- Senior Citizen Savings Scheme (SCSS) - Interest Rate 2023, Tax Benefits, & Eligibility

- ESIC Portal: Services, Login Process for Employee & Employers

- "Post Office Monthly Income Scheme: A Comprehensive Guide | Tax2win "

- Pradhan Mantri Jan Dhan Yojana (PMJDY)

- Public Provident Fund (PPF) India, Interest, Benefit, Withdrawals, Deposit etc

- RSBY - Rashtriya Swasthya Bima Yojana

- ELSS- Equity Linked Saving Schemes | investments to save money on Tax

- PRAN Card - Permanent Retirement Account Number Guide

Atal Pension Yojana (APY) Scheme - Features, Eligibility & Taxes

One of the major concerns in the country is the rising unemployment and lack of resources. Due to the shortage on the employment front, more people started working in the unorganized sector because they lacked the skills required for a mechanized world. Moreover, because of technological advancements, people in the unorganized sector were exposed to the atrocities and instability of the economy.

To offer pension benefits to workers in the unorganized sector, the Government launched Atal Pension Yojana. This scheme was launched in 2015 after the name of ex-Prime Minister Atal Bihari Vajpayee. To get a detailed understanding of this pension yojana, read the excerpt below:-

What is Atal Pension Yojana?

Atal Pension Yojana is designed for workers in the unorganized sector as they do not have formal pension provisions. This scheme aims to motivate workers to save voluntarily for their retirement.

These workers can be house helpers, gardeners, drivers, and other people from the unorganized sector. The Pension Funds Regulatory Authority of India (PFRDA) regulates the yojana. This scheme was launched as an extension of the Swavalamban Scheme due to its ineffectiveness and restricted reach. Atal Pension Yojana was designed to provide a better retirement period to people working in the unorganized sector.

What are the Objectives of the Atal Pension Yojana?

Atal Pension Yojana Focuses on the following -

- Encourages savings from an early age.

- Focuses on the security of senior citizens so that they do not have to worry about sudden illness, accidents, or chronic diseases in their old age.

- Focused mainly on the people employed in the unorganized sector, such as maids, delivery boys, gardeners, etc.

What is the Eligibility to Subscribe to the Atal Pension Yojana?

- Any Indian citizen is eligible to join the APY scheme.

- The age of an individual must be between 18 to 40 years.

- The contribution can be made for a minimum of 20 years.

- The applicant must have a valid savings account.

- The Aadhar card must be linked to the bank account they will be using under this scheme.

- The subscriber must have a valid mobile number.

- Individuals between 18 - 40 years who are already availing of the benefits of the Swavalamban Yojana will be automatically shifted to the APY scheme.

What are the Features and Benefits of the Atal Pension Yojana?

Given below are the features and benefits of Atal Pension Yojana -

- Guaranteed pension once the subscriber reaches the age of 60.

- 40 years has been set as the maximum bar for entry into the program, as contributions to this scheme shall be made for at least 20 years.

- The yojana offers a minimum pension of Rs. 1000 to Rs. 5000 depending on the corpus amount contributed by the subscriber.

- In case of the death of the subscriber, the pension is provided to the spouse. Also, in case of the death of both, the return of the corpus is paid to the nominee.

- A co-contribution of 50% of the total contribution, or Rs. 1000 per annum, whichever is lower, is made by the Government for all eligible subscribers who had joined between June 2015 and December 2015 for a period of 5 years, i.e., for financial years 2015-16 to 2019-20.

- Atal Pension Yojana scheme is available for private sector employees too.

- An automatic debit facility is available, which offers the feasibility of getting the monthly contributions directly debited from the bank account linked.

- Later in the scheme, an individual can make large contributions to the pension account.

What are the Tax Benefits of the Atal Pension Yojana?

As per the new rule of the finance ministry, from October 1, 2022, income taxpayers are not allowed to enroll in the Government's Atal Pension Yojana (APY). The reason behind it is to direct wealth to the welfare of economically weaker people. Therefore, from October 1, 2022, the taxpayers with an account under APY are shut down, and the sum amount is returned to the subscriber.

Who are the Other Social Security Schemes Beneficiaries not Eligible to Receive Government Co-contribution Under APY?

If you are a part of any of the social security schemes mentioned below, then you are not entitled to receive government co-contributions under the APY scheme:

- Seamens’ Provident Fund Act, 1966.

- The Coal Mines Provident Fund and Miscellaneous Act, 1948.

- Employees’ Provident Fund & Miscellaneous Provision Act, 1952.

- Assam Tea Plantation Provident Fund and Miscellaneous Provision, 1955.

- Jammu Kashmir Employees’ Provident Fund & Miscellaneous Provision Act, 1961.

- Any other social security scheme is operating by the statute.

What are the Modes of Applying for the Atal Pension Yojana?

There are two modes to apply for Atal Pension Yojana:- Online and Offline.

Online Mode:-

- If you are an internet user with a net banking facility connected to your bank account, you can simply register for the APY scheme online.

- While registering for the scheme online via net banking, you can opt for the auto-debit facility. With this, your contributions will automatically be deducted till you turn 60 years old from the age of enrolment. However, you must ensure that your account has a sufficient monthly balance to make payments for the scheme.

- Only a few banks offer this online facility. You need to check with your respective banks if they offer this facility via net banking.

- State Bank of India offers this facility. To know how to enroll in this scheme, read the next section.

Offline Mode:-

- Visit the bank/post office where you have your savings account and ask for the ‘Atal Pension Yojana form.

Alternatively, you can also download the subscriber registration form online.

- Fill out the entire form properly and submit it to the bank/post office. Attach a copy of your Aadhaar card with the form for identification purposes. All the fields marked with an asterisk (*) need to be filled mandatorily.

- The form contains an ‘acknowledgment section’. You are not supposed to fill out this section of the form. Once your registration application has been processed by the bank, the bank will fill the acknowledgment receipt and give it back to you.

- Once your application is approved, you will receive a confirmation message on your registered mobile number. That’s why it is imperative to provide the correct mobile number while filing the form.

What are the Charges and Penalties for Default?

The contributions towards APY can be made at quarterly/monthly/half-yearly intervals through an auto-debit facility from the subscriber's savings account/ post office savings bank account.

If you fail to contribute towards the scheme regularly, you are in for some penalty charged by banks extending scheme registration online. This amount is mainly dependent on your monthly contributions to the scheme. Check the chart below to know the penalties:

| Penalty per month | Contribution per month |

|---|---|

| Rs. 1 per month | Up to Rs. 100 |

| Rs. 2 per month | Between Rs. 101 to 500 |

| Rs. 5 per month | Between Rs. 501 to 1000 |

| Rs. 10 per month | Beyond Rs. 1001 |

What are the Consequences in Case of Continuous Default?

In case you fail to contribute towards the scheme, the following could happen to your account:

- If you fail to pay for 6 consecutive months, then your account will be frozen.

- If you don’t pay your contributions for 12 months, then your account will be deactivated.

- Your account will be closed if you fail to make payments for 24 months, i.e., 2 years.

What is the Atal Pension Yojana (APY) Withdrawal Process?

(Case 1:- Withdrawing from Atal Pension Yojana (APY) scheme after the age of 60 years)

Once you turn 60, you can request a withdrawal with your bank or post office. If the subscriber dies after turning 60, their spouse will be entitled to the same monthly pension amount. And if both the subscriber and the spouse die, then the nominee will get the returns on the pension amount accumulated by the subscriber till the age of 60.

(Case 2:-Withdrawal before the age of 60 from Atal Pension Yojana (APY) scheme)

Opting out of Atal Pension Yojana voluntarily is generally not permitted as per the notification dated 2nd May 2015, which is available on the Pension Fund Regulatory and Development Authority (PFRDA) website. However, it allows early withdrawals for exceptional cases like terminal illness and if the subscriber dies before turning 60. You will have to submit an ‘account closing application ’ to your respective bank to close your account. You can find the account closing on the official government website.

Suppose you are voluntarily exiting from the pension scheme and have received the Government’s co-contribution to the scheme. In that case, you will only be liable to receive a refund of contributions you have made to the scheme. After deducting the account maintenance charges, you will also receive the net income generated on your contributions. However, you will not receive the Government’s contribution to the scheme or the amount generated on these contributions.

How to Check your APY (Atal Pension Yojana) Account Status with PRAN?

You can check your APY account status online. Follow the steps mentioned below to check the details of your APY account.

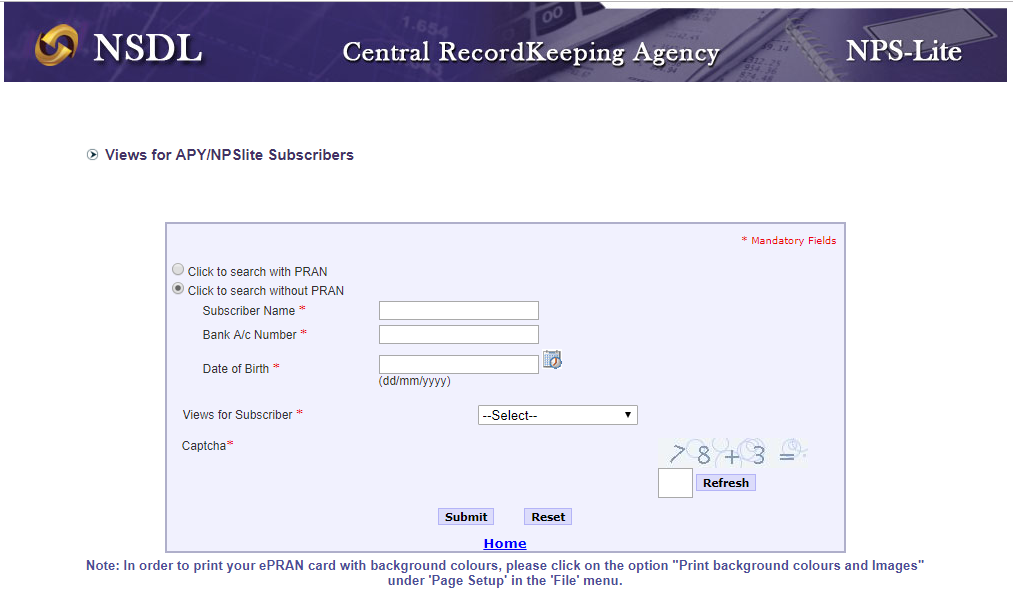

- You need to click on the official link of the Central Record Keeping Agency: NSDL to access data stored with the government Agency. The home page will resemble the image as shown here under

- As you can see, you can get the details of your APY account via two modes, i.e, by using your PRAN number and without your PRAN number.

- If you choose to retrieve details via your PRAN account, then you will have to fill in details like PRAN and your bank account number. Apart from this, you need to select one option from the ‘Views from Subscriber’ drop-down list. Since you are a subscriber, you should click on ‘SOT view’.

- To complete the form, you also need to fill in the captcha. Once you have filled in all the details, you can click on ‘submit’. This will give you all the details about your APY account. If you want to see the financials of a particular year, like contributions made in one particular year, then you need to select that financial year.

Check your APY (Atal Pension Yojana) Account status without PRAN

If you don’t know your PRAN, then you can opt for the second option. If you are searching without PRAN, then you need to enter your name (subscriber’s name), bank account number, and date of birth. Under ‘View for subscribers’, you need to select ‘SOT view’. This option generally gives a glimpse of your ‘statement of transaction’.

Post this, you need to fill in the captcha and click on the ‘submit’ button.

So, by using these two options, you can check the status of your APY (Atal Pension Yojana) along with your account statements and any other relevant details.

Mobile alerts: Check your Atal Pension Yojana Balance through Mobile

You can also subscribe for SMS alerts to inform you about your account balance, regular contributions, and other details related to your Atal Pension Yojana account. For this, it is mandatory that you register a valid mobile number to stay updated about your account activities via SMS. You can also check for the due date for making payments, and get updates on the auto-debit facility.

Need to know about more tax-saving investment options? Don’t worry! Get in touch with our tax experts. Book Tax Consultation Now!

Frequently Asked Questions

Q- Is my money safe? Will the scheme be changed when the Government changes?

Money invested in the atal pension yojana is safe because this is a government scheme, and the scheme does not change when the government changes; your contribution is secure.

Q- What are the minimum and maximum ages to join this scheme?

The minimum scheme to join APY is 18, and the maximum age is 40.

Q- When is the last date to join the Atal Pension Yojana Scheme?

There is no last date for joining the APY. The scheme is renewed every year on 1st June.

Q- How will I know if the pension scheme is activated?

When the scheme is activated, you will receive an SMS alert on the registered mobile number.

Q- How can I close Atal Pension Yojana?

Subscriber is required to fill account closure form to his associated bank. Wait for a month or two; your account will be credited with all your contributions.

Upload Form 16

File your ITR in just One Click

Easy & Quick

Easy & Quick Authorized by ITD

Authorized by ITD  Claim early refunds

Claim early refunds

Avoid Last-Minute Rush

Avoid Last-Minute Rush Faster Refund Processing

Faster Refund Processing Hassle-Free Filing with Experts

Hassle-Free Filing with Experts