An income tax refund refers to the amount of money that a taxpayer receives from the government when they have paid more income tax during a particular financial year than what they owe. It represents a return of excess tax paid by the taxpayer to the tax authorities. When individuals or businesses pay their income tax through tax deductions at source (TDS), advance tax payments, or self-assessment tax, they may end up paying more tax than their actual tax liability. This can occur if they have claimed excessive deductions or if their tax liability is reduced due to exemptions, deductions, or tax credits at the time of filing ITR.

In such cases, when the taxpayer files their income tax return and the tax authorities assess their tax liability, they calculate the actual tax liability based on the income and deductions declared. If the assessed tax liability is lower than the tax paid, the excess tax amount is refunded to the taxpayer. Remember, you have to finish e-filing to get your Income Tax Refund.

For example, if a taxpayer has paid Rs. 15,000 in taxes for the financial year 2023-2024, but their actual tax liability is only Rs. 10,000, they are entitled to a refund of Rs. 5,000 from the Income Tax Department. After filing and verifying the income tax return, the department will begin processing the return. Typically, it takes about four to five weeks for the refund to be credited to the taxpayer's bank account once the return is processed.

To claim an income tax refund, you need to file your income tax return (ITR) and disclose all the income and taxes paid information with the Income tax department. Once the ITR is processed by the Income Tax Department, and if there is any excess tax paid, the refund will be issued to you.

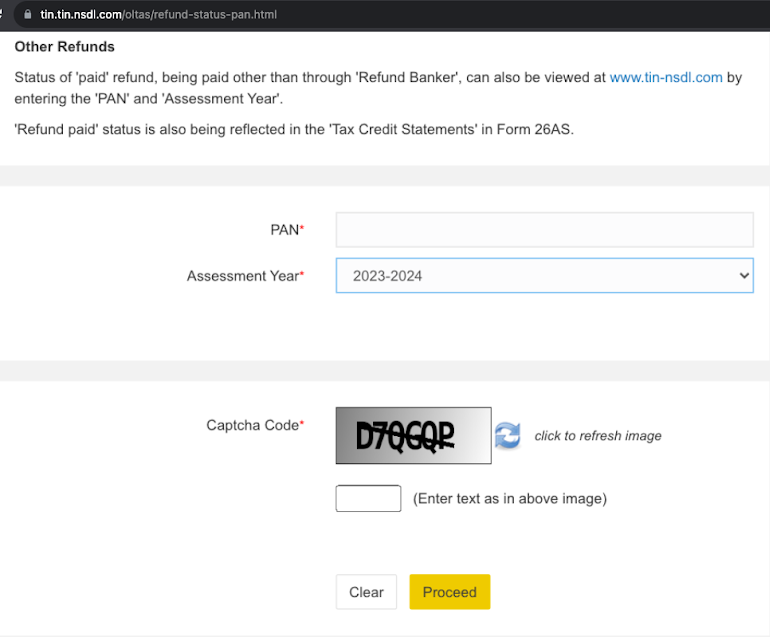

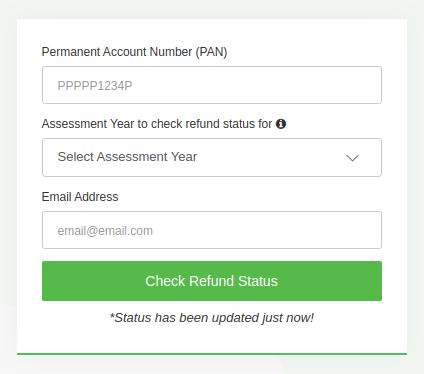

Once the refund is generated, it will be either directly credited to your bank account You can track the income tax refund status online through the Income Tax Department's website NSDL or through the Tax2win Income Tax Refund status tool.

To check the status of the refund, there is no separate tab for it in the new portal, just click on e- file tab and then click on the “ View Filed returns” tab and by clicking on view details, you can check the status of the current return filed as well as the previous returns filed.

| Status | Meaning |

|---|---|

| No Result Found | We were unable to check the filing status and e-verification status for PAN and Acknowledgement numbers entered by you. Kindly verify if the details entered by you are correct. |

| Refund is already credited to your bank, please contact your bank. |

Refund has been processed and credited to your Bank Account If your refund has not been credited, then contact: CMP, State Bank of India Address: Survey No.21 Opposite: Hyderabad Central University, Main Gate, Gachibowli, Hyderabad -500019 Email: [email protected] Toll-free Number: 1800 425 9760 |

| Refund cheque has already been encashed. |

Your income tax refund process is complete & it has been credited to your Bank Account, and the same has been encashed. If your refund has not been credited, then contact CMP, State Bank of India Address: Survey No.21 Opposite: Hyderabad Central University, Main Gate, Gachibowli, Hyderabad -500019 Email: [email protected] Toll-free Number: 1800 425 9760 |

| Refund Not Determined | As per the Income Tax department, no refund is determined after processing of your ITR |

| Unable to credit refund as the account number provided by you is incorrect. | This means that the account number provided by you was incorrect. You are requested to apply for refund reissue by providing the correct account number to claim your refund. |

| Defective return u/s 139(9) (or) ITR filed is defective or incomplete | It may be that your return has been treated as a defective Return. For the exact reason, you can check this on your income tax website account. |

| ITR Processed but need to submit rectification request | This may occur due to a mismatch in the calculation of the department & ITR filed. For this, you may receive an intimation from the department on your registered email id. |

| Return submitted. Processing rights transferred to Jurisdictional Assessing Officer. (or) ITR Transferred to Jurisdiction AO | This implies that your return will be processed by your Jurisdictional Assessing Officer (AO). Please contact AO for further details. Need help from an Expert CA? Click here. |

| Pending for e-verification | This implies that your return has been submitted successfully but it has not been e-verified either through post or online mode. Further, until and unless you verify your return, it would not be processed by the income tax department. So, please verify within 30 days from the date of filing. |

| Processed with no demand/refund | It implies that your return has been processed successfully without any additional tax payable or refund due. Further, you can check the details from the intimation received u/s 143(1) on your mail id. |

| Processed with demand due | This implies that your Income has been assessed by the Income tax department from your filed ITR and tax payable amount has been determined upon it. You can check the details from the intimation received u/s 143(1) on your mail id. In that case you need to submit the response through the E-Filing website under “efile tab” -> “Response to outstanding tax demand”. Need help from Expert CA? Click here. |

| Processed with refund due | This implies that your refund claim has been forwarded to the refund banker for processing. So, wait for some more days and the refund amount will be credited in the bank account mentioned by you at the time of filing the return. |

| Refund failure | This implies that the income tax department has sent a refund to you but your bank details (account number or IFSC code) are incorrect, due to which refund was not credited/paid. In that case you need to place a refund reissue request stating the failure reason under “My Account” -> Service -> “Refund reissue request”. Need help from Expert CA? Click here. |

| e-Return for this PAN and Acknowledgement Number has been digitally Signed (or) e-Return for this Assessment Year or Acknowledgement Number has been Digitally signed | This implies that your return has been filed successfully and it is digitally signed. |

| Under Processing | This implies that your Income-tax Return is still not processed. It is under process. Further, no need to worry if you have e-verified or sent your signed ITR V by post as it will definitely be processed by the department sooner or later and then you will receive a refund. It would be credited along with interest |

| Refund issued (or) Refund Re-issued | This implies that your return as well as refund has been processed successfully and the refund has been credited in your bank account. Now, no further action is needed from your side for this year. |

| Return Submitted and Verified (or) Successfully e-verified (or) E-Verified (or) ITRV Received | This implies that your return has been submitted and successfully verified. It will now be processed by the Income Tax Department. So, you have to wait for some more days |

| Invalid original return, File Revised Return | This implies that your return has been treated as an invalid return by the Income Tax Department. You need to file your return again in this case. Need help from Expert CA? Click here. |

| Return Processed and Rectification Rights Transferred To Assessing Office | This implies that your return has been processed. However, for rectification, you need to contact your Assessing Officer as the rectification rights have been transferred by CPC. So, instead of the online route, you have to submit your rectification request to your local AO directly. For more information/ query, please feel free to call us at +91 9660996655 or write to us [email protected] and our expert CAs will be happy to assist you. |

| Return Processed. Refund Adjusted Against Demand (or) Refund kept on hold,Intimation u/s 245 is issued proposing adjustment of refund towards outstanding demand. | If any previous amount is outstanding by the department, then the department will adjust the amount you owed in the current year’s refund. But before adjusting that amount they will send you a notice u/s 245, stating that they are adjusting your refund with the previous years' outstanding amount. You have to submit your response to it whether you agree with the department or not. If the response is not submitted timely then the department adjusts the demand and processes the return after adjusting the demand. For more information/ query, please feel free to write us [email protected] and our expert CAs will be happy to assist you. |

| ITR Accepted | Your ITR has been successfully received at CPC Bangalore & pending for processing. |

| ITR-V rejected | It may be that your return has been treated as a defective Return. Need help from an Expert CA? Click here. |

| Return Submitted and verified after due date. (or) ITR-V received after due date | This means that the Income Tax Department has received your ITR-V after the due date, i.e., after 30 days from the date of filing of your income tax return. You are now required to file your return again. Need help from an Expert CA? Click here. |

| Successfully e-Verified after due date | The Income Tax department has received your condonation request of E-verification post expiry of 30 days of filing ITR. Your condonation request is forwarded for approval of the assessing officer. Your ITR will be treated invalid till it is approved by the department. There is no specific timeline to approve this condonation request. Need help from an Expert CA ? Click here. |

| Rectification processed with refund due | Your rectification request has been processed by the department & refund is generated. |

| Rectification processed with no demand/refund | Your rectification request has been processed by the department & no demand/refund is due. |

| Processed and partially refund adjusted | If any demand is outstanding of any previous years with the department, then the department may adjust the outstanding demand with the current year’s refund. But before adjusting the amount, the department will send you a notice u/s 245, stating that they are adjusting your refund with the previous years\' outstanding demand. You have to submit your response to it that whether you agree with the department or not. If the response is not submitted timely then the department adjusts the demand and processes the return after adjusting the demand. For more information/ query, please feel free to call us at +91 9660996655 or write to us [email protected] and our expert CAs will be happy to assist you. |

| Under Processing Original return will not be considered, as revised return is taken up for processing | Once a revised return is filed then it replaces the original ITR. Your revise ITR is under processing which will take place the original ITR. |

| Another Return filed | You have filed another return,Please check status using the latest acknowledgment number. |

| Refund Re-issue failure | It implies that your refund re-issue request has been failed due to some incorrect details. Please raise a new refund Re-issue request to claim your refund. |

| Rectification filed | Your rectification request has been filed & it is under process. |

First, verify your Income Tax Return, then track the status of your income tax refund with the department. In case, you have still not received your refund then one of the reasons for the ITR refund delay could be due to a problem in your bank account or address details.

In such a situation, you can make a “refund reissue” request to the Income Tax Department but only after receiving an "Intimation"

Once all these steps are done successfully, you can then check the tds refund status on the dashboard.

There can be several reasons for a delay in receiving an income tax refund. Here are some common factors that can cause delays:

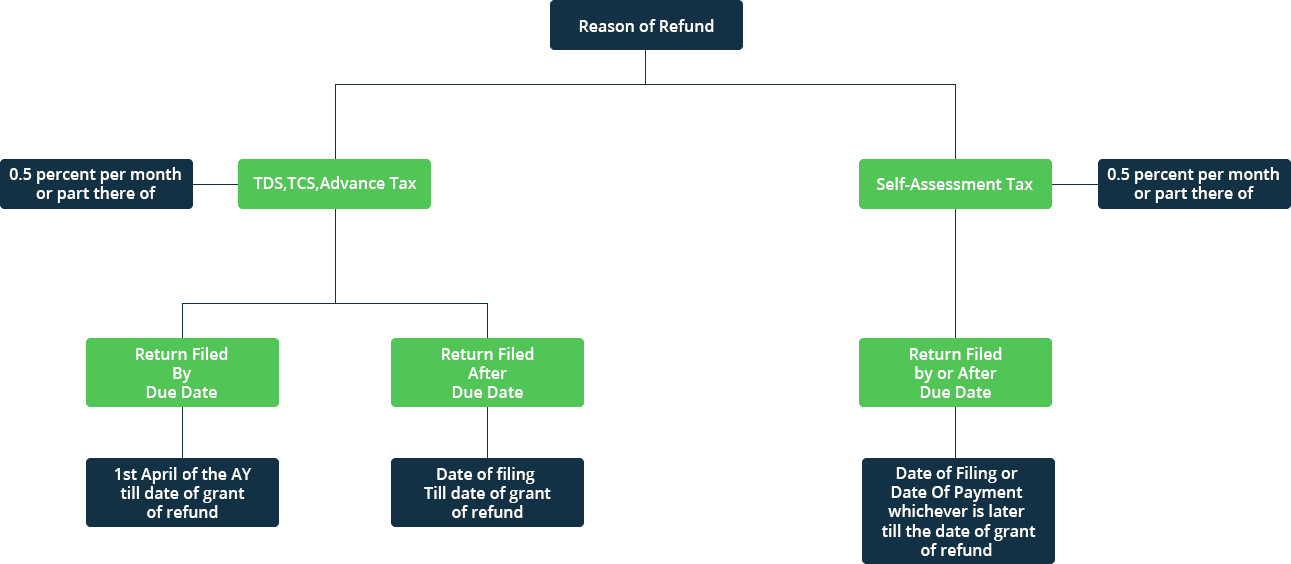

Yes, the Income Tax department takes the responsibility of granting a simple interest @ 0.5 percent per month to compensate for the delayed refunds .In the case of refund arising out of TDS / TCS / Advance Tax - Interest is calculated @0.5% for every month or part of a month for a period starting on 1st April of the relevant AY till the date of grant of refund, in case the return is filed on time i.e., on or before the due date. However, if the return is not filed within the due date the period of interest shall be from the date of filing the return to the date of grant of refund. In this case, if the refund is less than 10% of the tax determined under assessment or in intimation u/s 143(1), then you are not entitled to any interest.

The Refunds are sent by the Income Tax Department in two ways-

RTGS/NECS: This is the fastest facility provided by the department to get refunds. Under this facility your refund is directly credited in your bank account.

The Income Tax Department has altered the process of claiming the ITR refund a bit. It has been made compulsory by the IT Department to pre-validate your bank account in which you wish to receive the income tax refund. Pre Validating a bank account alone is not enough, the individual also needs to link the PAN with the bank account. This has come into force from March 1, 2019. The last date for linking Aadhaar and PAN is 30th June 2023.

The income tax return is furnishing your income and tax details yearly in prescribed ITR forms. Whereas, income tax refund means the amount due or received when taxes paid are greater than taxes actually payable. The refund can only be claimed after the successful filing and verification of the return.

Taxpayers can view the status of their refund 10 days after the Assessing Officer sends it to the Refund Banker. The Tax2win Check Income Tax Refund Status tool helps you view your refund status.

Yes, broadly Income Tax refunds and TDS refunds are one and the same thing. The excess of TDS deducted over and above the actual payable amount is known as an income tax refund. But, an income tax refund can also result from excess.

Once the ITR filing has been completed, you need to verify your income tax return. After verification, the return is processed by the Income Tax Department, and a refund is issued(if due). Usually, it takes 4-5 weeks for the refund to be credited to the account of the taxpayer.

No, the income tax refund is not taxable. However, the interest received on this refund is taxable and should be shown as “Income from other sources.”

To get a refund, file your return and e-verify the same, it is as simple as that.

Download your ITR form, and from there you can check your primary bank details.

There is no standard guideline for the same, but normally it takes 25-60 days to get income tax refunded.

Yes, it is possible to credit your refund to another account in certain cases. For this:

Tax refunds can be delayed due to several reasons: processing time during peak seasons, errors or discrepancies on the tax return, incomplete documentation for certain deductions or credits, offsets for back taxes or debts owed to the government, incorrect bank account information for direct deposits, postal service delays for mailed refunds, and issues related to identity theft or fraud. Ensuring accuracy in your return and providing necessary documentation can help minimize these delays.

Earlier, taxpayers had the freedom to file IT returns for two financial years. However, as per the new rules, IT returns u/s 139 of the Income Tax Act can only be filed for one financial year.

In case, you have a refund due for the years preceding the aforesaid year, and you forgot to file an income tax return for those years, then you can take despite of CBDT Circular No: 9/2015 to get a refund for the previous six assessment years. However, as per the circular, no condonation application for a claim of refund/loss shall be entertained beyond six years from the end of the assessment year for which such application/claim is made. So, as per the provisions of this circular, you can claim a refund for the AY 2018-19; AY 19-20; AY 20-21,AY 21-22, and AY 22-23,and AY 23-24.

This circular can be used only where your refunds are the result of the excessive deduction/collection of tax and/or excess deposit of advance /self-assessment tax.

For taking benefit of the above circular, you need to make an application to the relevant authority depending upon the amount of claim.

| Amount of claim (refund / loss) for any one assessment year | Application To: |

|---|---|

| 10 Lakhs or less | Principal Commissioner of Income-tax/ Commissioner of Income-Tax |

| More than Rs.10 Lakhs but less than Rs. 50 Lakhs | Principal Chief Commissioners of Income-tax/Chief Commissioners of Income-tax |

| More than 50 Lakhs | Central Board of Direct Taxes (CBDT) |

Note: These authorities have all the powers to make necessary inquiries or scrutinize to ascertain the correctness of the claim and accept/ reject your application. Also, in such cases,, the Income Tax department shall not pay any interest on the delayed refunds.

The changes made by you, in the bank/address details, will be automatically updated in the centralized TIN database, and your refund amount will be reissued to you as per your updated records.

As per the law, only the person whose excessive tax is deducted is eligible to get a refund. However, there are a couple of exceptions to this: When your income is included in any other person's income (as per provisions of the law), then the latter alone can get your refund. In case of death, incapacity, insolvency, liquidation or any other reason when you are unable to claim/receive a refund, then your legal representative or trustee or guardian or receiver shall be entitled to your refund.

It is advisable to file your ITR within the due date to avoid any complications and ensure timely processing of your refund. However, if you have missed the deadline, you can still claim the refund (if applicable) by filing a belated return under section 139(4). To know more about Belated Return, refer to our blog

Do remember-The due date to file ITR for FY2023-24 (AY2024-25) is 31st July 2024

Refund processing by the tax department starts only after the return is e-verified by the tax filer. Usually, it takes 25-60 days for the refund to be credited to your account. However, If you haven't received your refund during this time duration, you must check for discrepancies( if any) in your ITR status check; check your email for any notification from the IT department regarding the TDS refund status. Or you may not have to pre-validate your bank account on the Income tax Portal.

To know how to verify your Income Tax Return, refer to our guide.