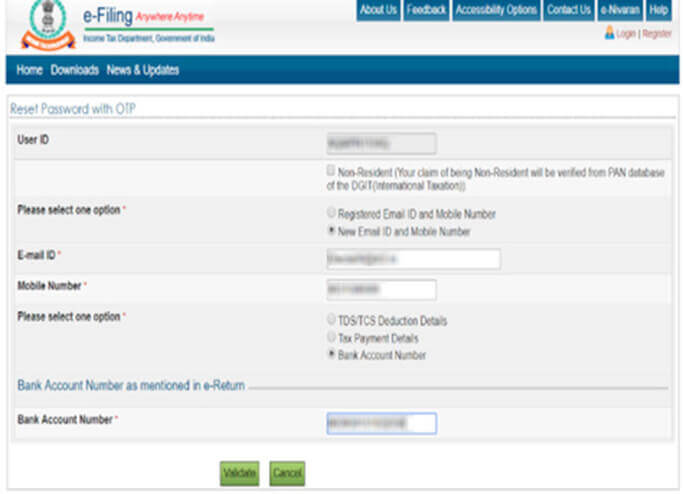

- C (1) In case of OTP option , you have to choose whether to reset it from registered Email ID and Mobile Number or New Email ID and Mobile Number.

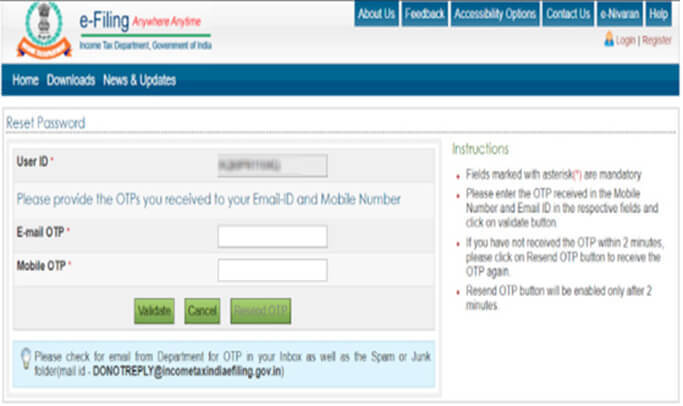

- C (2) After Validation as per above screen , enter the OTPs received both on email id as well as mobile.

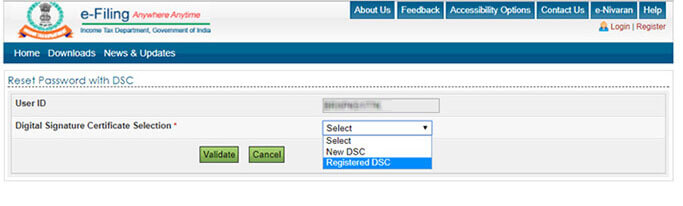

- D (1) In case of Upload Digital Signature Certificate, you have to select any one of the two options provided.

- D (2) After that upload Signature File and click on the “VALIDATE” button.Then, you can enter the New Password and confirm

Click on forgot password option on the login page, a new window will open asking the User ID and Captcha code.

As soon as you will click on the continue button from the above screen, all the options through which password could be reset would be displayed.

You can select any of them as per your convenience. They are namely : Answer Secret Question , Upload DSC , Using OTP , Using Aadhaar OTP. We will discuss each one of them one by one.

Firstly , let’s start with Answer a Secret Question :

A. In case of Secret Question option , Mention date of birth and select your Secret Question and answer to that secret Question from the dropdown.Click on validate button.

B. In case of Aadhaar OTP option, the OTP would be send to your registered mobile number . Enter it and then set the new password as you desire.

C (1). In case of OTP option , you have to choose whether to reset it from registered Email ID and Mobile Number or New Email ID and Mobile Number.

In case of OTP option , you have to choose whether to reset it from registered Email ID and Mobile Number or New Email ID and Mobile Number. Further, you have to select from the three options - namely TDS /TCS deduction details , Tax payment details and Bank account number. Click on Validate.

In the below screenshot, new mail and mobile number has been selected. Point to be noted here is that in both the options, the new password would be updated after 12 hours

C (2). After Validation as per above screen , enter the OTPs received both on email id as well as mobile.

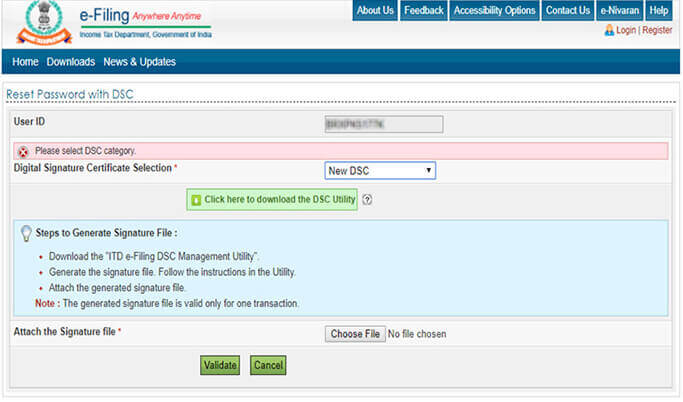

D (1). In case of Upload Digital Signature Certificate, you have to select any one of the two options provided.

In case of Upload Digital Signature Certificate, you have to select any one of the two options provided:

i. New DSC

ii. Registered DSC

D (2). After that upload Signature File and click on the “VALIDATE” button.Then, you can enter the New Password and confirm

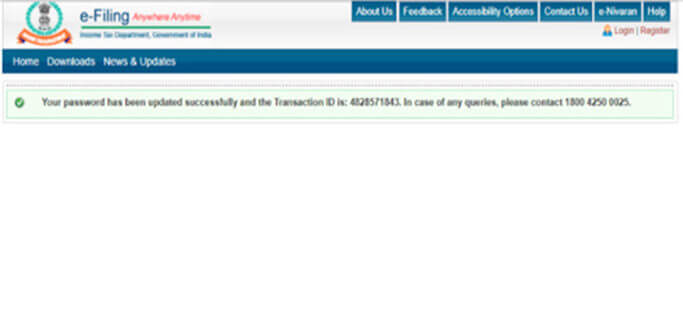

Whichever option you choose from the above explained options , you will get a success message as displayed below.

Frequently Asked Questions

Q- How much time will it take to reset an ITR e-filing password?

Ans: It takes 5minutes to reset an ITR e-filing password.

Q- How can you get an ITR acknowledgement without logging in to an income tax website?

Ans: An assessee can get ITR acknowledgment on their mail as it is mandatorily sent by IT department.

Q- How can I change my mobile number on my income tax e-filing account? I don't have the previous registered number with me.

Ans: 1. Login to Income Tax e-filing website.

2. Go to Profile Setting

3. Click on my Profile

4. Then, click on Edit my mobile number option and changed the number.

Q- How can I deregister and fresh reregister on income tax site?

Ans: User can deactivate the Secured Login at any time.

Go to Profile Settings ? e-Filing Vault - Higher Security and unselect the option “Login using Bank Account EVC” and click Proceed button. User will be redirected to a confirmation page. Click on Disable button.

For Registration on Income tax website

- Go to Income Tax e-filing website

- Register yourself

- Select user type

- Provide Basic Details

- Email Verification

- Activate E-filing Account.

Q- How to file an ITR, if I have forgotten my user ID and password?

Ans: Assesse can reset its User ID and Password by using Forgot my password link and e-filing login through netbanking.

Upload Form 16

File your ITR in just One Click

Easy & Quick

Easy & Quick Authorized by ITD

Authorized by ITD  Claim early refunds

Claim early refunds