- Form 16 - Meaning & How to Download Form 16 Online?

- Form 26QB: TDS on Purchase of Immovable Property

- Form 26AS - How to View and Download Form 26AS from TRACES?

- Form 15G & Form 15H to Save TDS on Interest Income - How to Filll Form 15G for PF Withdrawal

- Form 10-IE: Understanding its Significance under IT Act

- Form 27Q - TDS Return for NRI Payments

- Form 16B – TDS Certificate for Sale of Property - Download From 16B from TRACES Website

- What is Form 16A? - How to Get and Fill Form 16A?

- Simplifying Form 13 of Income Tax for Non-Deduction/Lower Deduction of TDS

- Form 16 Password - What is the Password for TDS Form 16 and How to Open Form 16 Password?

- Form 24Q: TDS Return on Salary Payment

How to e-file ITR 1 (SAHAJ) with rental income

ITR-1 is one of the income tax return (ITR) forms that are used by the resident individuals whose

- Total income does not exceed Rs 50 lakh in a financial year

- Taxable income includes income from salary, one house property, family pension income, agricultural income (up to Rs 5000), and other sources like-

- Interest from Savings Accounts

- Interest from Deposits (Bank / Post Office / Cooperative Society)

- Interest from Income Tax Refund

- Interest received on Enhanced Compensation

- Any other Interest Income

- Family Pension

- Income has been clubbed with that of the spouse or a minor child

ITR-1 allows you to report income from one house property, salary, other sources or agricultural income upto Rs.5,000. In this article, we will discuss the step-by-step process of filing ITR using the ITR-1 form with rental income from one house property.

Income Tax Return filing for FY 2024-25 has begun!

File your ITR on time with expert help – Accurate, timely, and refund-ready! File Today

What is income from house property?

Any income arising from house property, i.e., rental income, is considered ‘Income from House Property’ under the Income Tax Act. The house property here means a house, building, office, and warehouse. There are different ways to calculate taxable income from house property based on its type - self-occupied and let out.

Self-occupied property is the one that is used for one’s residential purpose. And a let-out property is the one that has been rented out to a tenant even for a few months. In the next step, we will guide you about how to calculate taxable rental income from a let-out property and file your ITR accurately.

How is income from house property calculated?

You will have to fulfil 3 conditions for an income to be taxed as ‘Income from House Property’.

- The house should be a building, land or an apartment

- You should own the property, and

- The house property should not be used for any business purposes carried on by the taxpayer.

Suppose all the 3 conditions are satisfied for a house property & you have given such property on rent even for a short period for FY 2020-21. In that case, you will have to calculate the taxable income from the property, pay tax & report it in your ITR. Here are the steps to calculate taxable income from let-out or rented house property.

- Step 1: Calculate the annual rent received

- Step 2: Deduct municipal taxes paid by you during the year, and you will arrive at NAV (Net Annual Value) of your house property

- Step 3: Then, deduct 30% of NAV as standard deduction and interest on housing loan (if any) from the NAV, and the resultant amount will be your taxable income

Details to be Filled in ITR-1

Personal Details of an Individual

You need to enter your complete name, gender, date of birth, PAN, and father’s name. You must also enter their postal address, email address, and mobile number.

Upload Form 16 for Income From Salaries

You must declare your income from your salary, including the following details -

- Name of the Employer

- Type of the Employer

- TDS on salary

- Break up of income from salary

- TAN of the employer

Details of Other Income

Enter the details of your income from other sources like interest, dividends, winnings from the lottery, online gaming, etc. In other words, any income that does not fall under capital gains or business/profession

Details of House Property

If you have a self-occupied house property, you must mention the following details -

- Interest on loan paid/payable on the housing loan on the property.

- Interest paid during the pre-construction period.

- Address of the house property

- For a co-ownership, the name, PAN and percentage of share of co-owners in his property.

In case of a property let out on rent, you need to furnish the following details -

- Annual rent received/receivable

- Municipal tax paid

- Name and PAN of the tenant.

- Interest paid/payable on a housing loan on property

- Pre-construction period interest

- Address of property and other details of the co-owners of the property

- Details of tenants such as name, PAN and TAN.

Details of Tax Deductions

- Municipal Taxes Paid

- Co-ownership Details (Name, PAN, and share percentage) to ensure tax liability applies only to your share.

- Interest on Housing Loan (up to ₹2,00,000).

- Additional Deduction under Section 80EEA (up to ₹1,50,000) if conditions are met.

- Standard Deduction of 30% on rental income (after deducting municipal taxes) for maintenance.

- No additional deductions are allowed for expenses like sweeping, painting, or renovation against rental income.

How to e-file ITR 1 with rental income from house property?

Once you have calculated the taxable income, follow these steps to file your ITR-1 with rental income from house property.

Step 1. Log in to the e-Filing portal using your User ID (PAN) and Password.

Step 2. Click on e-File > Income Tax Returns > File Income Tax Return.

If your PAN is inoperative, you’ll see a warning. Click ‘Link Now’ or ‘Continue’.

Step 3. Select Assessment Year 2024-25 and Mode of filing: Online, then click Continue.

Step 4. If you have a saved return, choose ‘Resume Filing’. If you want to start fresh, select ‘Start New Filing’.

Step 5. Select your applicable status (Individual, HUF, etc.) and click Continue.

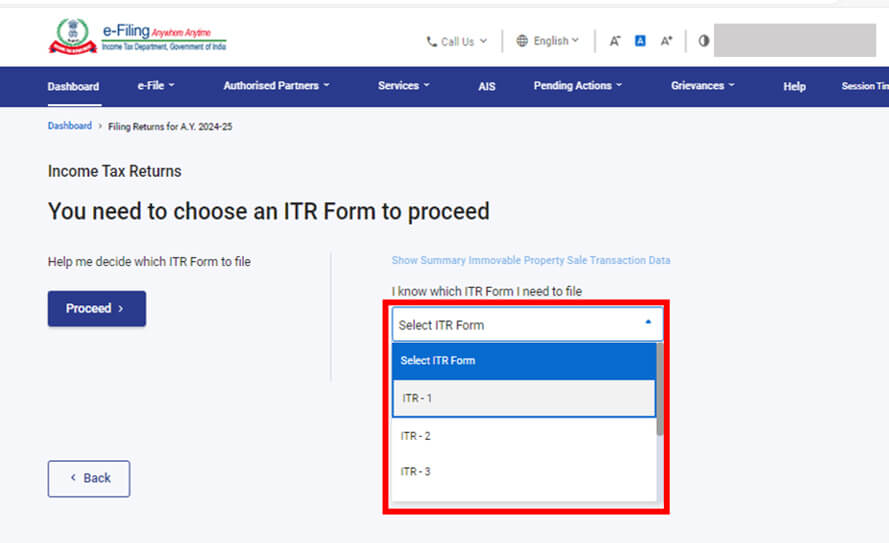

Step 6. If you know which ITR form to file, select it. If unsure, select ‘Help me decide’, answer the questions, and let the system recommend the correct form.

Step 7. Review the list of required documents and click ‘Let’s Get Started’.

Step 8. Select the applicable checkbox for your reason for filing ITR and click Continue.

Step 9. The New Tax Regime (default) is pre-selected. If you want to opt out, select ‘Yes’ under the Personal Information section. Review and edit pre-filled details, then Confirm each section.

Step 10. Enter income and deductions in the respective sections. After completing all details, click Proceed.

Step 11. If tax is payable, you will see a tax computation summary. Choose ‘Pay Now’ (recommended) or ‘Pay Later’. If you delay payment, interest may apply.

Step 12. If no tax is payable or if a refund is due, click ‘Preview Return’.

Step 13. If you chose ‘Pay Now’, you’ll be redirected to the e-Pay Tax service. Complete payment and return to the ITR filing process.

Step 14. Click ‘Preview Return’, check all details, select the declaration checkbox, and click Proceed to Preview.

Step 15. Click ‘Proceed to Validation’. If there are errors, correct them before moving ahead.

Step 16. Click ‘Proceed to Verification’ and e-Verify your return.

Step 17. Choose your preferred verification method (Aadhaar OTP, Net Banking, or DSC) and click Continue. If you choose ‘e-Verify Later’, you must verify within 30 days to complete the filing.

Step 18. Once successfully verified, your ITR is filed.

How to Download ITR-1 Form?

Here are the steps that you need to follow in order to download ITR-1 Form -

- Step 1. Visit the official website of the Income Tax Department.

- Step 2. Log in to your account using your credentials, user ID, and password.

- Step 3. Once you log in, go to the ‘downloads’ section on the homepage.

- Step 4. From the available list, choose the ITR-1 form and select the assessment year (2025-26)

- Step 5. Click the download link for the ITR-1 form. You can download it in Excel, PDF, or XML format.

Need assistance with ITR filing or have a tax-related query? Simply get in touch with our tax experts, who provide end-to-end tax solutions for your needs. From tax planning to tax filing, we have got you covered. Book an online CA now!

Frequently Asked Questions

Q- What documents one needs to submit while filing tax returns?

You don’t need to submit any documents while filing your income tax return. However, keep essential documents like Form 16, balance sheets, profit and loss statements, investment proofs, and audit reports ready. If the Income Tax Department issues a notice, you may need to present these documents later.

Q- What are the heads under which Pension and family pension are taxable?

Tax on pension is levied under the head ‘Income from salary’, whereas family pension is taxable under the head ‘income from other sources’.

Q- How bank accounts are reported in ITR-1?

You must report details of all savings and current accounts held at any time during the previous year in Part E of the ITR form under Other Information. The account number should align with the bank’s Core Banking Solution (CBS) system. However, you don’t need to provide details of dormant accounts inactive for the past three years.

Q- Can ITR-1 be filed in case of exempt agricultural income?

Yes, an individual can file ITR-1 if his agricultural income does not exceed Rs.5,000. However, if the agricultural income exceeds Rs.5,000, then the individual must file ITR-2.

Q- Is it necessary to file an ITR if the annual income does not exceed Rs 250,000?

Filing an ITR is not mandatory if your annual income is below ₹2,50,000. However, submitting a ‘Nil Return’ is advisable to maintain a financial record, which can serve as proof of employment when applying for a passport or loan.

Q- Can I file ITR-1 if I have a House Property loan?

Yes, you can file ITR-1 if you have bought a house property through a home loan.

Q- What are the types of income that shall not form part of ITR 1 form?

The following types of income cannot be reported in the ITR-1 form:

- (a) Profits and gains from business or profession

- (b) Capital gains

- (c) Income from more than one house property

-

(d) Income under Other Sources, including:

- Winnings from lotteries

- Income from owning and maintaining racehorses

- Income taxable at special rates under Section 115BBDA or Section 115BBE

- (e) Income apportioned as per Section 5A provisions

Authorized by ITD

Authorized by ITD