- Form 16 - Meaning & How to Download Form 16 Online?

- Form 26QB: TDS on Purchase of Immovable Property

- Form 26AS - How to View and Download Form 26AS from TRACES?

- Form 15G & Form 15H to Save TDS on Interest Income - How to Filll Form 15G for PF Withdrawal

- Form 10-IE: Understanding its Significance under IT Act

- Form 27Q - TDS Return for NRI Payments

- Form 16B – TDS Certificate for Sale of Property - Download From 16B from TRACES Website

- What is Form 16A? - How to Get and Fill Form 16A?

- Simplifying Form 13 of Income Tax for Non-Deduction/Lower Deduction of TDS

- Form 16 Password - What is the Password for TDS Form 16 and How to Open Form 16 Password?

- Form 24Q: TDS Return on Salary Payment

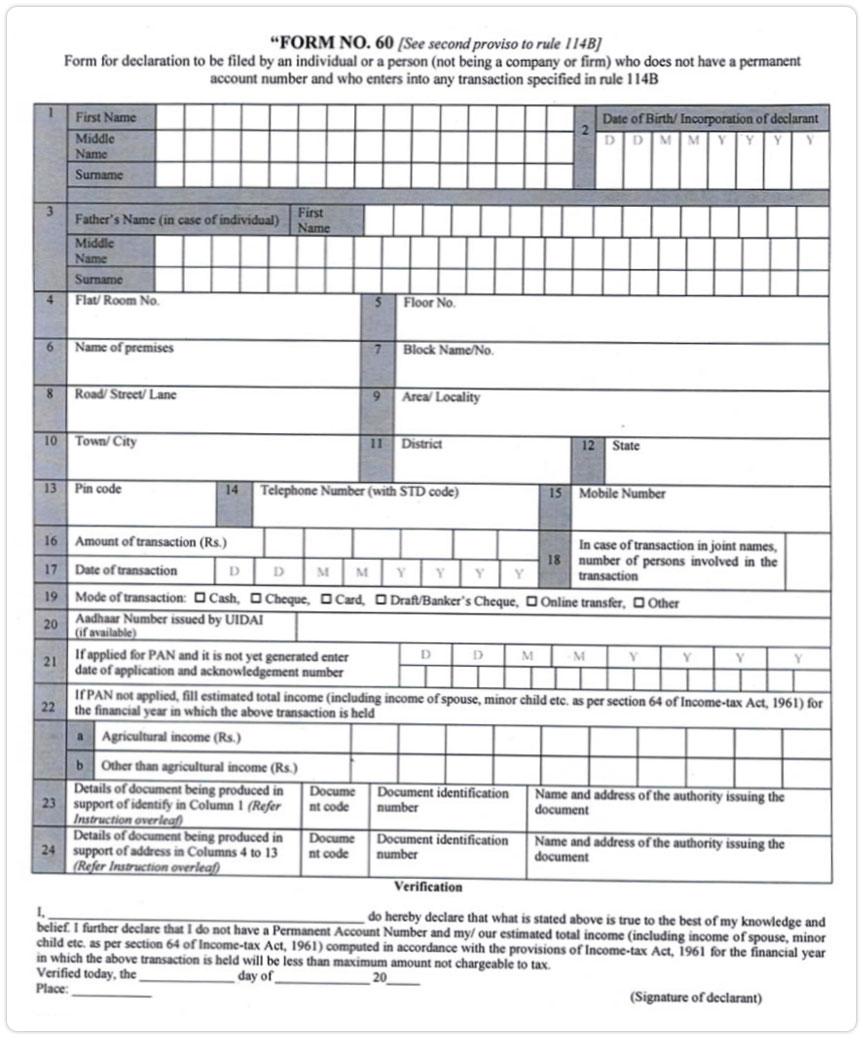

Form 60 - What is it, Applicability, How to Fill And Download Form 60 Online

Form 60 is a declaration form used in India for individuals who do not have a Permanent Account Number (PAN) but need to carry out certain financial transactions. It serves as an alternative to providing a PAN when conducting specific transactions or opening certain accounts.

It's important to note that while Form 60 income tax allows individuals to carry out financial transactions without a PAN, it does not exempt them from tax liabilities. The individual is still responsible for fulfilling their tax obligations. In this article, we will talk about what Form 60 means, Form 60 income tax, Form 60 format, and Form 60 PAN card.

Income Tax Return filing for FY 2024-25 has begun!

File your ITR on time with expert help – Accurate, timely, and refund-ready! File Today

What is Form 60?

Form 60 is the declaration that is required to be filed by an individual or a person (except companies and firms) who does not have a permanent account no. (PAN) while entering into some specified transactions as per Rule 114B of the Income Tax Rules, 1962.

If your total income (other than agriculture) is more than the basic exemption limit, then in such cases, form 60 format is not acceptable. In such a case, you can use Form 60 only if you have already applied for PAN, and you must also mention the date of application in column 22 of the form.

Form 60 format is available on the Income tax website and can be downloaded from here. It is required to be submitted to the person with whom you are entering into a specified transaction.

When is Form 60 of Income Tax Required?

When you decide to enter into any transaction with a banking institution or deal in some sort of asset, a PAN card is the basic identity proof required.

But, there are still several people who do not possess PAN, or they might have already applied for PAN and are waiting for an allotment. Form 60 can be used in many cases instead of furnishing PAN by such people.

Other than tax authorities, PAN or Form 60 PAN card, is required for a variety of transactions such as

| Nature of Transaction, | Value of Transaction |

|---|---|

| Sale or purchase of Motor Vehicle [other than two-wheeled vehicles], | Irrespective of value / Any Value |

| Opening a Bank account(other than basic savings deposit account) | Irrespective of value |

| Getting new Debit or Credit card | Irrespective of value |

| Opening DEMAT account | Irrespective of value |

| Payment to hotel or restaurant at one time | Cash payment exceeding Rs 50,000 |

| Travelling expenses to a foreign country or buying foreign currency at one time | Cash payment exceeding Rs 50,000 |

| Buying Mutual funds | Amount exceeding Rs 50,000 |

| Acquiring bonds or debentures | Amount exceeding Rs 50,000 |

| Acquiring bonds issued by RBI | Amount exceeding Rs 50,000 |

| Depositing money with (a) Bank (b) Post Office |

Cash exceeding Rs 50,000 in one day |

| Purchasing Bank Draft/ pay order/ banker’s cheque | Cash exceeding Rs 50,000 in one day |

| Time deposit (FD) with (a) Bank (b) Post Office (c) NBFC (d) Nidhi company |

Exceeding Rs 50,000 at a time or Rs 5,00,000 in a financial year |

| Life Insurance Premium | If the amount exceeds Rs 50,000 in an FY |

| Trading in securities | Amount Exceeding Rs 1,00,000 per transaction |

| Trading in shares of unlisted company | Amount Exceeding Rs 1,00,000 per transaction |

| Sale or purchase of any immovable property | If the amount or registered value is Rs 10,00,000 or more |

| Buying and selling of goods and services | Exceeding Rs 2,00,000 per transaction |

How to Download Form 60 PDF?

You can download Form 60 format via the Income Tax Department portal via the following princess:-

- Step 1 - Visit the official website of the Income Tax Department

- Step 2 - Click on ''Forms/Download'' on the top navigation menu

- Step 3 - In the drop-down menu, select ''Income Tax Forms''

- Step 4 - You will be redirected to a page with a list of different forms for income tax

- Step 5 - Scroll down the list until you reach "Form No.60."

- Step 6 - Select the document, and it will get automatically downloaded to your system.

Form 16 Format

Information Required to Fill Form 60

- Your complete name

- Date of Birth

- Full address

- Telephone Number / Mobile Number

- Amount of Transaction

- Date of transaction

- Mode of transaction

- Aadhaar number

- If PAN is applied, then the application and acknowledgment number

- Disclosures of income

- Sign and mention the date and place.

If you do not have any information to be disclosed in a particular column, write - “Not Applicable”.

Documents Required to Submit with Form 60

It is possible that a person may not have a PAN, or he may have applied for a PAN but not received it yet. In this situation, not having a PAN should not become a bar to make certain transactions. In such scenarios, Form 60 can be submitted along with relevant supporting documents to carry out the transaction. These documents are:-

- Aadhaar Card

- Driving license

- Bank Pass Book (having photograph)

- Elector’s Photo ID

- Ration Card

- Passport

- Pensioner Photo card

- Proof of address

- Telephone bill and electricity bill copies

- Communication or document issued by Central or State Government or local bodies

- Domicile Certificate

- Kisan passbook

- Arm’s License etc

There are many other proofs, a list of which can be found attached to Form 60.

If you have already filed Form 49A for allotment of PAN, you just need to render the application receipt and 3-month bank account summary. No other documents from the list, as specified above, will be needed.

How to Submit Form 60?

To the user's relief, Form 60 can be submitted both online and offline. Offline i.e., physical submission of Form 60, can be made to the concerned authority after duly filling up the form. For eg. If you are submitting Form 60 as per the Income Tax Act, then submit it to Tax Authorities or if you are filing Form 60 for opening a bank account submit it to the concerned bank.

The online procedure to file Form 60 with the Income Tax Department shall follow as under

- The electronic verification can be done through this website- https://report.insight.gov.in/reporting-webapp/portal/homePage

- It can also be done using certain Aadhaar specified Authentications:

- Through OTP on your Aadhaar-linked mobile number or mail ID.

- Through Biometric modalities, i.e., either through iris (scanning your eye) or fingerprint.

- Two-way authentication, i.e., OTP + biometric modalities

- Or Use of OTP & fingerprint & iris altogether.

What Should be Done if a Minor is Entering into a Transaction that Requires a PAN?

Rule 114B of the Income Tax Act 1961 expressly provides that if a minor enters into any of the above-specified transactions and he does not have income chargeable to tax, then the Minor can quote the PAN of his Father, Mother, or Guardian while entering into such contracts.

Whether NRI Needs to Submit Form 60?

As per Rule 114B, Non Residents are required to quote PAN or file Form 60 only for a limited number of transactions, which are as under:

| Nature of Transaction | Value of Transaction |

|---|---|

| Sale or purchase of Motor Vehicle | Irrespective of value / Any Value |

| Opening a Bank account | Irrespective of value |

| Opening DEMAT account | Irrespective of value |

| Buying Mutual funds | Amount exceeding Rs 50,000 |

| Buying bonds or debentures | Amount exceeding Rs 50,000 |

| Depositing money with (a) Bank (b) Post Office |

Cash exceeding Rs 50,000 in one day |

| Time deposit (FD) with (a) Bank (b) Post Office (c) NBFC (d) Nidhi company |

Exceeding Rs 50,000 at a time or Rs 5,00,000 in a financial year |

| Life Insurance Premium | If amount exceeds Rs 50,000 in a FY |

| Trading in securities | Amount Exceeding Rs 1,00,000 per transaction |

| Trading in shares of unlisted company | Amount Exceeding Rs 1,00,000 per transaction |

| Sale or purchase of any immovable property | If amount or registered value is Rs 10,00,000 or more |

For remaining transactions like payments made to hotels and restaurants, getting debit or credit card, traveling expenses, etc. Non-Residents are not required to furnish PAN or Form 60 in lieu of PAN.

Who Is Exempt from Submitting Form 60?

Non-residents do not have to submit Form 60 or quote their PAN card. This is applicable to specified transactions such as applying for debit/credit card or paying for restaurant bills.

Along with NRIs, individuals having a valid PAN card also are not required to submit Form 60.

Consequences of Wrong Declarations Made in Form 60

Any wrong declaration in Form 60 will make you entitled to repercussions under section 277 of the Income Tax Act 1961.

As per provisions of section 277, a person disclosing misleading or untrue information will be held liable under:

- If the resulting tax evasion amount exceeds Rs 25 lakhs, rigorous imprisonment of a minimum of 6 months to a maximum of 7 years + fine as applicable.

- For other cases, rigorous imprisonment of at least 3 months to 2 years with a fine.

Want to ensure that your Form 60 is filed accurately? Contact our tax experts for any tax-related queries. Get a CA Now!

Other Forms Related to PAN Apart From Form 60

Yes, there are a few forms that are also related to PAN. A short description of these forms has been mentioned below:

49A - This Application form is used by Residents of India to obtain PAN and for correction of PAN.

49AA - Unlike 49A, this application form is used by Non-Residents (foreigners) or bodies incorporated outside India to obtain PAN in India.

Now that you know about Form 60 and when should you file it, you can go ahead and file your Form 60 yourself. However, filing such forms on your own can seem complicated. If you arer also among those who find taxes complicated, don’t worry. Get in touch with our tax experts who provide end-to-end tax solutions for your needs, right from tax planning to tax filing. Hire eCA Now!

FAQs on Form 60

Q- What are the consequences of a wrong declaration on Form 60?

Any wrong declaration in Form 60 will make you entitled to repercussions under section 277 of the Income Tax Act 1961.

As per provisions of section 277, a person disclosing misleading or untrue information will be held liable as under

- If the resulting tax evasion amount exceeds Rs 25 lakhs, rigorous imprisonment of a minimum of 6 months to a maximum of 7 years + fine as applicable.

- For other cases, rigorous imprisonment of at least 3 months to 2 years with a fine.

Q- Difference Between Form 60 And Form 16

These two forms are altogether different. Where Form 60 is used as a document in lieu of furnishing PAN for some financial transaction, Form 16 is issued by your employer, which enlists your components of salary, etc.

Q- Who is not required to submit Form 60?

NRI, i.e., Non-resident Indians, are exempt from quoting PAN numbers or from submitting Form 60 for certain transactions (specified above).

Q- How many times can we use Form 16?

You can use Form 60 as many times as it is required. But, if you are subsequently furnishing Form 60 to the same person or authority, you can opt to disclose only the incremental information. Incremental information means the particulars that have changed after you filed Form 60 last time.

Form 60 is a boon for a person willing to enter into a financial transaction but was prevented to do so because he lacked PAN. Submitting this form online as per the recent changes made by CBDT has added to the benefits.

Q- What if a minor is entering into a transaction that requires a PAN?

Rule 114B of Income Tax Act 1961 expressly provides that, if a minor enters into any of the above transactions and he/she does not have income chargeable to tax, then the Minor can quote PAN of his Father, Mother or Guardian while entering into such contracts.

Q- How many times can we use Form 60 for banking transactions?

Form 60 is a replacement of the PAN card for various transactions that are specified in rule 114B in various conditions. There is no limit stated for the usage of Form 60 for banking transactions. But the Form 60 is only valid for six years from the end of the financial year in which the transaction took place.

Q- What is the maximum amount I can deposit to a savings account without having a pan card?

Any amount above Rs 50,000 to be submitted to a bank account is not allowed without a PAN card. Amounts below this limit can be submitted to a bank account without a PAN card.

Q- Can a minor fill out form 60?

As per Rule 114B, if a minor is involved in transactions as mentioned in Rule 114B, and does not have income chargeable to tax, then a minor can quote PAN of his father, mother, or any guardian and in any other case minor is required to fill Form 60.

Q- Is Form 60 required for NRI?

Yes, Non-Resident Indians are required to furnish Form 60 in place of a PAN card. However, Form 60 for NRIs is only valid for a few transactions mentioned in rule 114B.

Authorized by ITD

Authorized by ITD